Broker wars go crypto as Thiel-backed startup BlockFi offers free trades

Call it the race to zero.

Just months after Charles Schwab (SCHW) sparked a price war among online brokers by taking their commissions to zero, a startup is following suit by offering the same on cryptocurrency trades.

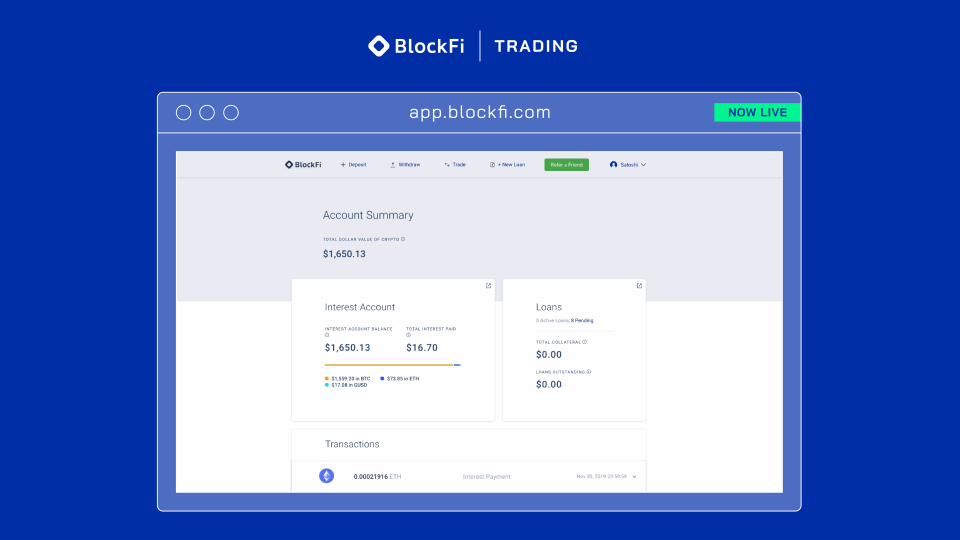

Peter Thiel-backed startup BlockFi will allow customers to trade their bitcoin (BTC-USD), ether (ETH-USD) or the Gemini USD stablecoin with zero fees attached. And since the coins are held within the platform, the trade execution is immediate.

Founder and CEO Zac Prince told Yahoo Finance that it’s all about enabling customers “to do things with their crypto that you can do with traditional assets and traditional systems.”

Popular cryptocurrency like bitcoin has soared more than 92% this year, making it a high risk and volatile asset for investors. But the risk also comes with hefty rewards.

“In exchange for that volatility, you’re compensated with what’s the best performing asset literally in the last ten years,” said Prince on YFi PM.

“If you compare it to the unicorns - it’s the largest unicorn out there with a market cap of over $100 billion dollars today,” he added.

Earn interest on crypto

It’s not just fees that are going zero: Bank deposit savings rates are going down in that direction after the Federal Reserve slashed rates three times this year. It’s hard to find anything that yields above 2% these days.

That’s where BlockFi steps in, offering to pay interest on crypto deposits up to 8.6%. It also gives out U.S. dollar-denominated loans off the crypto balance.

“And the ability to earn interest on something and grow your wealth passively, obviously is a trend that never stops happening in financial services,” said Prince.

The startup is generating the interest by lending cryptocurrency to institutional borrowers.

While BlockFi is treating cryptocurrency as a bank does with a government-backed currency, Prince believes the sector is still has a long way to go in terms of becoming more acceptable to mainstream investors.

“Right now the crypto sector in general is capital constrained primarily because you don’t have participation from traditional banks and other large financial institutions,” he said.

“As the sector matures, I would expect that it will start trend closer to what you see in the normal space,” he added.

Grete Suarez is producer at Yahoo Finance for YFi PM and The Ticker. Follow her on Twitter: @GreteSuarez

Read more:

Conservative think tank says ad slamming the wealth tax is not about defending the wealthy

Why the Disney+ 'hack' shows data is like 'oil' that needs to be secured

Study: Female-led startups are gaining more ground in venture capital race

Air taxi startup Lilium eyes NYC as aviation scrutiny tightens

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.