Skyworks Calls Jump as Stock Extends Sell-Off

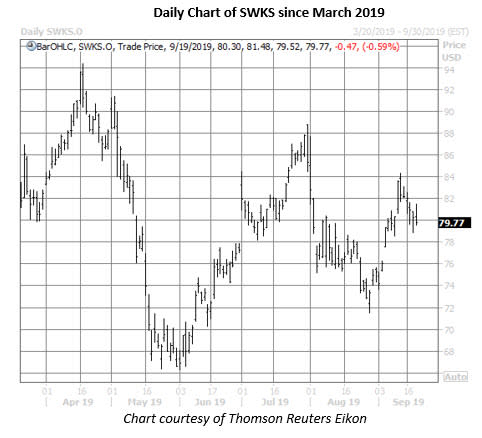

It's been a rough stretch for Skyworks Solutions Inc (NASDAQ:SWKS) stock. The shares are down 0.6% today to trade at $79.77, headed toward their sixth straight daily loss -- their longest losing streak since last September. Today's drop comes even after Cascend Securities boosted its SWKS price target to $95 from $90, pointing to 5G infrastructure expansion, among other things, as a potentially positive catalyst for SWKS stock.

This bullish bias is being seen in the Apple supplier's options pits, too, where calls are crossing at six times the average intraday pace. Most of this action has centered at September 81 call, which expires at the close tomorrow, Sept. 20. It looks as if new positions are being purchased here for a volume-weighted average price of $0.69, which would make breakeven for the traders $81.69 (strike plus premium paid).

SWKS call buyers have already been busier than usual in recent weeks. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock's 10-day call/put volume ratio of 2.49 ranks in the 82nd annual percentile, meaning long calls have been initiated relative to puts at an accelerated clip.

Given a recent spike in short interest, though, some of this call buying may have been at the hands of shorts hedging against any upside risk. Short interest jumped 22.2% in the two most recent reporting periods to 7.61 million shares. This represents roughly 5% of SWKS' available float, or around four times the average daily pace of trading.