The Southern Cross Electrical Engineering (ASX:SXE) Share Price Is Down 28% So Some Shareholders Are Getting Worried

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Investors can approximate the average market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. That downside risk was realized by Southern Cross Electrical Engineering Limited (ASX:SXE) shareholders over the last year, as the share price declined 28%. That's well bellow the market return of 7.1%. The silver lining (for longer term investors) is that the stock is still 8.5% higher than it was three years ago. Furthermore, it's down 24% in about a quarter. That's not much fun for holders.

See our latest analysis for Southern Cross Electrical Engineering

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Even though the Southern Cross Electrical Engineering share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped. It's fair to say that the share price does not seem to be reflecting the EPS growth. So it's easy to justify a look at some other metrics.

Southern Cross Electrical Engineering's dividend seems healthy to us, so we doubt that the yield is a concern for the market. From what we can see, revenue is pretty flat, so that doesn't really explain the share price drop. Of course, it could simply be that it simply fell short of the market consensus expectations.

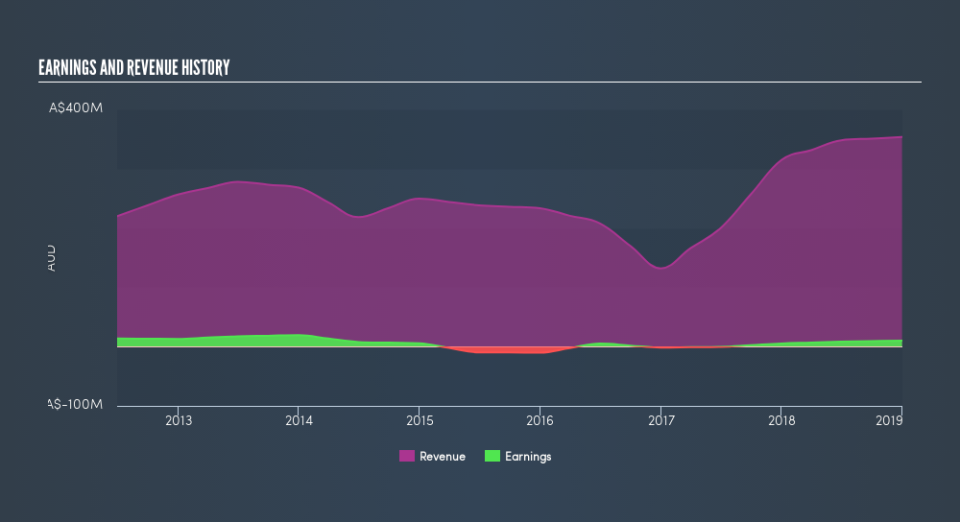

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

We know that Southern Cross Electrical Engineering has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Southern Cross Electrical Engineering's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Southern Cross Electrical Engineering's TSR for the last year was -24%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market gained around 7.1% in the last year, Southern Cross Electrical Engineering shareholders lost 24% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 2.0% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

We will like Southern Cross Electrical Engineering better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.