Spotify’s Biggest Decision After Joe Rogan-Gate: Whether to Police Its Content

- Oops!Something went wrong.Please try again later.

Spotify’s biggest decision to come may be content moderation as it forges ahead from streaming just licensed music into the more financially rewarding world of podcasting.

In the wake of the Joe Rogan public relations mess, Spotify seems to have decided it’s simply a platform, which may help the company to minimize its responsibility over misinformation and offensive content. But, as other media has proven in recent years, Spotify could be forced to redefine itself as a publisher if it continues to make exclusive talent and content deals, which will organically increase its responsibility to police its content.

“Like its social media counterparts, it is tackling the questions of content governance, censorship and free speech,” Talan Tyminski, vice president of strategic firm The MACH 1 Group, told TheWrap. “It wasn’t until after a public outcry did Spotify decide to act. Spotify is navigating a difficult path of being a platform over being a publisher.”

The difference between publisher and platform

Many social media companies have been forced to step into roles as publishers after initially being considered platforms. As a platform for music and other content that it licenses from traditional labels and content providers, Spotify takes far less responsibility by just offering a home to creators. As a publisher, however, the company assumes the role of an editor over its content, becoming more active in moderating content for harmful material, dangerous activities or hate speech.

By comparison, it’s unlikely that the streaming service will have to dedicate as many resources as Facebook, for example, to outsource services or build a full content moderation department. Yet Spotify stands to risk reputation damage, a loss in subscribers or face more extreme cancel culture if it refuses to act on potentially problematic content in the future.

That clearly cropped up in the case of Joe Rogan, whom Spotify signed to a lucrative deal in 2020 worth $200 million over three and a half years. The company’s continued backing of Rogan, an anti-vax advocate who has spread COVID misinformation and recently issued apologies for lack or balance and for his previous use of the N-word, has prompted artists like Neil Young and Joni Mitchell to pull their music from the service. The company has stood by Rogan, but has added content warnings to the podcast and made public its content policy.

Why Spotify is moving aggressively into the podcasting business

It’s clear Spotify wants to grow the podcast business, with the platform offering some 3.6 million podcasts to date. The company has already dropped billions on acquiring podcasting companies and exclusive content deals, including “The Joe Rogan Experience” and “Call Her Daddy” with Alex Cooper. Last week, Spotify said it’s acquiring two more podcast tech platforms, Chartable and Podsight, and is also among those considering bids on another podcasting platform, Audioboom.

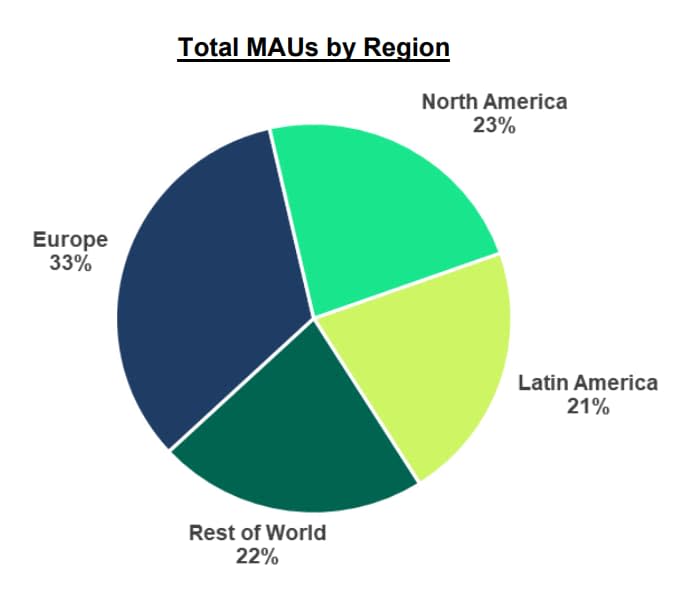

There’s increasing demand for podcasts on Spotify, and the company recognizes it needs more than music streaming to increase revenue. Spotify recently reported 406 million monthly active users in Q4, up from 381 million from the previous quarter. And ad-supported revenue accounted for a record 15% of total revenues in Q4, with a double-digit increase in monthly active users engaging in podcasts compared to Q3.

And podcasts are a more lucrative investment than tunes. “The music business decided years ago that they don’t want platform-specific exclusives,” Sundus Shahid Bari, associate director of strategy and planning at Blitz Advertising, explained.

“They largely want everything to be everywhere,” Bari said. “The majority of music rights are in the hands of three huge companies and will always make Spotify only a marginal amount of profit. Exclusive content is Spotify’s big chance, and where audio is concerned, it’s only podcasting that can deliver this.”

Currently, Spotify holds 31% of the music streaming market, while Apple accounts for 15% and Amazon Music accounts for 13%, according to Midia Research. However, Amazon is growing at a faster rate than the other two, and YouTube Music is also quickly catching up.

“Amazon Music once again out-performed Spotify in terms of growth (25% compared to 20%), but the standout success story among Western DSPs was YouTube Music, for the second successive year,” the Midia report noted. “Google was once the laggard of the space, but the launch of YouTube Music has transformed its fortunes, growing by more than 50% in the 12 months leading up to Q2 2021. YouTube Music was the only Western [digital service provider] to increase global market share during this the period.”

Notably, the Midia research also found YouTube Music to be especially popular among Gen Z and millennials, which should sound the alarm for Spotify — where the core base of millennial subscribers from the last decade or so are starting to age.

Plus, both Spotify and its creators fare well in these exclusive content deals. They’re an attractive way to eliminate any middlemen, such as a record or production company. Those middlemen mean less profit sharing for the podcaster and Spotify, Todd Krizelman, CEO of advertising intelligence platform MediaRadar, said.

“[Music services] have these constraints both on the consumption of music as well as these royalty payments, as recording artists want to be paid and there’s not as much room for essentially expansion of revenue or necessarily profit,” Krizelman told TheWrap. “Podcasting does not have that same issue.”

The cost of doing business in podcasts is content moderation

You’ve got to spend money to make money. Different companies have gone about content moderation differently, and it’s unclear what Spotify’s needs are and how extensively it will need to invest in moderation — or if the company cares about its content moderation responsibility at all. But that decision may not be 100% in Spotify’s court as it builds its podcasting business and runs into PR issues like the one over Rogan.

Facebook, which has been under increasing pressure to moderate harmful content on its platform, pays Accenture $500 million a year to help it clean up objectionable content. TikTok is also outsourcing its content moderation work and poaching hundreds of content moderators from across Accenture, and similar firms like Covalen and Cpl. Instagram and Facebook’s parent company Meta said it also uses machine learning models to identify misinformation and send it to fact checkers for review.

Spotify, meanwhile, is seeking a way to minimize the blowback from controversial shows like Rogan’s while preserving free expression. “We’re trying to balance creative expression with the safety of our users,” Ek said in an earnings call earlier this month. “While Joe has a massive audience, he also has to abide by those policies.”

Rogan’s show, which was rated No. 1 on Spotify last year, draws an estimated 11 million listeners per episode, and Cooper’s sex podcast “Call Her Daddy” was ranked fifth most popular on Spotify in 2020.

In choosing to respond to the Rogan backlash this way, Spotify seems to be asserting itself as a platform, with some limited obligations as a publisher — at least for now. But critics say that the company’s exclusive deal with Rogan makes it a publisher of his content, said Subbu Vincent, director of journalism and media ethics at the Santa Clara University Markkula Center for Applied Ethics. “[Spotify] should have taken the discourse and admitted they are the publisher — then the responsibility is substantially more,” Vincent told TheWrap.

Spotify’s response to the Rogan issue doesn’t provide enough accountability, many critics have argued. What Spotify should’ve done to be more effective against misinformation, Vincent said, is edit the actual content and insert the truth or any disclaimers right before and after it — what he calls a “truth sandwich.”

“That journey will not happen until Spotify will own up as a publisher,” Vincent said. “They want to get away with the content moderation and put a bunch of notices, and hope the responsibility is on the audience. They are basically washing their hands.”

Diane Haithman contributed to reporting.