SoftBank mobile business files for record £16bn float in Tokyo

SoftBank's mobile business has filed for a 2.4tn yen (£16bn) float in Tokyo as the Japanese technology company seeks to transform itself from a legacy internet company to an investment giant.

The float will see SoftBank spin off its mobile phone business, SoftBank Corp, which sells smartphones and network deals, and list it on the Tokyo Stock Exchange in what could be Japan’s largest ever share listing.

SoftBank Corp will list on December 19. The price of the listing will be set on December 10.

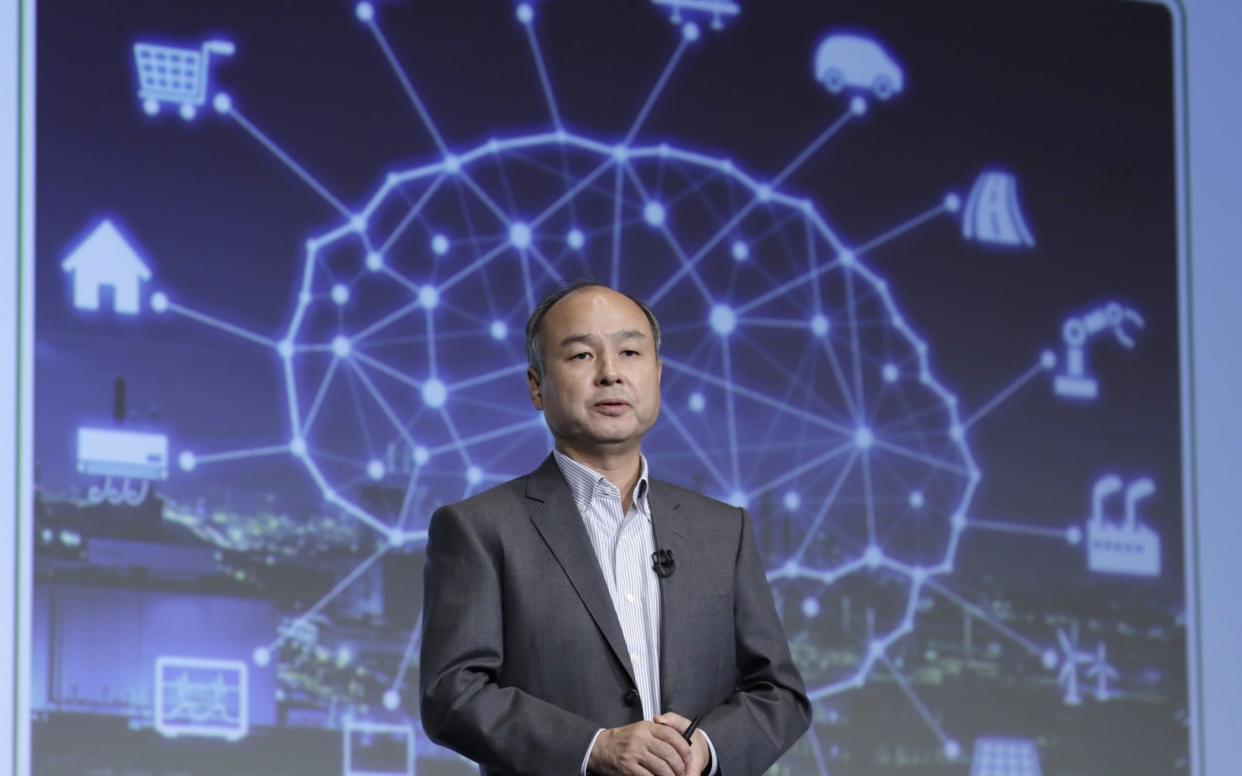

The deal will provide SoftBank with more funds to grow its network of technology investments. SoftBank Chief Executive Masayoshi Son has used the company's $100bn Vision Fund to invest in companies in sectors from gaming to ride-hailing, farming and chip design.

Mr Son's dealmaking has transformed worldwide venture investing. Deal values have increased and some small start-ups have walked away with hundreds of millions of dollars. Some of SoftBank's investments include stakes in Uber, Airbnb and UK video game start-up Improbable.

SoftBank's Vision Fund has attracted investment from Saudi Arabia and tech giants like Apple.

The listing comes close to the $25bn value of the most high-value listing ever, that of Chinese ecommerce company Alibaba on the New York Stock Exchange.

The news of the float comes as it emerges that SoftBank is in early stage discussions for further investments in the UK. SoftBank is targeting UK financial technology companies Revolut and Oaknorth, the Telegraph understands, although a final decision is not expected for several months. SoftBank could invest up to $500m in Revolut, a mobile banking start-up.

SoftBank and Revolut declined to comment.