South Korean Company Crypto Holdings Pass 10 Billion Won

Local media outlets are reporting that several well-known South Korean companies are holding cryptocurrencies as intangible assets, demonstrating the growth of the market.

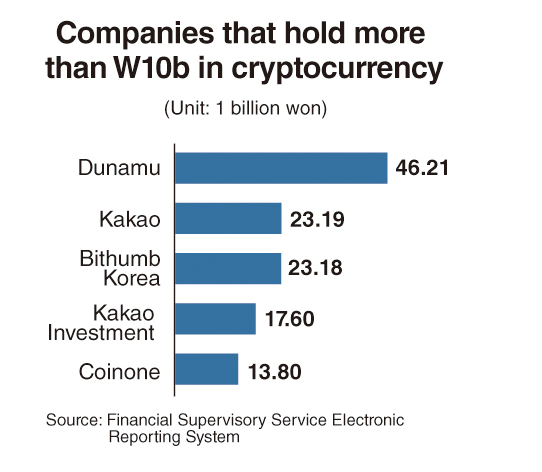

The Korea Herald reported that at least 23 companies in the nation are holding one or more cryptocurrencies as intangible assets. The financial reports of these 23 entities, filed with the Financial Supervisory Service last year. Companies that hold more than 10 billion won in cryptocurrencies include Dunami, Kakao, Bithumb Korea, and Coinone.

Dunamu’s holdings are worth roughly $41.2 million, which includes Bitcoin and Ethereum. In 2020 alone, the company bought 742 BTC. The Korean internet company Kakao holds 17.6 billion won in cryptocurrency and made a profit of 390 million won after selling some last year.

But the holdings are not limited to large, well-known companies. The report notes that a restaurant company called Sikui had one billion won in crypto.

With the way the market is moving, there is a good chance that more local businesses will make crypto a part of their holdings. Furthermore, South Korea has also been offering more clarity on regulation, which plays a large part in convincing or deterring companies to enter the market. It very recently brought about new tax guidelines for the market, though some investors have scoffed at the regulations.

Experts quoted in the report all agree that cryptocurrencies are becoming part of the mainstream. They remark that it serves diversification well and is an “inevitable trend.”

Crypto becoming part of the mainstream

The market has matured to the point where several businesses are turning to crypto assets. Last year, Microstrategy and Square put millions into BTC, which helped spur the market’s bull run.

One argument presented by some of these companies is that bitcoin is a good hedge against inflation. Indeed, bitcoin is the best performing asset since its birth. Some criticize this meteoric rise, but the woes surrounding inflation continue to persist.

This year, Tesla put a whopping $1.5 billion into Bitcoin, some of which it has liquidated, resulting in a $101 million profit. The arrival of such large companies has imparted legitimacy to the market, which in recent months has been attracting more retail and institutional investors.