Stark County cities not seeing major impact from income tax refunds for remote work

As municipalities issue 2021 income tax refunds, for which some remote workers now are eligible, the complete effect on city budgets remains unclear. Thus far, most local municipalities report little to no major disruptions.

Tax refunds: Taxpayers who worked from home outside cities may be entitled to large tax refunds

In 2020, state lawmakers passed a bill that let municipalities tax workers as usual even if they worked from home during the pandemic. However, last year's state biennial budget allowed people to receive refunds for remote work conducted outside of the taxing municipality in 2021.

For example, it would apply to someone who works for a company located in Canton if they now work from home in another community. People can seek a refund until April 15, 2025.

By the end of this year or early 2023, the Ohio Supreme Court also is expected to hear a case filed by the conservative Buckeye Institute that challenges the 2020 collection of taxes.

Because of the ongoing period to file for a refund and the undetermined 2020 case, municipalities still do not have a full picture of how remote work will affect their tax revenue.

"We issue refunds all throughout the year," Canton's Chief Deputy Treasurer Michael McEnaney said in an email. "Additionally, nonresidents claiming COVID or garden-variety refunds for city-taxed income earned outside the city limits of Canton, will have three years within which to apply for their refunds."

How much is Canton issuing in tax refunds?

From Jan. 1 to June 3, the city reported about $3.24 million in total refunds. Of that amount, $448,898 from 2021 has been refunded and $124,324 from 2020 would be paid only if the state Supreme Court rules in favor of the refunds.

"The 2020s are not addressed in state statute and, thus, are being posted to our books so we can track them, but they're being withheld until the various cases across the state are fully litigated," McEnaney said.

Auditor Richard A. Mallonn II said there's been a decrease in revenue related to the pandemic but not a large enough amount to prompt adjustments to the city budget.

"I don't think it's made that much of an impact," he said, adding that the city will continue to monitor refund requests.

Massillon and North Canton not expecting large impact

Lori Kotagides-Boron, the income tax and budget director for Massillon, said in an email that the city has issued only $36,981 more in total refunds than last year.

Out of about $319,110 in total refunds, about $84,187 went to people who worked remotely in 2021. Therefore, Kotagides-Boron said, refunds to remote workers haven't been particularly significant for the city's budget.

The city of North Canton issued 151 refunds totaling $46,906 between the start of January and June 3, according to a report from the Regional Income Tax Agency (RITA). Remote work accounted for 11 refunds totaling $8,304 in 2021 and five pending requests totaling $3,864 in 2020.

Canal Fulton tracking COVID-related refunds

The city of Canal Fulton issued 91 tax refunds for 2021 — totaling $43,000 — by mid-June of this year. Of those, about seven went to non-resident, remote workers and amounted to about $8,000.

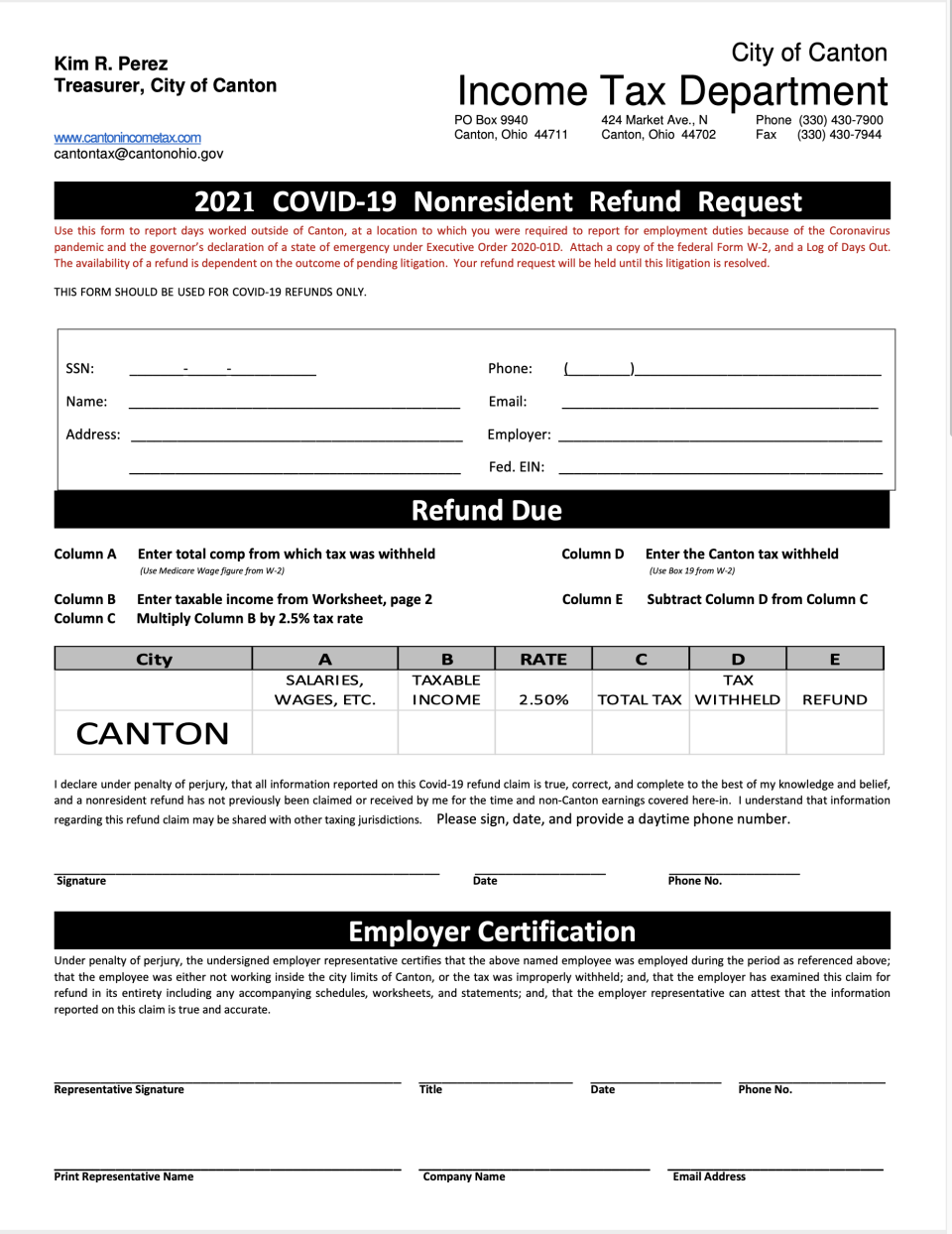

"We are tracking 2020 COVID refunds pending the Ohio Supreme Court decision," Tax Administrator Bill Keltner said. "All COVID requests must fill out the city’s refund request form with employer certification."

Keltner said the change in how remote workers were taxed in 2021 benefited Canal Fulton. The city's own tax reform approved by voters in 2019 also helped. It increased the income tax rate from 1.5% to 2% in 2020 and offered more reciprocity for taxes paid to other cities — shifting most of Canal Fulton's tax revenue from individual employee accounts to employers that withhold employee taxes.

"We have approximately gained 120 remote workers that were then added to our withholding, so it's generated about $12,000 a month in revenue," Keltner said.

If that amount remains unchanged, he said, it will add $150,000 a year to Canal Fulton's $2.7 million income tax revenue. The withholding accounts were established by companies in 2020 and 2021 "that have an understanding that their employees’ homes are now considered the employees’ workplaces."

Alliance and Louisville

The cities of Alliance, which issued 185 refunds totaling about $93,512, and Louisville, which issued 227 refunds totaling about $93,376, by early June did not identify refunds related to remote work.

"The tax system was not set up to internally track remote worker refunds for 2021," Louisville Tax Commissioner Laurie Arntz-Tournoux said in an email.

Alliance Auditor Kevin Knowles said in an email that he believed the amount refunded because of remote work was "relatively small."

Ohio Municipal League reports no big impact

There's been no singular effect on municipalities statewide.

"It really depends on the community and the makeup of the community and the location of the community," said Kent Scarrett, executive director of the Ohio Municipal League.

Some communities haven't seen the number of refund requests expected because taxpayers who live in other municipalities would still have to pay taxes, just to another city.

"So it's kind of a wash for a lot of taxpayers," Scarrett said.

Cities bordered by townships are more likely to lose tax revenue to remote workers seeking refunds, he added. The economic landscape, whether there's manufacturing or other businesses that operate in-person, also plays a role.

The nature of employment in a city likely will determine the future impact of the taxation change. Scarrett said pandemic-related government relief funds have helped stabilize municipal budgets in the short term.

"At least in five years, or the next few years, there'll be a certain amount of stability and things hopefully will settle down, and there'll be a little bit more predictability of workforce job performance," he said.

In addition to tax revenue, the trend toward remote work also has affected economic development agreements that provide businesses with tax abatements for creating a certain number of jobs. Those "new realities" for employers is something else for cities to consider in the future.

Scarrett also noted that the municipal income tax accounts for 70% to 80% of revenue for about 600 municipalities across the state. The Ohio Municipal League is working with Ohio State University's John Glenn School of Public Affairs to study the sustainability of the municipal tax and the effects of past legislative actions, such as the elimination of the estate tax and reduction of the local government fund.

"We're engaging with the General Assembly on how do they support municipalities that are experiencing revenue shortfalls that directly challenge their opportunity to support basic services like police and fire," he said.

This article originally appeared on The Repository: Stark County cities impact from income tax refunds for remote work