Spring real estate market off to an early start in Bucks County

When it comes to Bucks County real estate, an early spring market is already in high gear.

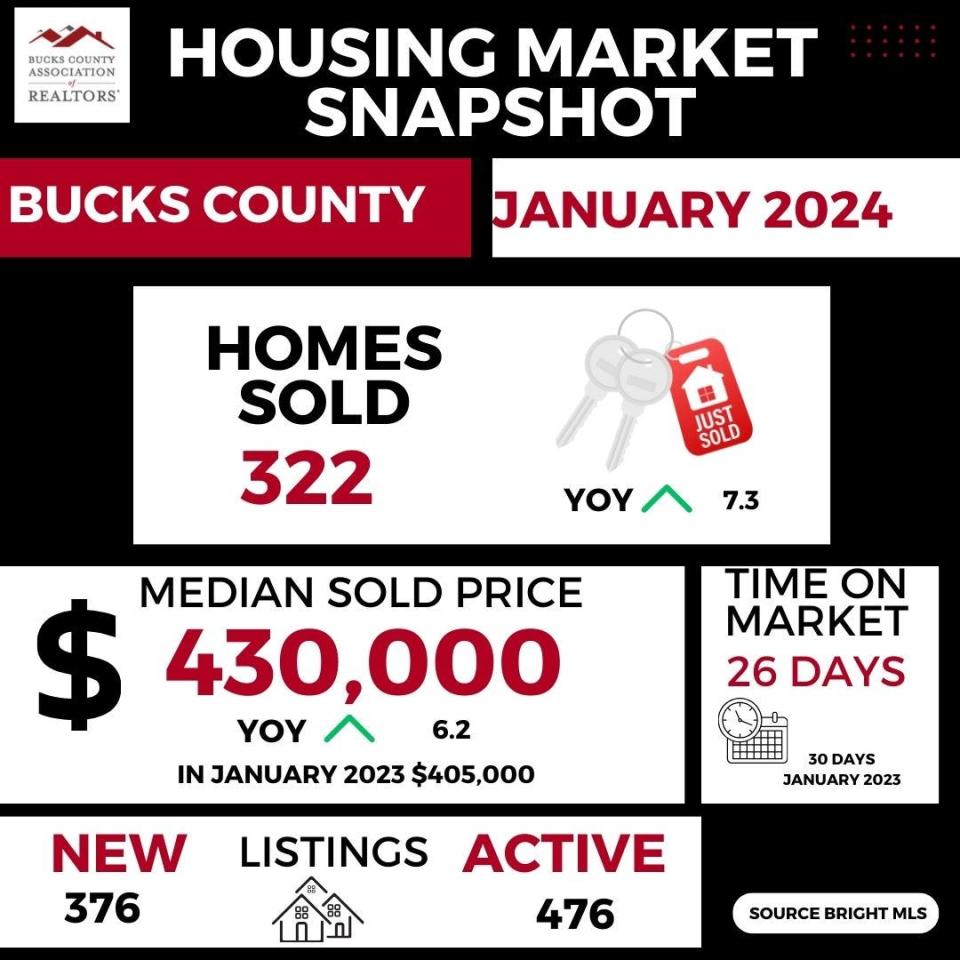

The January market report from the Bucks County Association of Realtors showed a “13.8% month-over-month increase in new contracts,” with 355 pending sales reported.

And the time the houses spent waiting to be sold dropped to 12 days, a 20% decrease “compared to the five-year January average of 33 days,” the association noted.

"The strong start to the year in Bucks County's real estate market is indicative of sustained demand and healthy buyer activity," said BCAR President Stephanie Garamon. "Despite seasonal fluctuations, we continue to see year-over-year growth in key metrics, demonstrating the resilience of our local housing market."

The median sold price stood at $430,000, a 6.2% increase from last January but a decrease of 5.5% compared to December's median price, the BCAR notes. The total sold dollar volume rose to $176.53 million, an "impressive" 19.1% year-over-year increase.

Bill Lublin, president-elect of the Pennsylvania Association of Realtors and CEO of Century 21 Advantage Gold in the Philadelphia region, said that over the long haul, statistics show that home sellers routinely sell their home for more than 97% of their asking price.

More: Bucks County housing market to see more home sales with cut in interest rate

But inventory is still low. Mary Mazza, a Realtor with Keller Williams in Newtown, said that houses priced right and in good shape are moving quickly.

"It's great for a listing agent right now," she said. For example, she said a house priced around $500,000 to $600,000 in a neighborhood with a good school district could sell within a few days of listing.

Upscale homes 'skyrocketed'

And higher priced homes in the Upper Makefield-New Hope area have "skyrocketed" since the pandemic has allowed more high-income earners to keep working from home.

"We have a lot of transplants from other markets," Mazza said, including both New York and Boston where prices are much steeper. "We are so extremely fortunate to be in our area," she said.

Lubin said people make moves because of "life changes" ― marriages or divorces, having children or becoming empty nesters, or job transfers, and it would be foolish to put off a move because of mortgage rates.

And he thinks mortgage rates will stabilize now that the Federal Reserve appears to be taking a break from substantial interest-rate hikes. The national average for a 30-year loan was 7.25 percent as of Feb. 27, Bankrate.com reported.

A good real estate agent, he said, will provide a client with valuable insights into their finances for free, helping them to decide whether to move or not and how much home they can afford.

More first-time buyers

Lublin said that with rental rates high as well, a first-time home for some younger people might make more sense.

"I would really be flexible and buy the best home they are able to, to build equity," he said.

First-time buyers appear to be taking that advice. Data from the National Association of Realtors shows that the number of first-time buyers rose from 26% to 32% in the past year.

This article originally appeared on Bucks County Courier Times: Bucks County real estate market continues to blossom