SPD chief encourages MO legislature to OK public pre-K funding, child care credits

- Oops!Something went wrong.Please try again later.

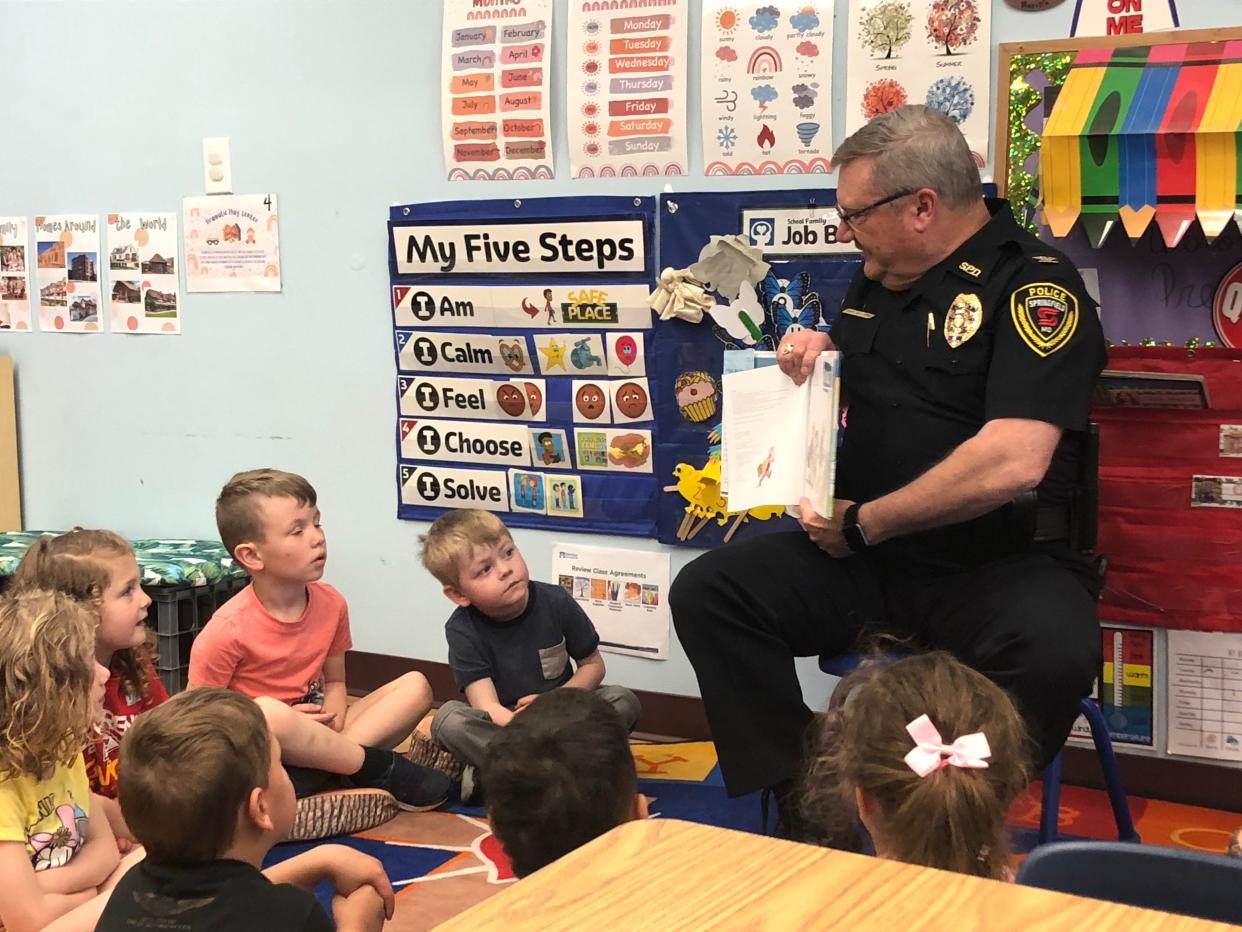

Springfield Police Chief Paul Williams joined Council for a Strong America representatives to urge the Missouri legislature to approve increases in funding for public preschool and for family and provider subsidies for child care, as well as targeted tax incentives to strengthen child care.

According to Terra Pascarosa, CSA mobilization director, infant care in a Missouri center averages over $10,000 per year, which is 8% more than a public college tuition. For an average single parent in Missouri, Pascarosa said, that is about a third of their income.

While a lack of child care can have economic impacts, Williams believes it also has an impact on public safety.

"It's a 'pay us now, or pay us later' (situation) when it comes to kids and crime. Adults who don't get quality support and early education when they start out are more likely to be involved in bad behavior and criminal behavior, and it's something I absolutely see," Williams said, noting that the Springfield Police Department had seen an increase in 13- to 17-year-olds involved in violent behavior.

Williams cited findings from Alabama's pre-kindergarten program, where students who attended preschool had lower rates of discipline and behavioral infractions in grades one through 12. Recently, the Springfield Mayor's Commission for Children found that children who attend preschool programs are more prepared to learn once they get to kindergarten than children who don't.

More: Study of Springfield students shows the bump kids get from attending pre-K programs

Audrain County Prosecutor Jacob Shellabarger explained that as economic opportunities increase, such as manufacturing jobs, so too do the early childhood investments. In addition to allowing parents to work, early childhood care can address behavioral issues that otherwise may go unaddressed, he said.

"I would much rather invest resources into our kids than encounter them in the criminal justice system or later on as adults," Shellabarger said.

Retired Army Brigadier General Daryl McCall also said the lack of investment in early childhood education has negatively impacted national security. Recent data from the Pentagon found more than 75% of Americans between the ages of 17 and 24 cannot qualify for military service without a waiver due to health problems like obesity or involvement with crime or drugs.

What has Gov. Mike Parson proposed in terms of expanding child care and tax cuts that benefit child care?

Governor Mike Parson recommended allocating $124 million toward expanding early childhood education, which would provide at least 17,000 more Missouri children access to preschool. Parson also recommended updating child care subsidy rates by $78.5 million for a total of $253.9 million in child care subsidies.

The governor also proposed three tax programs for child care credit.

The first would allow corporations, charitable organizations, individuals and partnerships with the state to take an income tax credit for up to 75% of a verified contribution to a licensed child care facility to promote child care.

More: How to make daycare more affordable? Missouri weighs tax credits for providers, employers

The second tax credit proposal is for up to 30% of an employers' eligible child care assistance expenditures.

The third tax credit proposal is for child care providers. Providers can receive a tax credit on eligible payroll withholdings for employees that work at least 10 hours a week and for at least a 3 month period and up to 30% of eligible capital improvements to their child care facility.

Each tax program has a cap of $200,000 per taxpayer and an overall cap of $20 million per calendar year.

Susan Szuch is the health and public policy reporter for the Springfield News-Leader. Follow her on Twitter @szuchsm. Story idea? Email her at sszuch@gannett.com.

This article originally appeared on Springfield News-Leader: Springfield police chief to legislature: OK early childhood funding