Spirit, JetBlue appeal of decision that blocked its merger to be heard in June. Will it be too late?

In a decision that will affect air travel in South Florida, JetBlue Airways and Spirit Airlines will have to wait until June before a federal court hears their appeal of a ruling that blocked JetBlue’s proposed $3.8 billion purchase of its smaller rival.

The schedule set Friday, Feb. 2, by the First U.S. Circuit Court of Appeals in Boston is a month later than the airlines had hoped. They asked for an expedited hearing in May so the court could rule before a July 24 deal-closing deadline in their merger agreement.

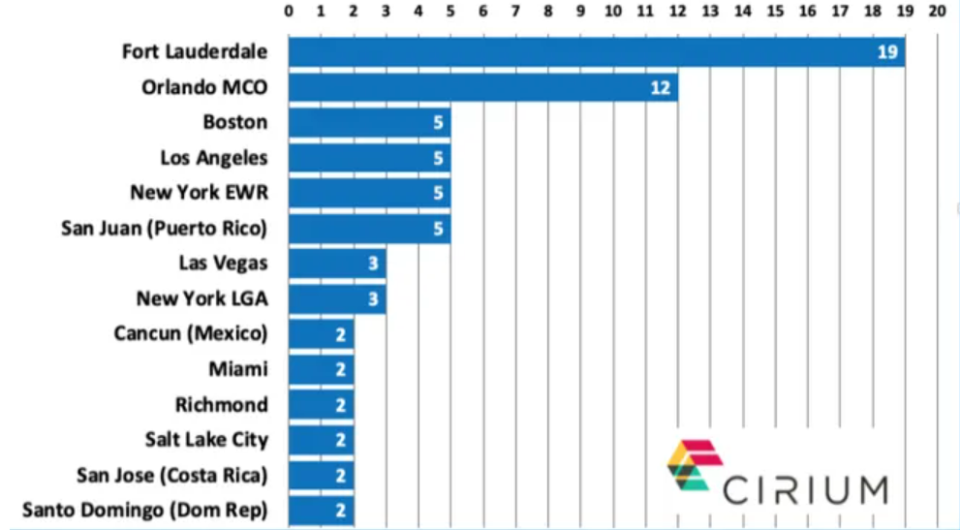

The two airlines account for more than half of the traffic at Fort Lauderdale-Hollywood International Airport. JetBlue is the No. 1 carrier at Palm Beach International Airport.

The airlines argued in a court document filed Feb. 1 that if their request for a May date was not granted, it is "unlikely" the appeal will be decided in time. The result would be "irreparable harm" to the airlines and millions of airline passengers who would benefit from the merger, the airlines said in the court document.

The U.S. Department of Justice accused the airlines of “threatening to rush the briefing of a complex appeal."

The airlines note that the merger is dependent upon JetBlue obtaining $3.5 billion of financing. It could lose that financing if the merger does not occur by July 24.

U.S. District Court Judge William Young on Jan. 16 agreed with the government's claim that the merger would adversely affect air travel by eliminating a major discount carrier, resulting in higher air fares throughout the country.

Spirit patrons who do not pay for luggage or seats can often obtain one-way fares to Northeast airports for less than $50. Young said in his opinion:

“Spirit is a small airline. But there are those who love it. To those dedicated customers of Spirit, this one’s for you.”

Another issue that has hurt Spirit is that dozens of its Pratt & Whitney planes have had to be grounded for intensive inspections to ensure they are safe. The airline expects to be compensated by Pratt & Whitney for lost revenue.

Meanwhile, bargain-basement, no-frills prices continue to be had on Spirit. One could have booked a one-way ticket to Atlantic City from Fort Lauderdale on Feb. 1 for a flight on Feb. 21 for just $27.

Is Spirit headed for bankruptcy?

Michael Cohen, the CEO of the California-based MDC Financial, has been following the proposed merger for the past year and attended the recent trial before Young. He said he found it ironic that the judge’s concern was keeping fares low for consumers but if Spirit goes out of business, the decision may have the opposite effect.

Unless it can turn itself around and become profitable, Cohen said he thinks Spirit is headed into bankruptcy.

Unlike other carriers, Spirit stock has not recovered since COVID. Fitch, the ratings agency, reported on its website that Spirit faces "serious headwinds toward improving its profitability including engine availability issues, overcapacity in certain leisure markets, and intense competition."

Cohen said it is clear Spirit wants and needs the merger to go through, but that JetBlue may not, since Spirit shares have drastically fallen over the past year and especially since the court ruling.

More: JetBlue's buyout of Spirit Airlines blocked by judge citing competition threat

Under the merger agreement, JetBlue must pay $33 for each share of Spirit stock. Spirit's stock price was $6.30 at the start of business Monday, Feb. 5. JetBlue filed a statement with regulators saying it continues to evaluate its options under the agreement. Cohen said he took that to mean it is looking to see if it can get out of the merger.

Of concern to analysts is the $1.1 billion in debt coming due in September 2025 for Spirit. The airline reported it is working on a restructuring plan but both Fitch and Cohen,question whether it will be successful.

Since the court decision was announced on Jan. 16, Spirit Airlines' share price has fallen 61%. During the past 12 months, JetBlue's price as dropped 41%. Wall Street analysts were calling on JetBlue to lower the purchase price given all of Spirit’s problems, and that was before the judge’s ruling.

The Associated Press contributed to this story.

Mike Diamond is a journalist at The Palm Beach Post, part of the USA TODAY Florida Network. He covers Palm Beach County government and transportation. You can reach him at mdiamond@pbpost.com. Help support local journalism. Subscribe today.

This article originally appeared on Palm Beach Post: Is time running out for Spirit, JetBlue merger? Analysts say yes.