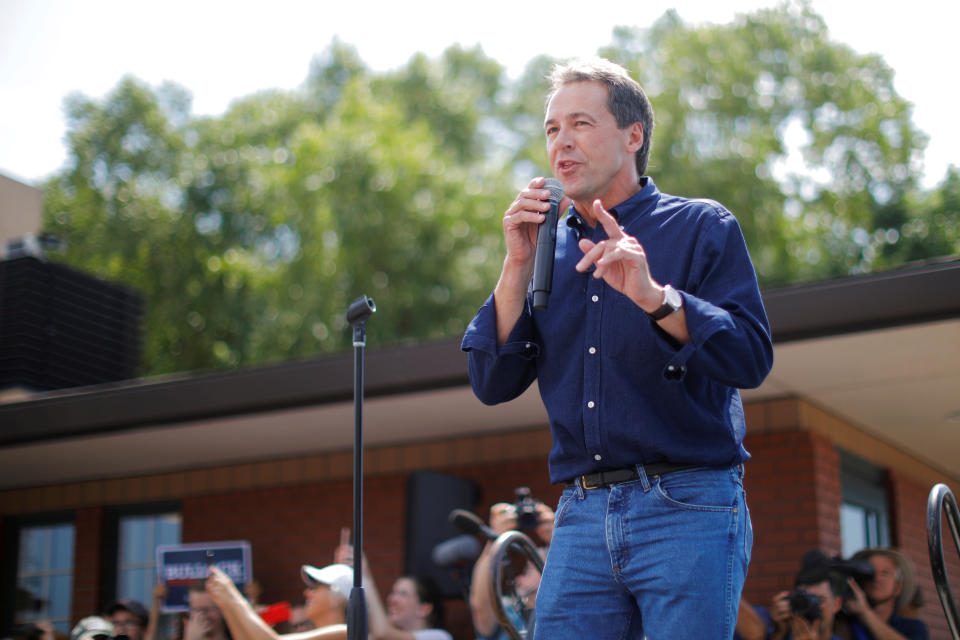

Steve Bullock: The Retirement Survey

Yahoo Finance and the Funding our Future campaign (an alliance of organizations dedicated to making a secure retirement possible for all Americans) teamed up to get more details on where the 2020 candidates for president stand on retirement. According to a recent Gallup poll, “Not having enough money for retirement” is a top financial worry among Americans yet the issue has received minimal attention thus far on the campaign trail. During the September debate, the words “Social Security” or “Retirement” weren’t uttered, according to ABC’s transcript.

The following are the responses from Steve Bullock, the Governor of Montana.

Will you address the coming insolvency of Social Security’s Old-Age and Survivors Insurance trust fund in your first term as president? If so, what specific policies will you advance?

Social Security is a vital program that rewards a lifetime of hard work. It is critical to the retirement plans of most Americans and serves as a vital insurance policy for all Americans. That is why, as President, I will make preserving the trust fund a priority. This is not a choice, but rather increasingly urgent with Social Security starting to spend more than it takes in each year.

Any changes to Social Security will require bipartisan consensus, something that has been in short supply for too long in DC. But that is something I have done successfully in Montana, successfully working with a Republican legislature to push a variety of policies including Medicaid expansion, making our State pension system actuarially sound and investing in education.

I would look at a variety of policies to address Social Security, including boosting benefits for the lowest-earners. I would also bolster Social Security by assessing payroll tax on income – not solely wages – above $250,000 (as is now done with Medicare). The additional revenue will extend the life of the Trust Fund and allow for a “bump up” in payments for the poorest beneficiaries.

Should every person who pays into Social Security be eligible for full benefits, regardless of their socioeconomic status? In other words, will your plan include means testing?

• Will your plan include raising the retirement age or other benefit reductions?

Every working American who pays into Social Security has earned the benefit and deserves to be eligible for full benefits.

I do not support raising the retirement age. For working folks, especially those who make a living in manufacturing and other industrial careers, extending their working careers is simply not realistic.

Should Social Security be funded primarily through payroll taxes, as it is currently, or should other revenue be used to shore up the program’s funding? If so, what revenue source(s) do you propose using?

Social Security should be funded primarily through payroll taxes, where employers and employees share in providing for this important tool. It will be necessary to consider supplemental revenue for Social Security, as we have done for Medicare.

But we need other revenue sources to shore up the program’s funding. That is why I would also bolster Social Security by assessing payroll tax on income – not solely wages – above $250,000 (as is now done with Medicare). The additional revenue will extend the life of the Trust Fund and allow for a “bump up” in payments for the poorest beneficiaries.

Should Social Security benefits be increased for any beneficiaries? If so, how do you propose increasing them, and how will your plan pay for any increase in benefits?

We should consider increasing benefits at the lowest end of the earnings ladder, with a small formula adjustment. This change will be especially important for women, as Social Security is the primary source of income for nearly half of widows and unmarried women.

Current legislation in Congress, the SECURE Act, has bipartisan support. Its primary pillars are expanding access to workplace retirement savings plans, increasing retirement income options, and enabling people to contribute to and retain their funds in IRAs and 401(k)s at later ages. Do you support the legislation? Why? Are there certain aspects you oppose? Why?

I support the SECURE Act, but equally important, Congress needs to enact the Butch Lewis Act, which is criticial to ensuring the future solvency of multi-employer pensions. About 130 of these plans are at risk of failure in the next 20 years, putting in jeopardy the earned retirement benefits of over 1.3 million Americans.

Should every worker have access to a workplace retirement savings account?

a) If so, how would you make that happen?

b) If not, why not?

c) Many states are establishing plans of their own. Do you support these plans and what role do you envision them playing in the broader system?

Yes, every worker should have access to a retirement account. State and municipal plans clearly have enormous potential for additional retirement savings options, and I will support states that create that option for their residents. Unfortunately, a 2015 Social Security report found that only 20% of businesses with fewer than 10 employees offered a retirement plan, like a 401(k), compared with 72% of businesses with more than 100 workers. I also believe that private businesses should be able to deduct the cost of providing 401(k) or similar retirement programs so that employees may choose between an employer-sponsored or state-operated retirement plans.

The gig economy has upended traditional retirement models, and those workers face some of the greatest barriers when it comes to saving for retirement. How would you improve the ability of gig workers to save for retirement?

First, we need to make certain that workers are appropriately classified. Many so-called gig workers may not actually be independent contractors and therefore deserve the same benefits as employees -- including health insurance and access to a 401(k) or even defined benefit program.

Second, it’s important that independent contractors have access not only to a retirement plan, but a greater ability to determine their own future. That includes modernizing labor law to allow workers to bargain collectively and to have basic protections from harassment, discrimination and unfair scheduling, as well as the chance to bargain for needed benefits.

For contract workers who are properly classified and do not have access to a retirement plan, we need to consider all options, including requiring employers to automatically enroll gig workers in state- or municipally-run retirement programs, or a private retirement plan such as an IRA.

Do you support making it easier for workers to move their retirement benefits from one employer to another, such as a portable benefits model? How would you achieve that?

Yes I do. There are many ways to make benefits portable, and I want to hear from impacted stakeholders to determine a path forward. This is especially important in a 21st century workforce that includes freelance and gig-economy workers.

One of the most important things to do here is to support States’ attempts to provide portable benefits that suit their workers’ needs. That is why I support the Portable Benefits for Independent Workers Pilot Program Act, a bipartisan bill that provides funding to States to introduce a portable benefits model. I also would work to repeal the law signed by Donald Trump that repealed protections for cities and states that established automatic IRA programs. We need to make it easier for hard working Americans to receive benefits.

We should also consider Guaranteed Retirement Accounts (GRA), a mechanism to ensure that workers who do not have access to existing retirement accounts can still save for retirement. A worker would only use a GRA if their employer did not have a retirement plan, or if it was worse than their GRA.

How would you propose improving retirement security for low-income Americans, many of whom cannot afford to put away savings?

No plan will give every American a fair shot at a dignified retirement unless we also address the factors that limit people’s ability to save for retirement - from the cost of health care, to the cost of caring for a loved one or saving for a child’s college fund. In Montana, I expanded Medicaid for 96,000 low-income residents and froze tuition at state colleges, despite having a very conservative legislature. These kinds of common-sense measures are critical to giving all Americans a fair shot.

About 32% of workers earning less than $25,000 reported having access to a retirement plan, meaning that Social Security is critically important to the retirement security of most Americans. That is why I support increasing Social Security benefits at the lower end of the income spectrum.

More Responses

Every active campaign was invited to participate. Several declined or did not respond to repeated requests for comment. Some campaigns opted to respond only to select questions and are not included here.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.