State regulators let embattled property firm keep its license. Now dozens of communities have accused it of fraud

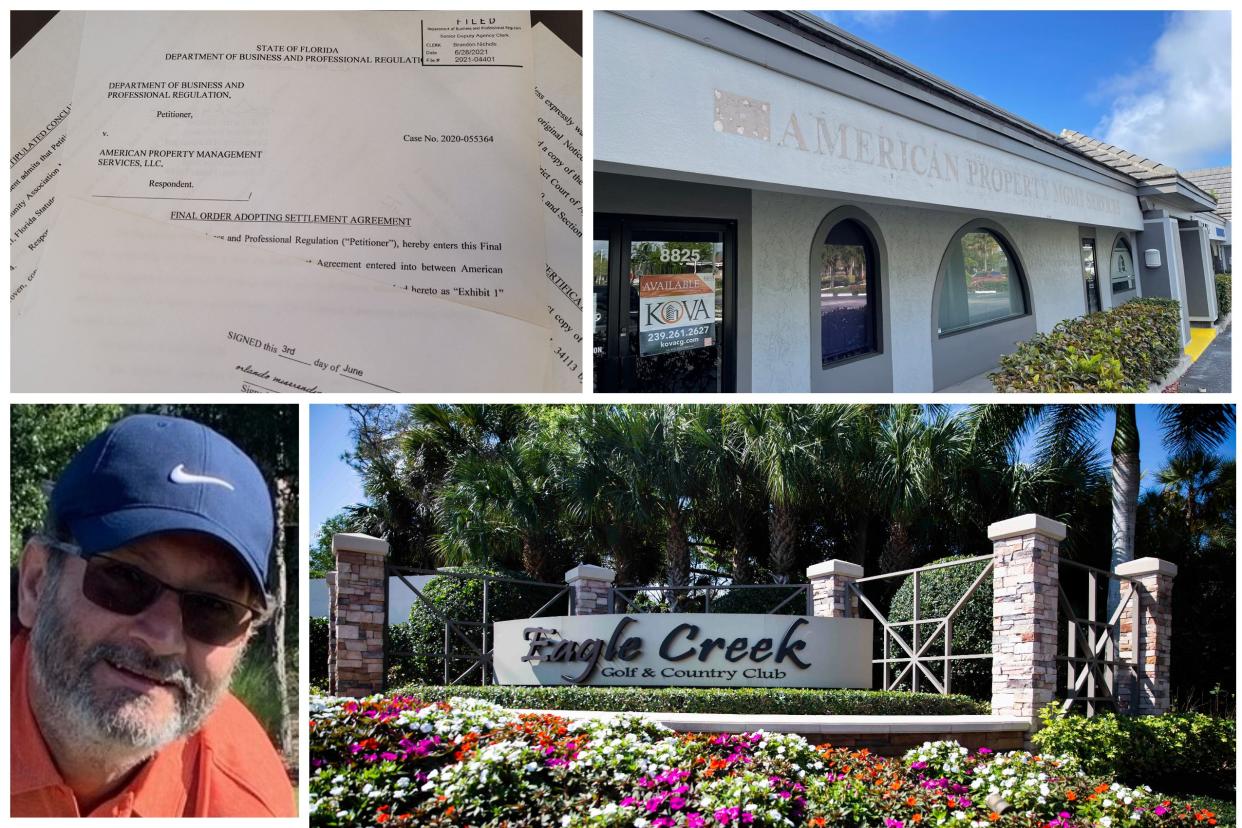

State regulators had a chance last year to pull the license of a property management firm whose alleged multimillion-dollar embezzlement scheme has now pushed multiple community associations in Southwest Florida to the financial brink.

Instead, they chose to slap the company with a $1,000 fine, which it never paid.

Florida's Department of Business and Professional Regulation, which is responsible for policing community association managers, acknowledged in a statement that it knew Naples-based American Property Management Services was under criminal scrutiny when the agency allowed it last June to settle a 2020 embezzlement complaint and keep its license.

"It does seem like a really weak response," said Ben Wilcox, research director for the Tallahassee-based government accountability nonprofit Integrity Florida.

Beyond the APMS case, statistics from the agency show it has handed out fewer disciplinary orders each year since 2018 — despite rising numbers of complaints against community association managers.

Now dozens of community associations are suing APMS, saying the firm hijacked their bank accounts and took at least $8 million — some of which could have been saved if regulators had acted earlier, association representatives told the Naples Daily News / The News-Press.

"The amount of money that’s involved in this case is staggering, really," Wilcox said.

The latest: Naples property firm at center of fraud lawsuits got $245,000 in COVID-19 relief funds

Investigation: American Property Management Services, accused of seven-figure fraud, has history of legal trouble

Timeline: Key dates in legal trouble for American Property Management Services

APMS has denied all wrongdoing in formal responses to civil lawsuits, saying its clients were aware and approved of its actions. No criminal charges have been filed against the company.

"That's crazy," Royal Bay Villas Condo Association President Laura Rigsby said after being informed of how regulators handled APMS's case. She claims that APMS drained $600,000 from Royal Bay's accounts.

“Absolutely it would have been prevented," Rigsby said. “I had no reason to look up anything. No reason to be suspicious. If we had any reason to be suspicious, we would have investigated further.”

The maximum penalty for a community association manager using client funds for an undesignated purpose is a $5,000 fine and license revocation, according to the Florida Administrative Code. The minimum is a $250 fine.

A spokesman for the Department of Business and Professional Regulation said the decision to settle with APMS and its owner Orlando Miserandino Ortiz for $1,000 fines each was based on the now 13-year-old company's clean disciplinary history and the fact that it had already reimbursed its alleged victim.

"For those reasons, the Department settled with Mr. Ortiz, but only after he agreed to pay a fine in excess of the minimum for a first-time offense," the agency's deputy communications director Patrick R. Fargason wrote Wednesday in an email. "Since Mr. Ortiz nor his company has paid those fines, the Department is now pursuing revocation of the licenses."

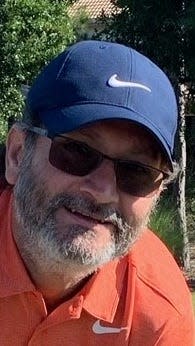

While APMS's license is still active, it is unclear whether it is still in business. Its Naples offices are shuttered amid eviction proceedings, and its former clients are not aware of Ortiz's whereabouts, according to the associations' attorney Jason Mikes. The company's attorney has not returned requests for comment.

What regulators knew about APMS

Association leaders say they were blindsided when they learned in December that their accounts had been compromised. By that time, APMS had been on regulators' radar for more than a year.

In November 2020, Naples' Eagle Creek community association filed a complaint with the Department of Business and Professional Regulation accusing APMS of taking more than $200,000 from its accounts and trying to pay it back using funds belonging to other associations.

The state agency investigated and allowed APMS and Ortiz to settle without admitting guilt.

Beth N. Pannell, the agency's communications director, acknowledged that the agency already knew that APMS was under criminal scrutiny at the time it settled with the firm.

"During the pursuit of administrative actions relating to these licenses that resulted in these settlement agreements, it became apparent to the Department that several law enforcement agencies were already aware of the licensees’ alleged criminal activities," Pannell wrote in an email.

"Certainly some of the losses could have been avoided" if regulators had acted more decisively,Mikes said in a text message.

Mikes, who represents Royal Bay and the 34 other associations in the civil lawsuit, is suing to force Wells Fargo Bank to turn over control of accounts which the associations allege were hijacked and drained by APMS. Records obtained in the suit suggest the company took at least $8 million, he said.

The associations will not know exactly how much was allegedly lost after APMS's June 2021 settlement with state regulators until they regain access to their bank accounts and can check transaction dates, Mikes said.

The Department of Business and Professional Regulation did not respond to follow-up questions about when it learned APMS was under criminal scrutiny and which law enforcement agencies were involved at the time.

Regulators' enforcement drops

The Department of Business and Professional Regulation's enforcement activity against community association managers has decreased in recent years, according to statistics released in the department's annual reports.

In fiscal year 2018-19, the department received 1,381 complaints against community association managers and issued final orders containing disciplinary action 85 times. In 2019-20, there were 1,234 complaints and 29 disciplinary actions. Last year complaints jumped to 1,569, with the department issuing discipline 23 times.

Community association manager discipline

Infogram

Discipline numbers in that time frame also dropped across the agency's full portfolio of regulated professions, from construction companies to cosmetologists to veterinarians. While total complaints hovered between 19,000 and 20,000, disciplinary final orders dropped from 3,566 to 2,499 to 1,677.

Those decreases coincide with the spread of COVID-19. Agency officials did not respond to questions about whether the pandemic affected their disciplinary efforts.

Regulatory agencies in Florida routinely refer cases to law enforcement partners when they receive complaints that include criminal allegations, and the claim that APMS took hundreds of thousands of dollars from a client's accounts clears that bar, said Douglas Molloy, a Fort Myers-based attorney who previously worked as a federal prosecutor, statewide prosecutor and deputy state attorney.

“The path is to bring, as soon as possible, a criminal investigative agency onboard," Molloy said in an interview. “When it doesn’t, that’s an unfortunate mishap and mistake.”

Regulatory agencies in Florida typically have three avenues when they want to refer a case for criminal investigation, Molloy said: the local State Attorney, the state Attorney General's Office of Statewide Prosecution or federal agencies like the FBI or Secret Service.

The 20th Judicial District’s State Attorney’s Office, which has jurisdiction over Lee and Collier counties, said it never received a criminal referral regarding APMS. The state’s Office of the Attorney General said its Office of Statewide Prosecution is not currently prosecuting AMPS. It did not elaborate when asked if they were part of any open investigations into the company.

Officials from associations suing APMS have said they were contacted by the Secret Service. While the Secret Service is best known for protecting federal officials, it was originally created to combat counterfeiting and continues to investigate financial crimes.

The Naples Daily News / The News-Press reported this week that APMS received $245,000 from the federal government in Paycheck Protection Program pandemic relief funds. The Secret Service has been active in investigating PPP fraud, including in last year's conviction of Fort Myers roofer Casey Crowther.

A spokesperson for the Secret Service said it does not confirm the absence or existence of specific investigations.

APMS, incorporated in Naples in 2008, abruptly shuttered its Naples office in January. Mikes said his clients have been unable to reach Ortiz for months.

A company started by Ortiz acquired a Hawker 800XP business jet in May 2021, shortly after APMS was first sued by one of its clients. The jet makes frequent trips around North and Central America and continues to do so as the lawsuits progress, according to flight records.

Within the last week, the plane has flown between Miami, Cancun and the Dominican Republic. It was most recently pinged in Miami on Sunday.

It is unclear whether Ortiz personally traveled on those trips, as available flight tracking data is based on transponder pings and does not include passenger manifests.

The company's landlord placed an eviction order on the APMS office on Jan. 14 citing failure to pay. As of last week, the company name was no longer on the office façade and a placard showing the office available for rent was prominently placed on the front door of the 8825 Tamiami Trail East address. Neighboring APMS offices at 8817 and 8819 Tamiami Trail East were also empty.

With APMS gone, its clients have been left holding the bag: 23 of the 89 accounts that associations claim were hijacked by APMS have been completely drained, according to bank records obtained in the civil suit.

Some communities have had to open lines of credit with other local banks or hike resident fees to pay vendors such as lawn maintenance and pool companies.

“We have to pay the bills," said Rigsby, whose association recently levied a special assessment fee. "Unfortunately, there were no other options."

Breaking news reporter Michael Braun contributed to this report. Connect with him: MichaelBraunNP (Facebook), @MichaelBraunNP (Twitter) or mbraun@news-press.com.

Criminal justice investigative reporter Dan Glaun can be reached at daniel.glaun@naplesnews.com or on Twitter @dglaun.

This article originally appeared on Naples Daily News: State regulators knew APMS was under criminal scrutiny; issued fine