Solid Biosciences Stock Surge Ignites Options Activity

The shares of gene therapy name Solid Biosciences Inc (NASDAQ:SLDB) hit a five-month high today, after an upgrade from SVB Leerink to "outperform" from "market perform." The brokerage firm also hiked its price target to $15 from $8 -- a roughly 70% premium to Friday's close -- noting the company's Duchenne muscular dystrophy (DMD) treatment could be a positive catalyst if upbeat data is reported later this year, adding that the equity has a good risk/reward profile. At last check, the stock is up 7.7% to trade at $9.49.

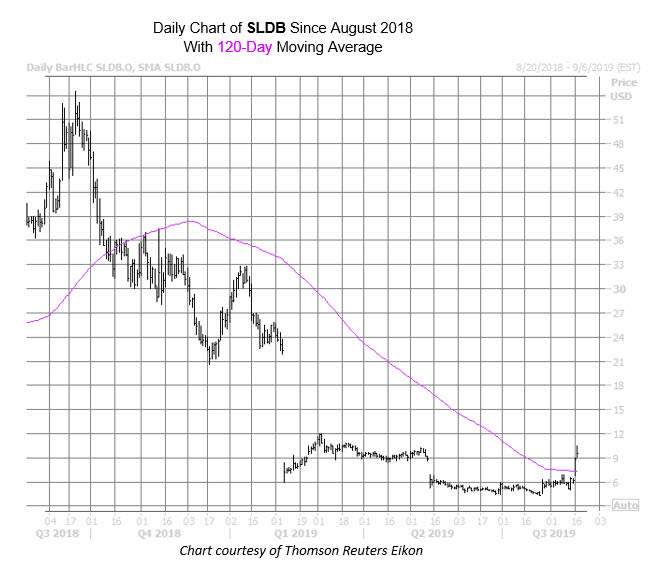

This bull note follows Friday's surge, when the firm's slimmer-than-expected second-quarter loss sent the stock up 43.3% to close at its mid-May bear gap. And while the security is still down roughly 65% year-to-date, last Friday's pop put it north of its 120-day moving average -- a former area of resistance the stock hadn't closed atop since last October.

SVB Leernik's price-target hike joins a bull note from J.P. Morgan Securities issued last week, but there's still room for more analysts to follow suit. Currently, the consensus 12-month price target of $10.29 is at a relatively slim 9% premium to current levels. What's more, prior to today, all five analysts in coverage gave SLDB a "hold" or worse rating.

While overall option volume is light -- especially compared to the wild options activity that took place last Friday -- these contracts are still trading at three times the average intraday pace, with 606 calls and 657 puts on tap. The January 2020 series seems to be the most popular, with possible buy-to-open action taking place at the 10-strike call and the 7.50-strike put.

Should SLDB continue its rally, some short sellers could be hit the exits. Short interest surged 66.8% in the last two reporting periods to 4.25 million shares. This represents a solid 19.5% of the stock's available float, and it would take over eight days to cover these pessimistic positions, at SLDB's average pace of trading.