Sirius XM Holdings (NASDAQ:SIRI) Has Announced A Dividend Of US$0.015

The board of Sirius XM Holdings Inc. (NASDAQ:SIRI) has announced that it will pay a dividend on the 30th of August, with investors receiving US$0.015 per share. The dividend yield is 0.9% based on this payment, which is a little bit low compared to the other companies in the industry.

Check out our latest analysis for Sirius XM Holdings

Sirius XM Holdings' Dividend Is Well Covered By Earnings

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Prior to this announcement, the company was paying out 418% of what it was earning, however the dividend was quite comfortably covered by free cash flows at a cash payout ratio of only 16%. Healthy cash flows are always a positive sign, especially when they quite easily cover the dividend.

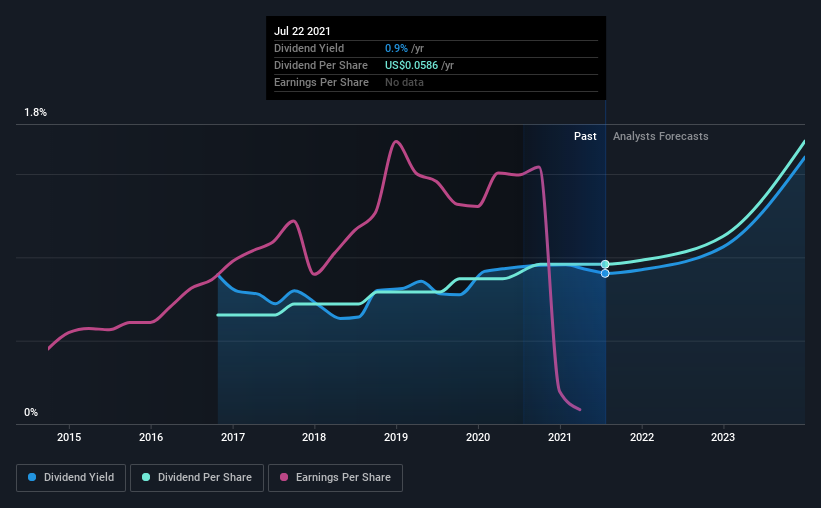

Looking forward, earnings per share is forecast to rise exponentially over the next year. If recent patterns in the dividend continue, we could see the payout ratio reaching 26% which is fairly sustainable.

Sirius XM Holdings Is Still Building Its Track Record

It is great to see that Sirius XM Holdings has been paying a stable dividend for a number of years now, however we want to be a bit cautious about whether this will remain true through a full economic cycle. The first annual payment during the last 5 years was US$0.04 in 2016, and the most recent fiscal year payment was US$0.059. This implies that the company grew its distributions at a yearly rate of about 7.9% over that duration. Investors will likely want to see a longer track record of growth before making decision to add this to their income portfolio.

Dividend Growth Potential Is Shaky

The company's investors will be pleased to have been receiving dividend income for some time. Let's not jump to conclusions as things might not be as good as they appear on the surface. Sirius XM Holdings' EPS has fallen by approximately 34% per year during the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

The Dividend Could Prove To Be Unreliable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 4 warning signs for Sirius XM Holdings (of which 1 makes us a bit uncomfortable!) you should know about. We have also put together a list of global stocks with a solid dividend.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.