Southern Utah lawmakers' legislation: Tax cuts, vaccination status privacy, death penalty update

- Oops!Something went wrong.Please try again later.

The 2022 Legislative Session started on Tuesday, setting off a frantic 45-day period in which 104 elected officials gather in Salt Lake City to create and update Utah’s laws.

Lawmakers from southwestern Utah are pushing a number of major pieces of legislation, including proposals for tax cuts, updates to vaccination rules and changes to the state's death penalty laws.

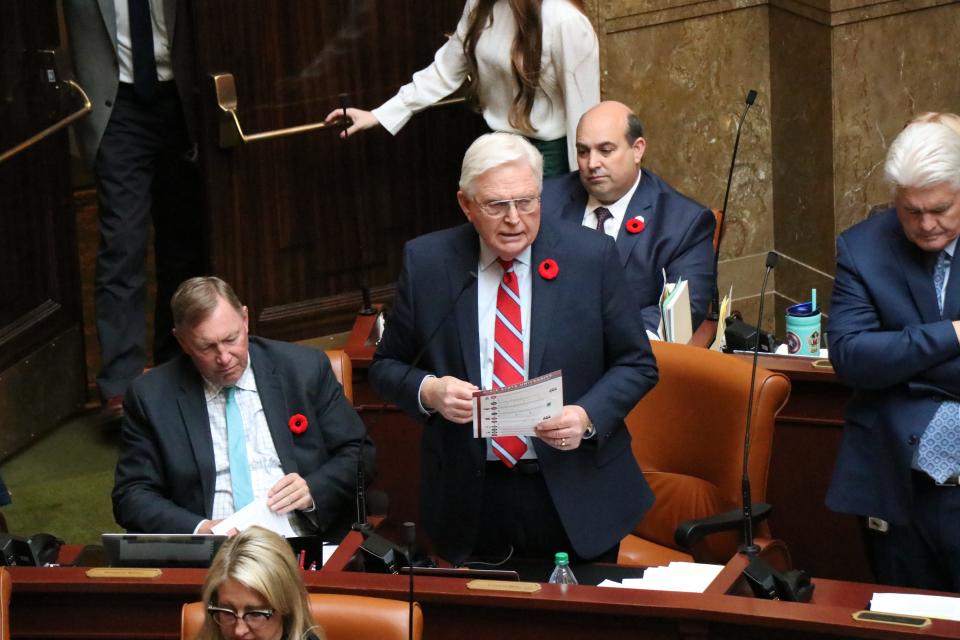

With hundreds of bills being proposed, it’s impossible to know what will happen on Capitol Hill, but with large Republican majorities in both the House and Senate, the GOP will again drive the discussion, and Sen. Evan Vickers, R-Cedar City, the Senate Majority Leader, said the caucus has big plans for 2022.

Vickers listed water, public education, tax cuts, infrastructure funding, economic development reform, improving access to mental health resources, affordable housing issues and homelessness as major issues. But Vickers noted that the session goes quickly and not every piece of legislation will get a vote or committee hearing in the seven-week session.

“There's a lot of action. It gets pretty fast and furious,” Vickers said. “But that's kind of the pattern. It's a slow ramp up, and then it really starts taking off. And then it peaks, you know, just right up until the end.”

Action on the coronavirus pandemic

One issue that won’t be treated with “urgency” is updating the state’s response to COVID-19, according to Vickers. Although there are some bills in place that will address the pandemic, Vickers says those bills will be considered in the same process as any other proposed legislation.

“We'll take a look at them, but I don't know how urgent they’ll be,” said Vickers.

One controversial bill that was added just before the session started was HB 182, which amends how local health departments can apply rules. This bill would change the rules and limit how local governments can issue mandates after the ‘Pandemic Endgame,’ which put mandate powers in the hands of local agencies like county governments.

This comes after a public battle between the Salt Lake County Health Department and Gov. Spencer Cox over the health department's recent 30-day mask mandate to combat the surge of COVID-19 cases due to the omicron variant. In response to the mandate, Cox said state buildings and workers wouldn’t need to comply. The governor’s ruling was contested by Salt Lake County officials, but currently, the mandate is in place, even if the state government isn’t enforcing it.

If this bill was passed, it would make it legal for the state government to not follow local rulings. It also prohibits any chief executive of a municipality — meaning mayors — from exercising any emergency powers to respond to an epidemic, pandemic or other health emergencies.

Specifically, it states any state-owned facilities aren’t under the jurisdiction of a local health department, meaning any kind of mandate, including a mask mandate, issued by a public health department wouldn’t apply to state buildings.

Rep. Walt Brooks, R-St. George, is one legislator that’s filed a bill to address the pandemic but the bill isn’t looking at a way to reduce case numbers or hospitalizations. Rather HB 60, which is titled "Vaccine Passport Amendments," reduces the legality of vaccine requirements in almost all areas of life.

The bill — which is co-sponsored by Sen. Michael Kennedy, R. Alpine — would nullify most vaccine requirements by adding a person’s immunity status to a list of protected categories that can’t be discriminated against. If passed, this bill would add immunity status to a list of protected categories that currently includes race, sex, color, religion, nation of origin and pregnancy.

Just as it’s illegal for a person to be discriminated against based on the color of their skin, a person couldn’t be singled out and treated differently based on their vaccine status, according to the bill.

Brooks said he thinks this bill “shouldn’t be necessary” but because of the coronavirus pandemic, society’s view of immunization has changed into people being expected to share their vaccination status.

HB 60 outlaws vaccine passports — documents that verify vaccine status — since Brooks thinks it's “un-American” for people to have to show identification to patronize normal businesses like stores and restaurants.

The bill would apply this to any place of public accommodation, which are places like restaurants that cater services to the public for a fee, but this bill wouldn’t apply to private places such as churches, apartment buildings or clubs, since those places are private in nature, according to the text of the bill.

HB 60 would also ban employers and government entities from asking for proof of immunity status, although there are some exceptions for health care-related fields, since those fields often deal with federal regulation, according to Brooks. It would also prohibit an employer from requiring an employer or government entity from requiring an employee to get a vaccine.

Taxes

In 2021, the Legislature made several moves in regards to taxes, approving a nearly $100 million tax relief bill that targeted families and seniors. But in 2022, there will be multiple pushes to create additional cuts, according to Vickers.

The main push coming from the Republican caucus will be to reduce the income tax rate, which currently sits at a flat 4.95%, Vickers said, although it’s not clear what the final tax will look like. Vickers has a bill to cut the tax rate to 4.9%, while another southern Utah legislator, Rep. Travis Seegmiller, R-St. George, has filed a bill to cut the rate to 4.75%. Another proposal would cut the rate to 4.6%.

The current state of the economy is what is driving the push for a tax cut but the legislature doesn’t want to cut taxes that would create the necessity for a tax increase in the future, says Vickers.

“We know that there's a lot of cash in the economy right now, a lot of that cash has been stimulated by money coming from the federal government,” he said. “Then at some point, the cash is going to dry up and then the economy's going to start to slow down."

These various tax cuts would cost the state government millions of dollars, with every .5% reduction in the state income tax amounting to some $80 million. The Republican caucus has agreed to set aside around $160 million for tax cuts in this legislative session, according to Vickers. This means the target cut to the state income tax is 4.85% which would cost $160 million. The governor has also outlined a proposal to set aside $160 million for a grocery tax credit that will target low-income residents.

Vickers said there is a discussion within the legislature to approve some version of the grocery tax credit but said the priority would be to get an income tax cut across the finish line.

Another tax bill being considered would affect social security tax credits. Last year, a bill pushed by Brooks passed that allowed any retired couple making under $50,000 to not be taxed on their social security income. Now he is sponsoring HB 53, with a co-sponsor from Sen. Don Ipson, R-St. George, further raising the taxable income threshold from $50,000 to $62,000.

Legislation from southern Uth legislators

Sen. Evan Vickers, R-Cedar City

As majority leader of the Senate, Vickers has a more complicated job than other senators, but he was still able to sponsor multiple bills. The bill with the biggest impact could be Vickers’ proposed tax cut, which would make the income tax rate 4.9% instead of 4.95% and cost the state around $80 million. Vickers acknowledged the Republican caucus would be willing to bring the rate as low as 4.85%.

Outside of taxes, Vickers is handling some housekeeping measures in the Legislature including, making technical corrections to the state code with SB 91. He also is sponsoring a joint resolution — SJR 01 — to authorize the pay for employees working with the Legislature during the session.

Vickers is also working on legislation related to healthcare. One bill he has is updating the Nurse Apprentice Licensing Act to make some technical changes as well as allowing the Division of Occupational and Professional Licensing the ability to issue a license for a registered nurse apprentice.

He is also sponsoring HB 80, which is called the Diabetes Prevention Program. If passed, this bill would allow the Medicaid program to reimburse people that use the National Diabetes Prevention Program created by the Centers for Disease Control. This program gets people in health programs to help prevent Type 2 diabetes by promoting healthy eating and an active lifestyle, according to the CDC website.

Sen. Don Ipson, R-St. George

There is a wide range of legislation sponsored by Ipson, with some notable pieces including sponsoring a house bill that relates to the mental health care of first responders.

HB 23 would make it a requirement for any first-responder agency — including law enforcement officers, paramedics, firefighters and EMTs — to have mental health resources for all employees as well as their spouses and children. It would also cover retirees from these agencies. The bill was voted through the Law Enforcement and Criminal Justice Interim Committee by a vote of 10-0 with six absent.

If passed, this bill would also give the Department of Human Services, which covers mental health services for employees, a one-time appropriation of $5 million from the state general fund.

Another bill sponsored by Ipson that made it through the Law Enforcement and Criminal Justice Interim Committee is amending how law enforcement collects and stores DNA samples. The bill — HB 19 — would require a sheriff’s department to notify an individual related to a DNA sample to be notified once that sample is destroyed and would allow a person to request the destruction of their DNA if certain conditions are met.

These conditions include that a person wasn’t found guilty of a crime for which the DNA sample was collected, or any conviction of a crime was overturned by a court. DNA destruction can be requested by an individual or ordered through a court.

Ipson is co-sponsoring some bills with Brooks, including the proposal to change the social security tax credit. Another would amend the state’s lane filtering regulations. There is also a budget-focused legislation Ipson is working on, SB 08, which would increase the pay of state employees to keep up with market wages and increase spending on insurance benefits.

Rep. Rex Shipp, R-Cedar City

Shipp has a bill that would ban gender-affirming medical treatment for anyone under the age of 18. This bill — HB 127 — would have any medical professional that provided “medically unnecessary” services related to gender be charged with unprofessional conduct, which could result in fines or jail time for the provider.

The bill would specifically prohibit practitioners from providing puberty inhibitors or sex characteristic-altering procedures to any minor. And the treatments that would be banned are based on a person’s biological sex at birth, so different treatments are banned for those born male and for those born female.

Shipp is also sponsoring HB 158, which limits how political subdivisions — counties, cities — can regulate retail pet stores. The bill would ban a city or county from enforcing an ordinance that states a pet store can only sell animals from an animal shelter or a “similar entity.”

Rep. Lowry Snow, R-Santa Clara

This will be Snow’s last session, as he announced he wouldn’t seek reelection in 2021. Nevertheless, he’s proposing several different points of legislation that focus on criminal justice and education.

Snow has been trying for years to change the death penalty in the state since often putting a prisoner through the death penalty process is more expensive for the state compared to a life-long sentence. His most recent attempt to change the death penalty is HB 147, which would change sentencing options and prohibit the death penalty from being issued in the future.

In Utah, only the charge of aggravated murder carries the death penalty. Snow’s bill proposes adding a possible sentence of 45 years to life for anyone convicted of aggravated murder. It would also prohibit the state from filing or seeking death penalty charges for any crimes committed before May 4, 2022, unless the state filed the notice of intent to seek the death penalty before then.

Snow is also sponsoring HB 179, which proposes to make amendments to the state’s juvenile records law. It would amend who can see juvenile records and when those records get expunged and would make some technical changes to the law.

Another bill, SB 87, would change how court fees are charged. SB 87 defines when an individual won’t have to pay court fees due to lack of financial resources. The bill would make it so any “indigent” person — someone who isn’t financially able to pay fees— wouldn’t need to pay certain court fees. It defines that any person that has income below 150% of the poverty of the federal poverty level would be indigent, and any person being represented by a nonprofit, receiving benefits from government programs, would also be exempt from certain court fees.

In education, Snow has a few education-focused bills, including HB 42, which would extend repeal dates on certain public education programs, and SB 42, which creates funding goals for higher education institutions. Snow also sponsored a resolution to honor the 125th anniversary of the National Parent Teacher Association.

Walt Brooks, R-St. George

In addition to his bills on vaccine passports and tax credits, Brooks is working on legislation relating to retirement with his sponsorship of SB 24.

This bill would revise certain aspects of Utah’s retirement system and was approved by the Retirement and Independent Entities Interim Committee by a vote of 11-0, with four absent. It codifies and updates how an employer communicates retirement information and what an employee needs to do in order to qualify for retirement benefits.

Brooks is also sponsoring SB 34, which would repeal certain sunset dates for the Utah Statewide Radio System that would make appropriations for this system non-lapsing.

Brad Last, R-Hurricane

As of Wednesday, Last only had one official bill he was sponsoring. SB 07 would create a base budget for state funds in relation to the National Guard and Veteran Affairs programs in Utah. This bill sets aside funds for both fiscal years 2022 and 2023.

Last has other bills in the process of being drafted and it’s unclear what the bills will actually look like, but of the three in the process, two were related to budget appropriations and one was related to the amendments around the Transient Room Tax.

The Transient Room Tax is one charged for any short-term rental — 30 days or less — of a living space. This tax heavily impacts Washington County because of the high rate of tourism in the county. From 2020 to 2021 the county ranked third in the state for taxes collected from the Transient Room Tax, according to the Kem C. Gardner Policy Institute at the University of Utah.

Travis Seegmiller, R-St. George

There are only two bills that Seegmiller is sponsoring: a tax cut bill and a proposed cost-saving initiative.

The tax cut bill is HB 105 and is just one of several proposals by Republicans to increase the state income tax. Seegmiller’s bill would reduce the income tax rate from 4.95% to 4.75% which would cost the state around $320 million in tax revenue, based on the estimate that any .05% cut to the state income tax would result in $80 million in lost revenue for the state.

The cost savings initiative — HB 89 — would only apply to state employees and would create an anonymous reporting tool for state employees to report any misuse or inefficient use of tax dollars. It would also allow employees to submit ideas on how to implement cost-cutting measures and ideas on how the state can optimize the use of state funds.

Sean Hemmersmeier covers local government, growth and development in Southwestern Utah. Follow on Twitter @seanhemmers34. Our work depends on subscribers so if you want more coverage on these issues you can subscribe here: http://www.thespectrum.com/subscribe.

This article originally appeared on St. George Spectrum & Daily News: 2022 Legislative Session in Utah: Economic reform, affordable housing