Stay Far Away From Canopy Growth Stock … For Now

Some say that history repeats itself, and while that is sometimes true, it’s never a guarantee. And when it comes to the crash in Canopy Growth (NYSE:CGC) that doesn’t mean buying CGC now will lead to impressive gains again in the future.

Source: Shutterstock

As I wrote last month in an article on Canopy Growth for InvestorPlace, a conversation regarding cannabis stocks wouldn’t be complete without shares of CGC. And along with the continued shrinking fortunes of this once very green market, the industry’s largest player has also been stinking up the joint.

Blame that on whatever you think. But some finger pointing for CGC stock’s continued slide in shareholder value could be rightfully directed at peer Hexo (NYSE:HEXO), which announced an awful revenue warning and guidance retraction a week ago. And of course fatalities tied to vaping have been regular headline news since August and much to the detriment of the cannabis market.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Unlike the infamous Dot.bomb tech crash and today’s market-leading innovators — Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN) or Netflix (NASDAQ:NFLX) — the cannabis market in 2019 can’t claim to have any companies of that caliber at bargain-bin prices. And that goes for CGC stock too. At the end of the day, it’s a commodity and one currently suffering from a lot of product and overall weak demand.

That’s not to say there isn’t great potential for growth. According to investment bank Stifel & Co. legal cannabis could be worth $200 billion over the next ten years versus a market worth less than $11 billion in 2018. And movement towards that end is underway. For one, edibles are legal as of today in the Canadian market. Canopy Growth stock also just landed the U.K.’s first medical cannabis bulk import license.

Positive developments like those happening in CGC right now are victories. But to be clear, there remains an incredible amount of push-back and red tape from most regulators which CGC and the cannabis industry need to get past. And in our estimation it’s going to take much longer than most anxious investors already exposed to the group dare to fathom.

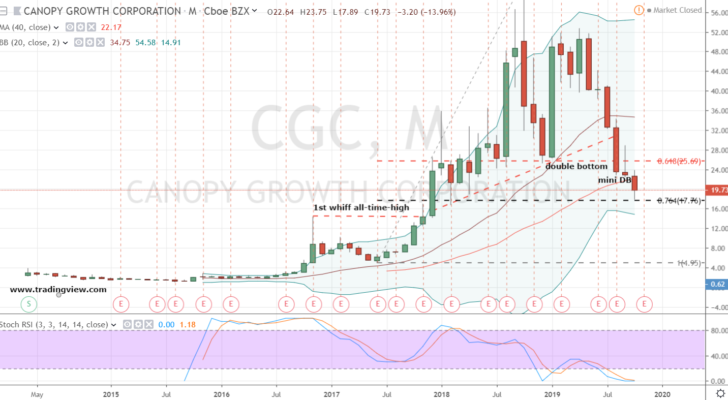

CGC Stock Monthly Chart

If you’re going to believe in the cannabis market and CGC at this point in time, the monthly chart is a good place to assess those prospects. On this longer-term perspective, Canopy’s five years as a publicly-traded company are fully captured and we can see both the hype and the damage to CGC stock price.

Currently and after a pair of potential double bottom patterns from approximately $23 – $26 failed to be confirmed around the 62% retracement level, shares of CGC are in a testing position of the 76% Fibonacci level. With Canopy Growth stock’s stochastics oversold and nearing a bullish crossover signal, the combination is something for bullish investors to monitor. But I’d warn against jumping into shares today and buying CGC as a core longer-term holding.

The fact is many technicians agree the 76% level is a less important technical support and stocks are more likely to revisit the low of the cycle after a failure of the more formidable 62% level. In this instance, the breakdown could take shares of CGC down toward $5 and 2017’s bottom, which marked the low after shares enjoyed their first whiff of success.

Ultimately, given the failures and uneven environment off and on the price chart of CGC stock, I’d recommend investors wait for price confirmation on the monthly perspective. That could be as simple as CGC shares forming a bottoming candlestick over the next couple weeks and then (at the moment) trading above the October high of $23.75 in November. Then again, investing successfully in CGC may not prove to be nearly that easy of a task.

Disclosure: Investment accounts under Christopher Tyler’s management do not currently own positions in any securities mentioned in this article. The information offered is based upon Christopher Tyler’s observations and strictly intended for educational purposes only; the use of which is the responsibility of the individual. For additional options-based strategies and related musings, follow Chris on Twitter @Options_CAT and StockTwits.

More From InvestorPlace

The post Stay Far Away From Canopy Growth Stock … For Now appeared first on InvestorPlace.