Colorado bills sponsored by Pueblo legislators signed into law by Gov. Jared Polis

- Oops!Something went wrong.Please try again later.

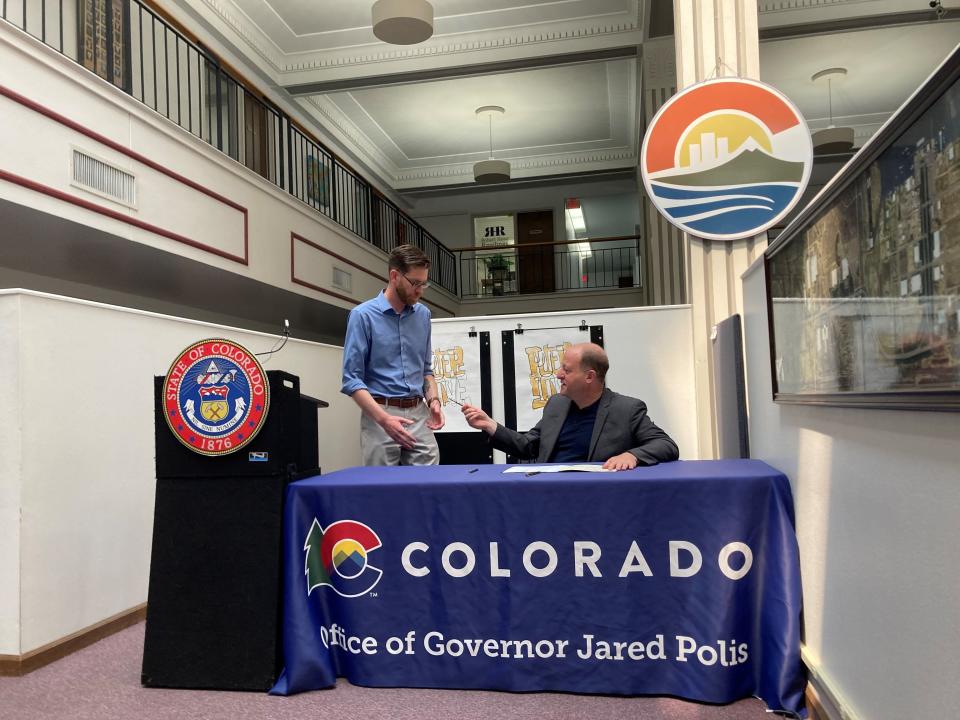

Colorado Gov. Jared Polis took his first bill-signing trip down to Pueblo this year to sign two new laws Tuesday, both sponsored by local legislators.

Polis was joined by current and former lawmakers as well as community leaders during his visit to Pueblo, where he signed laws amending regulations for electric vehicle charging and expanding the tax credit for businesses that want to convert to an employee-owned model.

He also had a tour and ate lunch at the newly opened Fuel & Iron Food Hall, which was not open to the press.

Protesters demonstrated outside the first bill signing at the Pueblo Economic Development Corporation headquarters downtown, asking Polis to sign a law he may veto that restricts the state and local government from entering contracts with private companies for immigration detention and prohibits federal immigration detention.

Polis signs EV bill after vetoing another one last year

Polis signed a bill that expands requirements for electric vehicle infrastructure at an EV charging lot in downtown Pueblo.

House Bill 1233, sponsored by Rep. Tisha Mauro, requires that new multifamily housing includes EV charging equipment, effective March 2024. The bill also negates any local parking restrictions for EVs and expands where residents can install charging ports. EV charging stations are exempted from property taxes until 2030.

This bill was passed without Republican support. Two House Democrats sided with Republicans to cast dissenting votes on the third reading.

Last year, Polis vetoed another bill that also would have required new large buildings and apartments to install EV chargers.

Mauro told the Chieftain that she and her team worked extensively with the governor’s office on this year’s bill, which includes requirements that are less stringent than last year. New construction and some renovations on multifamily dwellings will require installing some infrastructure for electric vehicle charging.

“It's 10 times better for anybody building anything new to be thinking ahead, because it's so much less expensive to do the wiring now even if you don't put on a charger (immediately),” Mauro said.

Lobbying records show that the Colorado Apartment Association opposed the bill, while supporters included several environmental groups and Tesla Motors. These organizations followed the same pattern as last year’s bill, as reported by Colorado Public Radio.

Employee ownership tax credit

Pueblo state Sen. Nick Hinrichsen was the Senate’s prime sponsor on a bill that expands the tax credit for businesses that convert to a worker-owned cooperative. The bill is an expansion to the law established in 2021.

House Bill 1081 passed the Colorado House and Senate with unanimous support from Democrats and some Republican votes. One of the bill’s prime sponsors in the House is Rick Taggart, a Republican from Grand Junction.

The new law expands the tax credit for costs businesses incur when converting to a co-op model, which can recoup up to 50% of the costs for converting to a shared equity model via a tax credit.

The maximum value varies, based on the type of conversion. The tax credit for changing to an employee-owned stock option has been increased from $100,000 up to $150,000. The credit for converting to a worker-owned cooperative or employee ownership trust used to be up to $25,000 and is now up to $40,000.

Just 12 businesses in Colorado applied to the state from July 2021 to June 2022, with a total of $403,750 in tax credits issued, according to the bill’s fiscal note. The overall financial impact on the state’s budget is expected to be relatively minimal: approximately $1.4 million per year.

The law specifies that companies need to be headquartered in Colorado.

Anna Lynn Winfrey covers politics for the Chieftain. She can be reached at awinfrey@gannett.com or on Twitter, @annalynnfrey.

This article originally appeared on The Pueblo Chieftain: Colorado bills sponsored by Pueblo lawmakers signed by Gov. Polis