Sir Nicholas Goodison, magisterial Stock Exchange chairman who oversaw the ‘Big Bang’ – obituary

- Oops!Something went wrong.Please try again later.

Sir Nicholas Goodison, who has died aged 87, was an unusually cerebral chairman of the London Stock Exchange who played a leading role in the 1980s reform of City securities markets known as “Big Bang”. He was also chairman of TSB – and outside business life, a noted connoisseur of 18th-century clocks, barometers and decorative objects.

Nicholas Goodison was the third-generation head of the stockbroking firm of Quilter Goodison when he was elected chairman of the Stock Exchange in January 1976, but one City columnist observed that “central casting could never have supplied this angular ambitious aesthete as a typical stockbroker”.

Behind his donnish and patrician manner, however, was an almost revolutionary zeal for change in a market still stuck in ways that would have been familiar to his grandfather in the late 19th century.

Much earlier than most of his fellow practitioners, Goodison formed the view that the Exchange’s traditional “single capacity” separation of market-making (by jobbers) from client sales functions (by brokers), combined with fixed minimum commissions, was out of tune with the way modern securities markets in London and elsewhere were developing.

The future, he observed, lay in more efficient “dual capacity” (the two functions side by side) within “large organisations capable of dealing with all aspects of the securities business”.

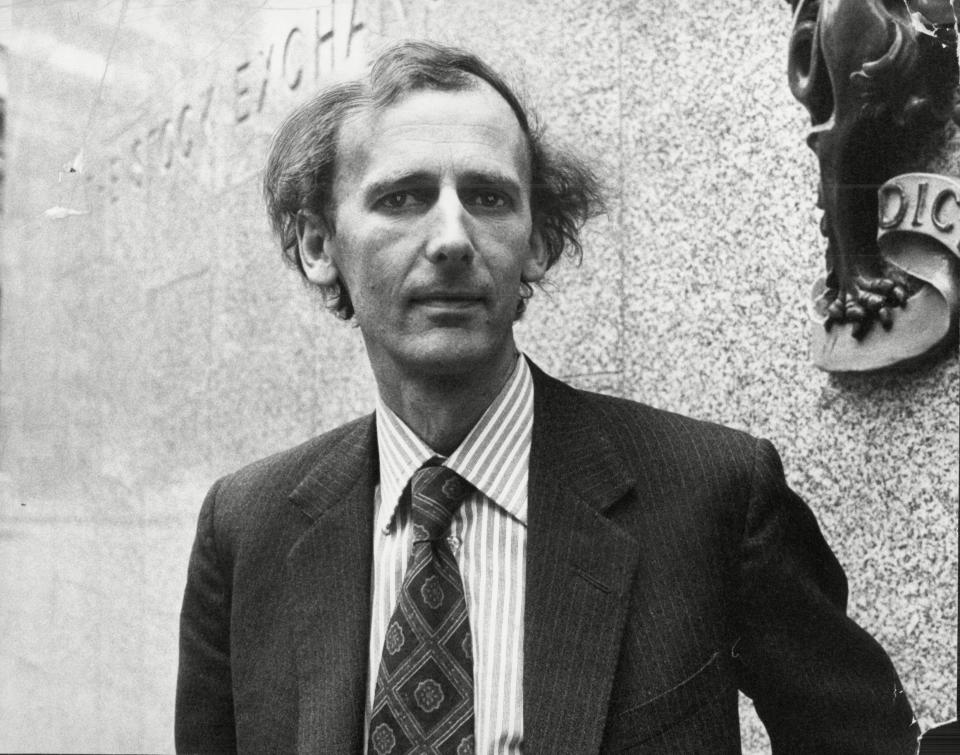

Meanwhile, the view from Westminster after the 1979 election was that, as a bastion of old-school-tie connections and an uncompetitive impediment to London’s role in global finance, the Exchange was ripe for a Thatcherite shake-up. But Goodison’s efforts to persuade the Exchange’s council to contemplate a different future made scant progress until the Office of Fair Trading launched a case against it in the Restrictive Practices Court in 1981.

After extensive political manoeuvres this led in July 1983 to an accord between Goodison and the trade secretary, Cecil Parkinson, whereby the court case was lifted in return for the abolition of minimum commissions and an increase to 100 per cent (from a previous limit of 29 per cent) in the permissible ownership of member firms by third parties.

Dual capacity naturally followed, as jobbers and brokers were rapidly bought up by banks and assembled into Wall Street-style trading houses that would compete under the new rules from the declared date of Big Bang, October 27 1986.

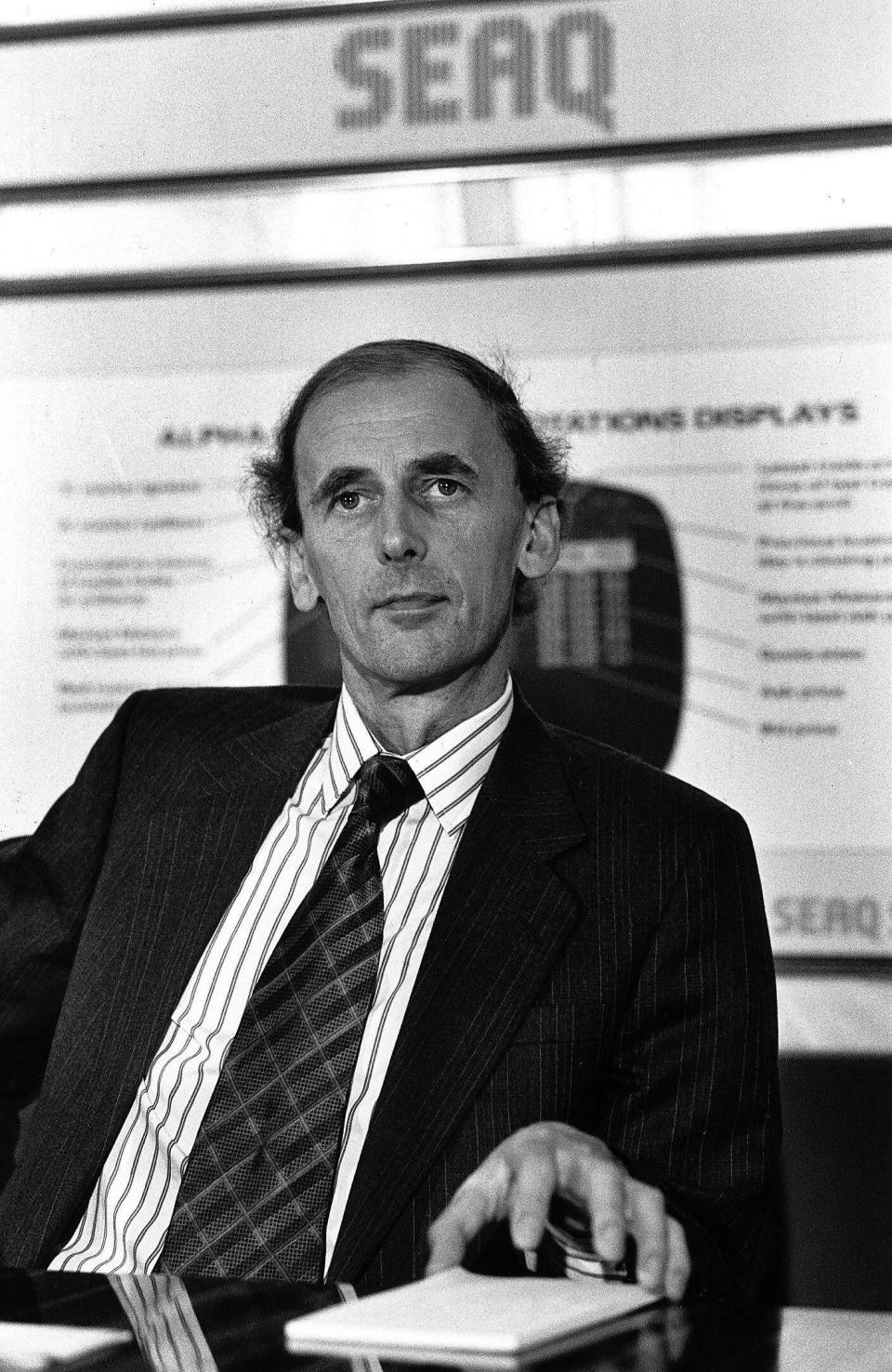

A year later came the Black Monday crash, in which many new-style firms lost heavily and some began to retrench. Goodison was swift to defend the City’s new hi-tech trading systems against accusations that they had increased market volatility and risk. Big Bang, he said, had increased liquidity, transparency and competition and reduced dealing costs, while adding to London’s capacity to generate new capital for industry.

Goodison’s exceptionally long chairmanship also saw the transfer of the Exchange’s self-regulatory role to a new body, the Securities Association, and a complete transformation of its technology. The latter project was perhaps the least successful aspect of his tenure, with huge settlement backlogs during the post-Big Bang phase and too much hope pinned on a new system, Taurus, first mooted in 1981, that eventually had to be scrapped in 1993 at huge cost.

But overall, Goodison’s authority among his Stock Exchange peers and in negotiations on their behalf was magisterial, and when he stood down as chairman in 1988, he was widely hailed for a visionary contribution to the development of City markets.

Nicholas Proctor Goodison was born on May 16 1934. He was educated at Marlborough, and went on to read Classics as a scholar of King’s College, Cambridge.

He inclined towards a teaching career but was drawn by inheritance to the City – which he found “a very human business”, its intricate workings as fascinating in their way as those of the timepieces he studied in his spare time.

His grandfather Henry Goodison had became a member of the Stock Exchange in the 1880s and created the firm of H E Goodison & Co in 1910. It was led in the next generation by Nicholas’s uncle, also Henry; Nicholas joined after graduating in 1958, becoming a partner in 1962. Three years later, Goodisons merged with Hilton Gibbes to form Hilton Goodison, which specialised in broking property company shares to institutional investors; in 1969 it merged again with a firm more oriented towards private clients, Quilter & Atchley, to form Quilter Goodison.

Nicholas Goodison had by then been elected to the Stock Exchange council (its youngest member in the post-war era) and in 1972 he joined a committee to look at the future of the Exchange. Some of its ideas, including corporate ownership of member firms, were left aside after the market crash of 1973, but the committee did achieve a modernisation of the Exchange’s management structure.

Goodison became chairman of Quilter Goodison in 1975. After stepping down from that role (and having overseen the sale of the firm to Commercial Union) as well as the Exchange chair, he was appointed chairman of TSB at the end of 1988. The UK’s sixth largest high street bank, formed from the amalgamation of many local savings institutions, TSB had floated on the stock exchange two years earlier and splashed £800 million of the proceeds to buy the merchant bank Hill Samuel.

But by the time Goodison took the helm, profits were dropping, bad debts looming and the Hill Samuel deal looked wildly overpriced; job losses and retrenchment followed, but in the depths of the early-1990s recession TSB fell into losses.

It became a takeover target, and eventually opted for merger with Lloyds Bank as Lloyds TSB, of which Goodison was deputy chairman from 1995 to 2000. He was also deputy chairman of British Steel, and a director of General Accident.

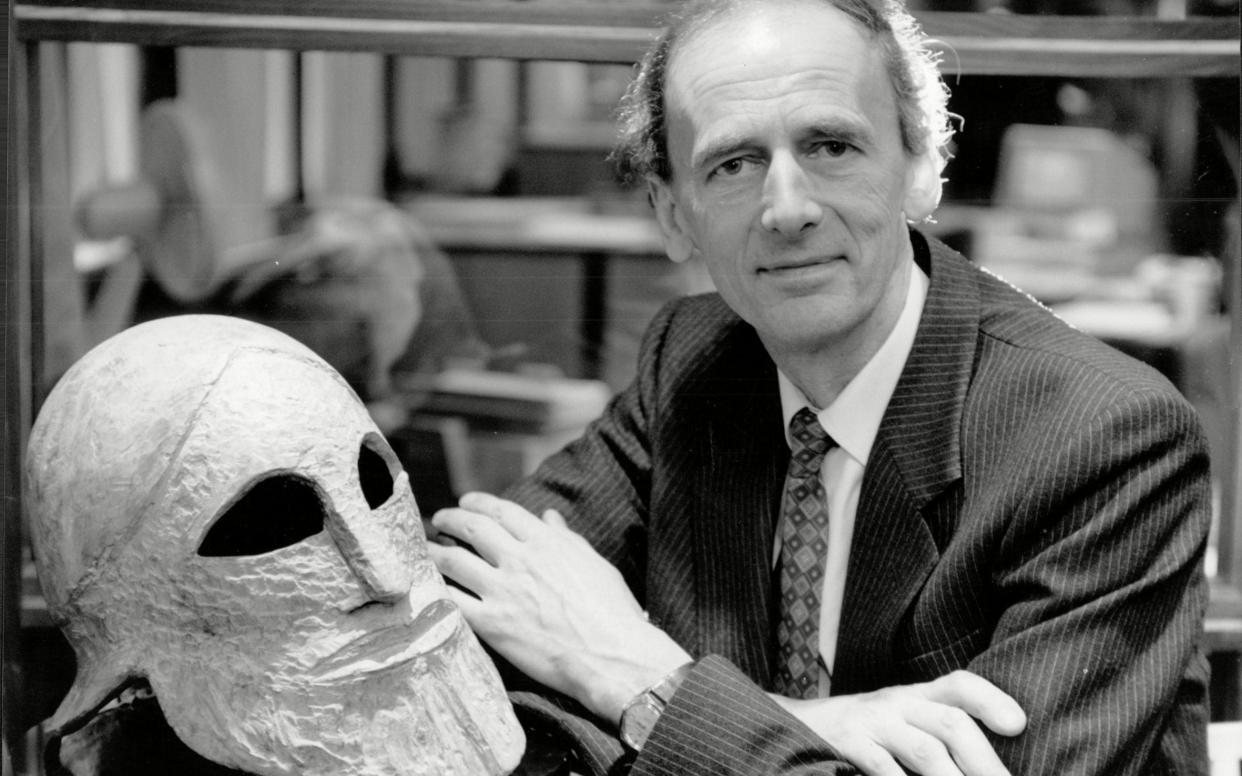

Despite the demands of City life, Goodison absorbed himself in lifelong studies of the work of English craftsmen. He published the definitive English Barometers 1680-1860 in 1968 and Ormolu: the Work of Matthew Boulton in 1974 (revised 2002).

The latter was an exhaustive study of the production of vases, candelabra, clock cases and other ornaments at Boulton’s Soho manufactory in Birmingham between 1768 and 1782. One critic commended “meticulous research combined with a narrative style that makes the book a pleasure to read”.

Goodison wrote many articles in scholarly journals on similar topics, and completed a doctorate at King’s in architecture and history of art in 1981, in the middle of his Stock Exchange chairmanship.

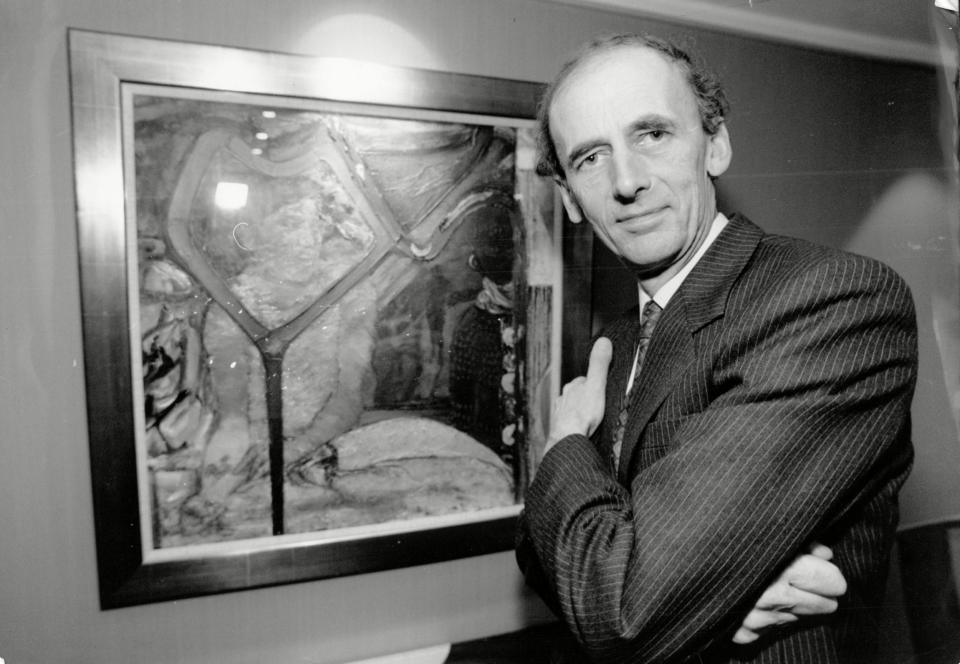

He was chairman of the National Art Collections Fund, the Courtauld Institute, the Burlington Magazine and the Crafts Council, president of the Furniture History Society and the Antiquarian Horological Society, and a trustee of the National Heritage Memorial Fund.

At the Fitzwilliam Museum in Cambridge, where he was honorary keeper of furniture, he and his wife Judith (herself an expert in English furniture, particularly of the 18th Century) donated from their private collection more than 120 items by contemporary craftsmen working in wood, glass, metal and ceramics. Goodison spoke of the couple’s love of objects “that you can’t walk by” because they “sing” to you, and of “how happily works of fine and decorative arts live together”.

Knighted in 1982, he led a review for the Treasury in 2003 into state and philanthropic support for museums, culminating in a report titled “Securing the Best for our Museums”. He was also a vice chairman of English National Opera, and a long-serving governor of Marlborough College.

He married, in 1960, Judith Abel Smith, who descended from a Lincolnshire banking dynasty; they had a son and two daughters.

Sir Nicholas Goodison, born May 16 1934, died July 6 2021