Spain’s Sanchez Is Struggling to Make the Case for the Economy

- Oops!Something went wrong.Please try again later.

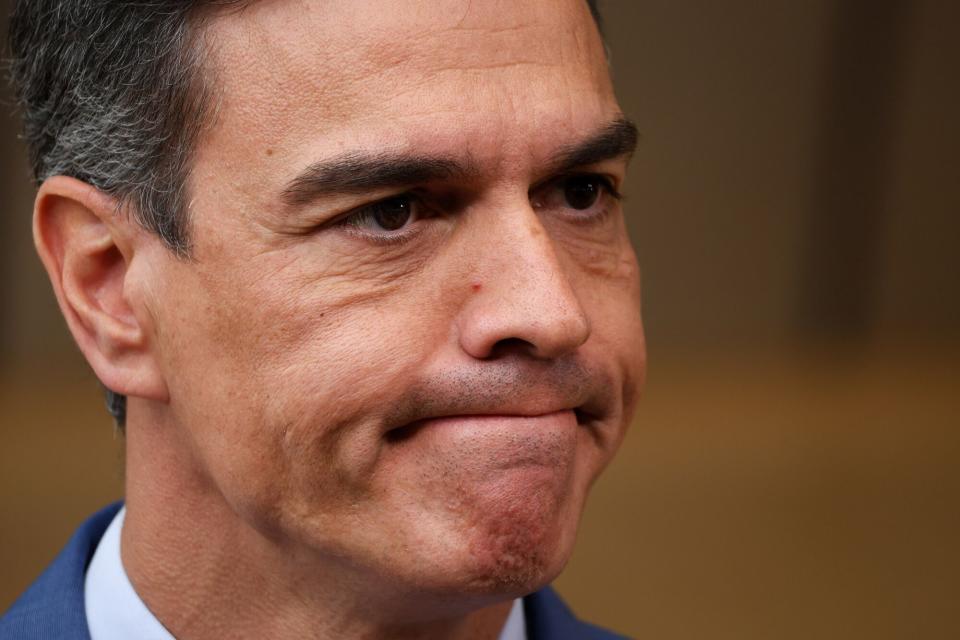

(Bloomberg) -- The resilience of Spain’s economy likely won’t be enough to convince voters to reelect Prime Minister Pedro Sanchez in Sunday’s election when his Socialists look set to lose to the conservative People’s Party.

Most Read from Bloomberg

Apple Tests ‘Apple GPT,’ Develops Generative AI Tools to Catch OpenAI

A $500 Billion Corporate-Debt Storm Builds Over Global Economy

In London, New York and Paris, a Giant Office Bet Is Going Wrong

Tesla Investor Rode a 14,800% Gain Thanks to 27-Year-Old Analyst

What a UPS Strike Would Mean For Consumers, Businesses and the Economy

Spaniards are still reeling from one of the sharpest drops in real income in Europe even as output is growing steadily, with soaring inflation easing back to normal and record employment.

“The economy is doing well, but when you look at it in detail the picture is not that rosy,” said Manuel Hidalgo, an economist and senior fellow at the Esade Centre for Economic Policy, a think tank in Madrid. “You may be growing more than the rest of the continent and creating more jobs with the lowest inflation, but if families can’t make ends meet, they will blame you.”

A sharp erosion of purchasing power and dwindling consumption remain major headwinds for the Socialist, who lost swathes of the country to the People’s Party of Alberto Nunez Feijoo and far-right Vox in local elections on May 28.

Here are the key challenges:

Food Inflation

The euro area’s fourth-biggest economy has been more successful in bringing down the pace of inflation than other members of the currency bloc. The headline rate even dipped below the European Central Bank’s official goal of 2% in June for the first time in more than two years, and yet food prices continue to rise by more than 10%, hitting families.

Bloomberg’s Paella Index showed the increase in the cost of the ingredients needed to make the classic Spanish dish accelerated again in June to 14.5%, with olive oil 31% more expensive than a year earlier.

Growth Laggard

Spain’s economy is growing four times the European Union average, but it’s still playing catch-up after taking a bigger hit to output than other nations during the Covid pandemic. It will likely need until at least late 2025 to close the gap with the euro area, according to the latest quarterly forecasts from the Bank of Spain.

Spain’s GDP per capita also lagged the rest of Europe in 2019-2022, with an accumulated contraction of 2.4%. Only Iceland was worse. Some economists have called into question the reliability of the official GDP readings after a string of steep upward revisions over the last year.

Dwindling Income

Record inflation and lagging growth, offset only partly by moderate wage hikes, have left household disposable income 2.4% lower than before the pandemic.

The median Spanish wage has risen for six straight quarters, but price increases mean purchasing power has slid back to 1996 levels, according to a study by human resources consulting firm Adecco.

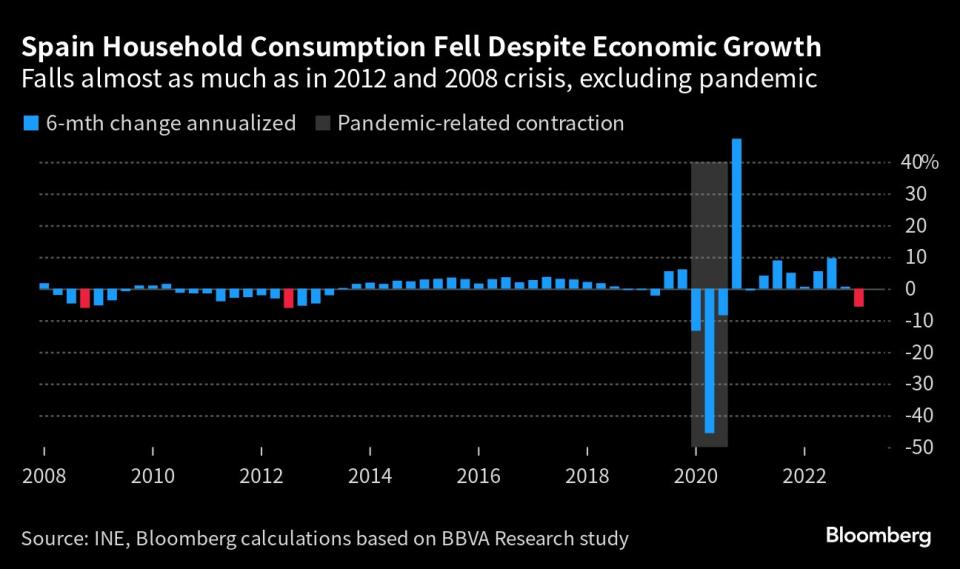

Falling Consumption

This has led Spaniards to slash spending on everything from cars and trips abroad to protein, with meat and fish down 7% and 12% respectively in April from a year ago, according to Agriculture Ministry data. Household consumption dropped a staggering 6% in annualized terms between September and March.

Actual individual consumption, an indicator of material wealth, has remained stuck at around 85% of the EU average since 2020, placing Spain in the lower half of the bloc alongside Poland and Estonia, according to Eurostat data.

At the same time, rising mortgage costs resulting from the ECB’s record tightening campaign will likely eat into savings accumulated during the pandemic, according to the Bank of Spain. Seven out of 10 home loans are linked to market rates. Fitch Ratings forecasts monthly floating-rate mortgage payments will use up about 40% of household income on average by 2024, rising from 30%-35% last year.

Fewer Bonds

Spanish company executives, meanwhile, are shying away from the higher cost of debt financing. Corporate bond issuance has been slow so far in 2023, with only 2022 seeing a lower level at the same point in the year in the period since the financial crisis, according to Bloomberg league table data. In Europe’s other major economies, issuance has rebounded as firms have taken advantage of stable market conditions.

As for sovereign debt, a growing number of strategists including Morgan Stanley, Barclays Plc and Citigroup Inc. are highlighting that government bonds are cheap after months of underperformance, saying election risks are overdone.

Trailing Earnings

Since Sanchez took over as prime minister five years ago, Spain’s biggest listed companies have struggled to match the profitability of European peers, according to a key metric. Earnings per share in the country’s benchmark IBEX 35 have been lagging other major European indexes, including Italy’s FTSE MIB and France’s CAC 40.

Banks and utilities have the largest weightings on the IBEX 35 — two sectors that have been hit by a windfall tax the government passed last year.

--With assistance from Ronan Martin, Macarena Muñoz, Aline Oyamada and Zoe Schneeweiss.

Most Read from Bloomberg Businessweek

No Testing, No Inspections: Contaminated Eyedrops Blinded and Killed Americans

MG Shows a British Pedigree Can Do Wonders for a Chinese Brand

©2023 Bloomberg L.P.