New small-business loans are aimed at northern Wisconsin

A Minnesota non-profit is expanding loans, grants, and consulting services to small businesses across much of northern Wisconsin.

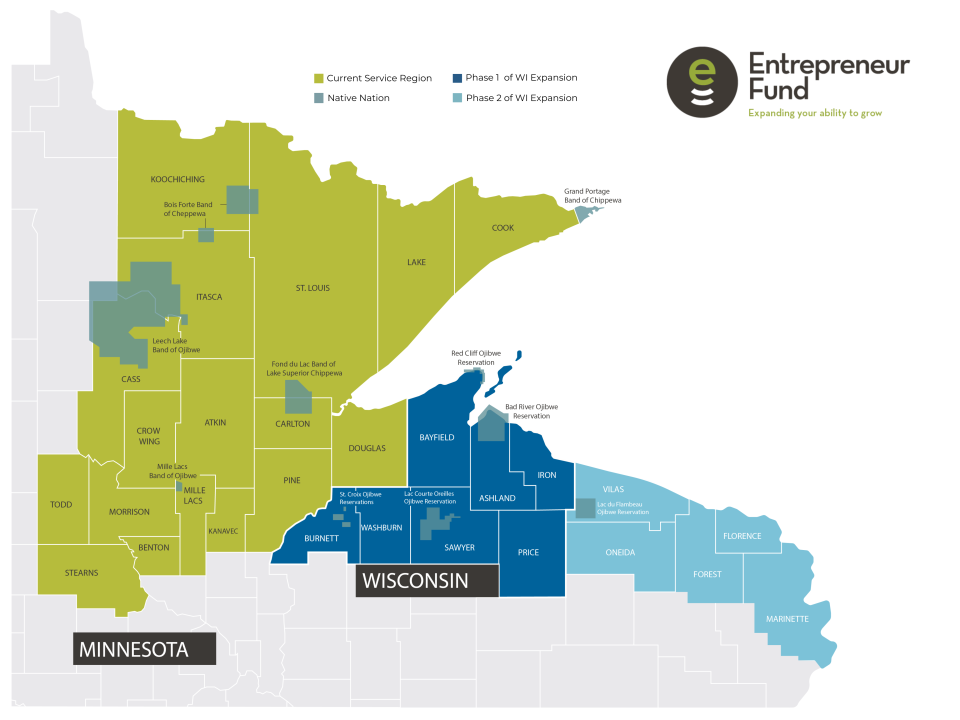

Entrepreneur Fund, of Duluth, says the effort has been fueled by $8 million from the state of Wisconsin initially aimed at seven northwest counties. Another five counties in the northern part of the state will be added by 2025, and five Native nations are included as well.

Much of the money, from Wisconsin’s share of the American Rescue Plan Act (ARPA), is meant for rural businesses under-represented in traditional lending.

The focus is on an area north of State Highway 8 which historically has lacked access to capital, said Shawn Wellnitz, president and CEO of Entrepreneur Fund. Some of the communities would include Spooner, Hayward, Ashland, Bayfield, and Eagle River.

Through a $3.5 million revolving fund, the non-profit will offer loans at below-market rates. Grants totaling $800,000 will also be available, with eligibility criteria to be announced by next spring.

“If you’re a startup business, this could be your best resource,” Wellnitz said.

For years, Entrepreneur Fund has served northeast Minnesota and Douglas County, Wisconsin, on the Minnesota border. With the ARPA money, loans, grants, and business services are being expanded in 2023 to Ashland, Bayfield, Burnett, Iron, Price, Sawyer and Washburn counties. By the end of 2025, Florence, Forest, Oneida, Marinette, and Vilas counties will have been added.

Services include one-on-one consulting in areas such as business strategy, finances, human resources, and raising capital for startups and expansions.

Ben and Mary Anderson used Entrepreneur Fund to create a business plan and secure financing when they acquired Eddie's Restaurant, in Superior, in August.

Mary had worked in the hospitality industry, including catering meals to film crews in New York, and Ben had worked as an emergency medical technician and staff member at an orthopedic clinic.

Eddie's originated in the late 1800s. Over time, Ben said, it evolved from a railway café to a supper club well known for barbecue ribs, steaks, and a Route 66 theme.

The Andersons used loans from a credit union and the fund to acquire the business and make renovations, which included more seating to generate additional revenue.

“We’ve kept the supper club theme,” Ben said, and in a tribute to Superior's shipping port heritage the restaurant now has reclaimed wood from old grain bins.

The first bank the Andersons approached for a loan suggested they instead reach out to the Entrepreneur Fund.

“I didn’t have a background in business,” Ben said, so the help was needed.

Less than three months later they closed on the loans they needed through a credit union and the Entrepreneur Fund.

“I think it was because they helped us lay the groundwork,” Ben said.

The Entrepreneur Fund, started in 1989, assisted more than 2,000 businesses last year. As a community development institution, one of its goals has been to help startups through their initial challenging years.

Jonathan Browstowitz, of Douglas County, used the fund to launch storage-unit businesses and a dog boarding kennel.

“They helped me from the very beginning,” he said.

“When I’ve reached out to them, they were welcoming."

By the end of 2025, the fund expects to serve 29 counties and 10 Native nations in Minnesota and Wisconsin.

"Basically any small business in northern Wisconsin will be eligible for services and capital,” Wellnitz said.

Entrepreneur Fund is establishing a Wisconsin office, possibly in Hayward.

'We pair people with loans to make sure borrowers are getting the help they need to succeed long-term," Wellnitz said.

Traditionally the non-profit has worked with businesses having $5 million or less in annual revenue, which comprises most small businesses.

The revolving loan fund will be leveraged to acquire more capital, with a goal of lending out more than $11 million through 2024.

“We will borrow from social-impact investors and others who care about rural Wisconsin,” Wellnitz said.

This article originally appeared on Milwaukee Journal Sentinel: Northern Wisconsin targeted for new small-business loans.