Steven Cohen's Top 5 Buys in the 3rd Quarter

Steven Cohen (Trades, Portfolio), manager of Point72 Asset Management, disclosed last week that his firm's top five new buys for the third quarter were MGM Resorts International (NYSE:MGM), Coupa Software Inc. (NASDAQ:COUP), Eli Lily and Co. (NYSE:LLY), Intuitive Surgical Inc. (NASDAQ:ISRG) and Tyson Foods Inc. (NYSE:TSN).

According to the firm's website, Cohen views Point72 as a firm where people "can come and accomplish the things [each individual] wants to accomplish in their careers." The Stamford, Connecticut-based firm said that its mission is to "deliver superior risk-adjusted returns, adhering to the highest ethical standards and offering the greatest opportunities to the industry's brightest talent."

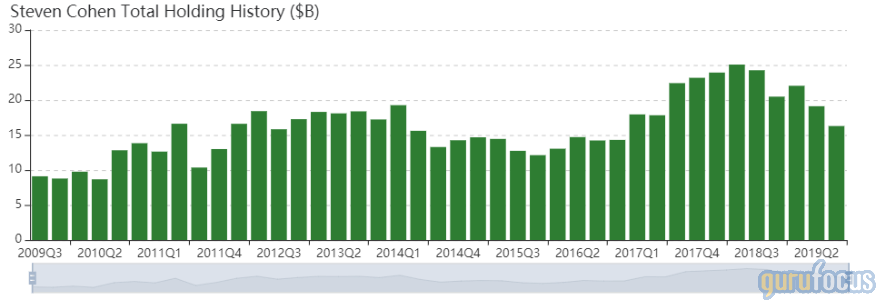

As of quarter-end, the firm's $16.28 billion equity portfolio contains 1,089 stocks, of which 291 represent new holdings. The firm has a turnover rate of 45% and at least a 16% exposure to the technology, health care and consumer cyclical sectors.

MGM Resorts

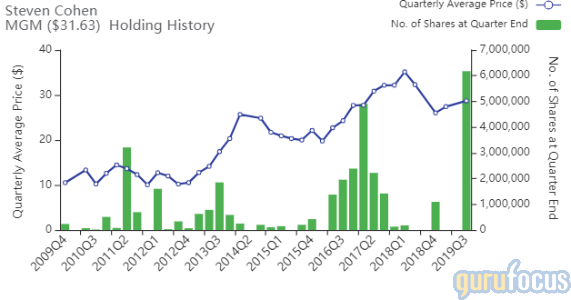

Point72 purchased 6,175,717 shares of MGM Resorts, giving the stake 1.05% weight in the equity portfolio. Shares averaged $28.71 during the quarter.

On Tuesday, CNBC columnist Yun Li said Goldman Sachs Group Inc. (NYSE:GS) reported in October a list of stocks with high revenue exposure to China, a country struggling to negotiate a trade deal with the U.S. CNBC sources said China is "pessimistic" about a trade deal with the U.S. most likely due to the conflicting viewpoints regarding the Dec. 15 tariffs.

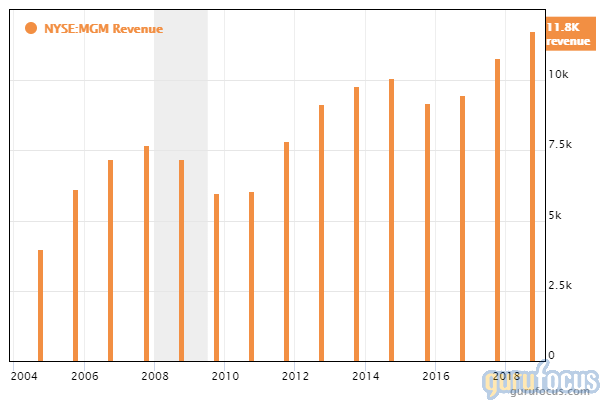

Goldman's list included two resort and casino operators: Wynn Resorts Ltd. (NASDAQ:WYNN) and Las Vegas Sands Corp. (NYSE:LVS), two of MGM's major competitors. MGM said in its Nov. 5 quarterly reported MGM China revenue of $738 million for the quarter ending Sept. 30, up 22% from the prior-year quarter, driven by increased operations at MGM Cotai in Macau, China. The company increased its main floor table games win percentage by 47% on the heels of 25 additional new-to-market tables at MGM Cotai.

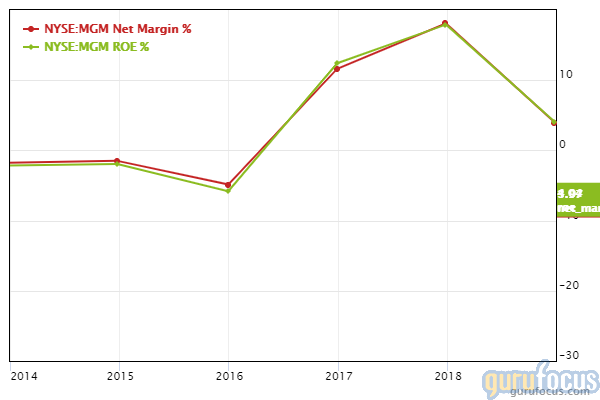

GuruFocus ranks the Las Vegas-based casino operator's profitability 5 out of 10: Although MGM's operating margin is near a 10-year high of 14.6%, the operator of resorts like Bellagio and MGM Grand's net margin and return on assets are underperforming over 66% of global travel and leisure competitors.

Other gurus with holdings in MGM include Bill Nygren (Trades, Portfolio) and PRIMECAP Management (Trades, Portfolio).

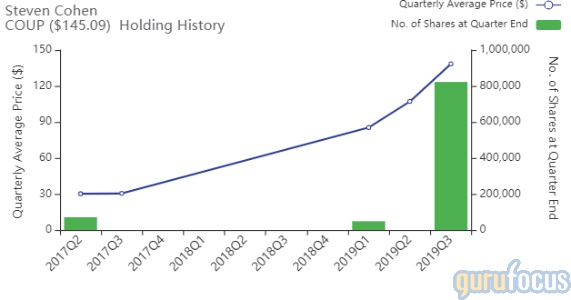

Coupa

The firm purchased 822,566 shares of Coupa, giving the position 0.65% weight in the equity portfolio. Shares averaged $138.40 during the quarter.

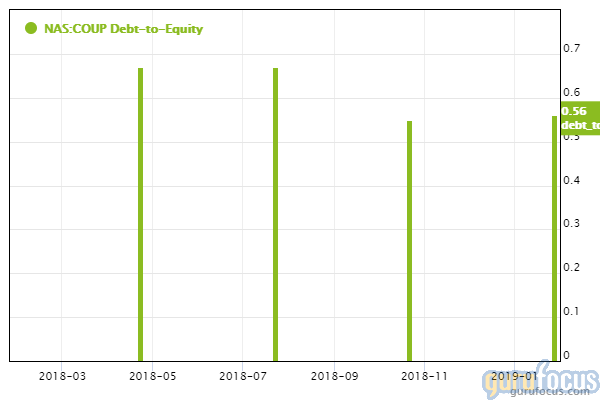

The San Mateo, California-based company offers cloud-based spend management platforms through various applications to its clients. GuruFocus ranks the company's financial strength 5.2 out of 10: Although it has a strong Altman Z-score of 5.47, Coupa's debt-to-equity ratio of 1.66 underperforms 91.58% of global competitors.

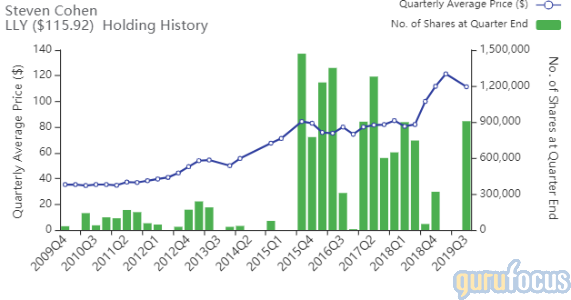

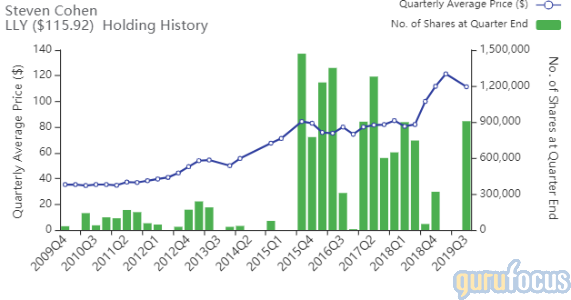

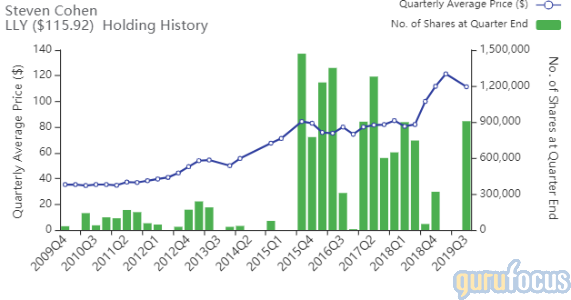

Eli Lily

Point72 purchased 906,761 shares of Eli Lily, giving the position 0.62% weight in the equity portfolio. Shares averaged $111.41 during the quarter.

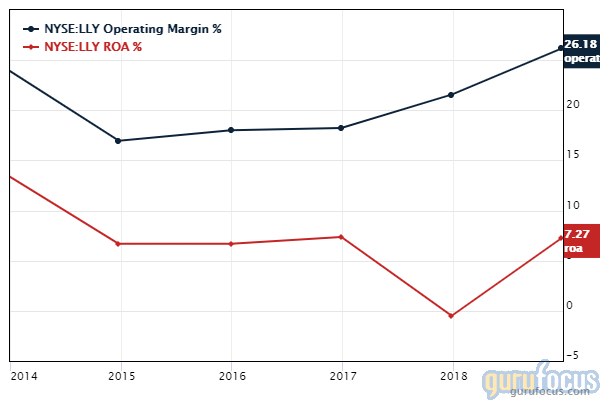

The Indianapolis-based drug manufacturer focuses on neuroscience, endocrinology, oncology and immunology. GuruFocus ranks Eli Lily's profitability 8 out of 10 on several positive investing signs, which include expanding profit margins and a return on assets that outperforms 93.99% of global competitors.

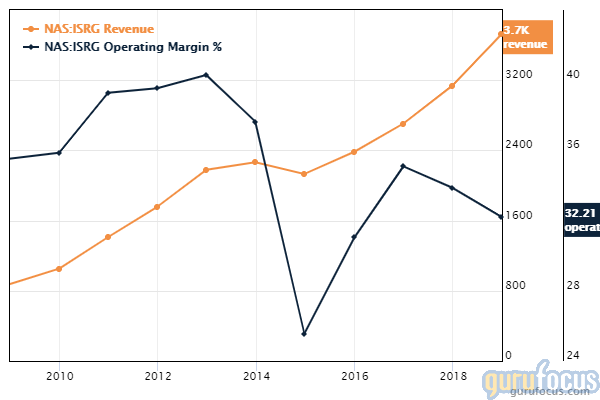

Intuitive Surgical

Point72 purchased 906,761 shares of Intuitive Surgical, giving the position 0.62% weight in the equity portfolio. Shares averaged $111.41 during the quarter.

The Sunnyvale, California-based company develops, produces and markets a robotic system for assisting minimally invasive surgery. GuruFocus ranks Intuitive Surgical's financial strength 10 out of 10 on several positive investing signs, which include no long-term debt and a robust Altman Z-score of 30.9. Other positive investing signs that contribute to a profitability rank of 9 include consistent revenue growth and operating margins that outperform 96.59% of global competitors.

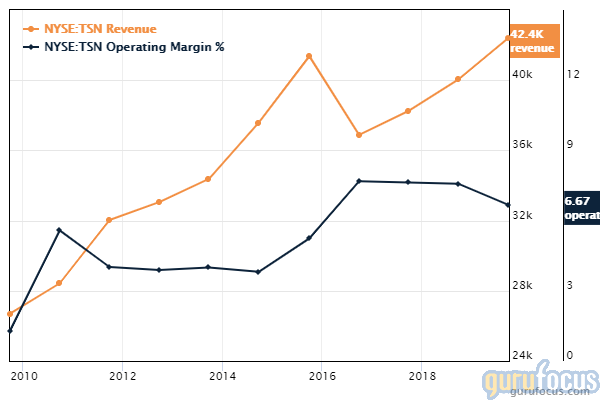

Tyson

Point72 purchased 906,761 shares of Tyson, giving the holding 0.62% weight in the equity portfolio. Shares averaged $111.41 during the quarter.

The Springdale, Arkansas-based company raises, processes and distributes raw and value-added beef, chicken, pork and other prepared food products. GuruFocus ranks Tyson's profitability 7 out of 10 on several positive investing signs, which include expanding profit margins and a return on equity that outperforms 77.14% of global competitors.

Disclosure: No positions.

Read more here:

Daniel Loeb's Top 5 Buys in the 3rd Quarter

Top 5 Buys of John Rogers' Ariel Investment

5 Stocks That Boosted Dow Above 28,000

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.