As Stevens Point's 2024 budget nears final approval, here are some of the highlights and changes

STEVENS POINT − As next year's budget begins to take shape, city leaders held a presentation last week to share the $19 million 2024 budget proposal.

City Comptroller-Treasurer Corey Ladick presented the budget to the Finance Committee along with an explanation of the state’s changes to shared revenue aid, part of Wisconsin Act 12, which was signed in June by Gov. Tony Evers.

The Finance Committee will vote on the budget at its November meeting, before it moves to the full Common Council later this month for final approval.

Here are some of the highlights and changes in the proposed 2024 budget proposal.

Stevens Point is receiving an increase in shared revenue aid

The change to shared revenue aid, the state’s over 100-year-old strategy to reduce property tax burdens, according to Ladick, gave the city about $865,000 more than the roughly $3.3 million it would have received from the program without the change. The amount of increase is equal to about 3.2% of the city’s annual operating budget.

Shared revenue comes from state tax sources, mainly income and sales, and is returned to counties and municipalities in the form of two lump sums through the course of the year, Ladick said. The increase is largely driven by routing more sales tax money into the shared revenue sum, which is divided based on a formula to the state’s counties and municipalities.

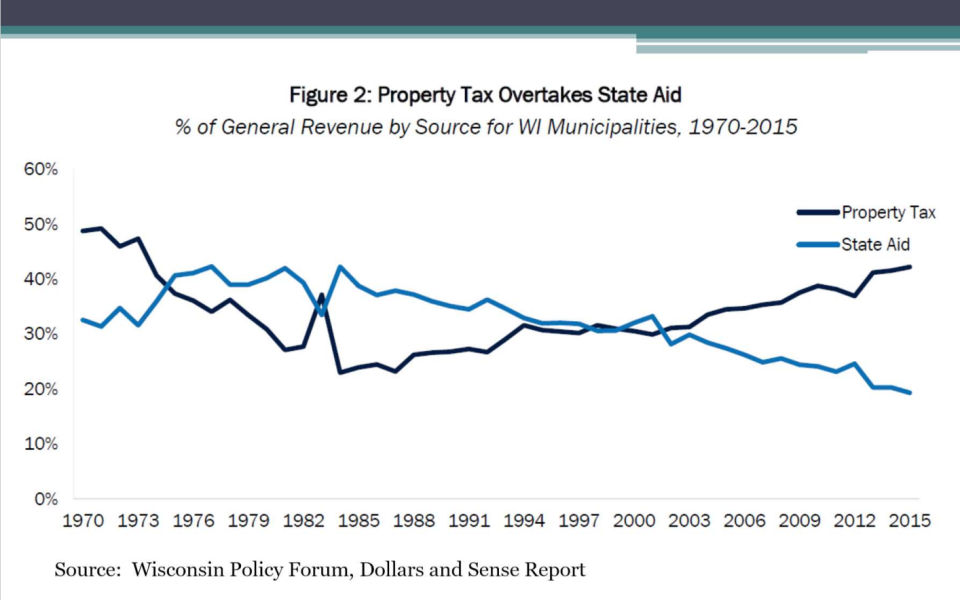

When the program was initiated in 1911, 90% of the money was returned to the municipality and county of the taxpayer. This formula was changed in 1972 to take into account population, property values and revenue requirements in order to resolve inequalities created by the original formula. Another change in 2001 essentially eliminated the formula and based the amount of aid on the previous year’s payment. Since that change, the burden of revenue for local government has shifted back to property tax payers.

How is the city using the new aid in its budget?

The Common Council had two main priorities with the 2024 budget: a zero increase in the dollars collected through property taxes, called the levy, and increasing compensation for city employees. The new budget accomplishes both of these goals, but the shared revenue increase was not enough on its own. The budget was still about $140,000 short of being balanced, according to Mayor Mike Wiza, so money for these priorities still had to be found elsewhere.

Ladick also showed new revenue coming from other areas including about $260,000 from investments boosted by changes in interest rates, almost $100,000 in transportation aid and about $60,000 from room taxes.

“Our room tax has fully recovered and actually exceeded how much money we were collecting in room tax before the pandemic,” Ladick said.

Act 12 requirements for public safety raise concerns

There was one part of Act 12, called "maintenance of effort requirements," that Ladick took time to explain and that alders had several questions about. These requirements have to do with police, fire and emergency medical services spending by the city. If the city does not meet the requirements, it loses 15% of the shared revenue payment, or about $639,000 for 2024.

“We literally cannot afford to fail to meet these requirements,” Ladick said.

For police, one of three things cannot decrease:

Number of sworn officers employed

Amount of property tax levy dollars spent on employment of sworn officers

Percentage of property tax levy spent on employment of sworn officers

For fire and EMS, two of four things cannot decrease:

Expenditures for fire protective services and EMS

Number of full-time equivalent firefighters and EMS personnel employed

Level of training of and maintenance of licensure for firefighters and EMS personnel

Response times for fire and EMS adjusted for call location

The expenditures referred to are actual expenditures and not budgeted expenditures, meaning, if there is an unexpected increase or decrease in actual expenditure, the city may find itself in a tough spot at the end of the year.

“You might have a position that’s vacant and maybe you don’t fill it right away and now you haven’t met that specific maintenance of effort requirement,” Ladick said.

District 2 alderperson David Shorr and District 1 alderperson Marc Christianson made comments about the state making “tax cuts” while shifting the burden of paying for services like police, fire protection and EMS to local governments.

“They were basically tax shifts because of those services still needing to be provided,” Christianson said. “We didn’t receive the shared revenue so all the other taxing entities − the counties, the municipalities and the school districts − had to increase their levy in order to still provide those necessary services. The state legislature looked great because they had these tax cuts, but it wasn’t actually a tax cut it was a just a shift to the other entities.”

“Even with our bearing most of that tax burden we still have to prove ourselves worthy by meeting these maintenance of effort requirements,” Shorr said.

City leaders say this year was the most 'nerve-wracking' budget process

Council members also expressed criticism for “innovation grants” that were created as part of Act 12. The innovation grants reward local governments that “transfer specified types of services to another county or municipality, or to a nonprofit organization or other private entity.” In order to qualify for the grant, the transfer of service must create a 10% savings in expenditures by the third year of implementation.

“Instead of assuming … that local governments are pinching our pennies, which we have to because of a lack of revenue sharing,” Shorr said. “Instead the legislature puts all this money into one-time innovation grants, the premise of which is all these imagined efficiencies just waiting to be realized through reorganization and through privatization.”

The statewide increase in shared revenue aid is $275 million and the innovation grants were allocated for $300 million. Ladick said he and his staff are still investigating how the city could qualify for the grants.

“They’re kind of operating under the assumption that we haven’t been as frugal as we can be,” Christianson said. “We’ve been able to survive with zero increases in departments, and I give our directors a lot of credit for being able to be creative in ways of being able to meet needs.”

Wiza said this was the most “nerve-wracking” budget process that he has been a part of due to the changes in the state aid provisions. He thanked staff for their hard work on it.

Christianson echoed the point.

“It was tempting to use some of that increase in shared revenues for other things, but I am glad that the council chose to prioritize salaries and compensation for our employees," he said. "They are our greatest asset."

Local election news: Here's an early look at what Stevens Point area voters will see on their spring 2024 ballots

Local education news: Stevens Point students' test scores still lag behind pre-COVID levels

Erik Pfantz covers local government and education in central Wisconsin for USA-TODAY NETWORK-Wisconsin and values his background as a rural Wisconsinite. Reach him at epfantz@gannett.com or connect with him on Twitter @ErikPfantz.

This article originally appeared on Stevens Point Journal: Here's what Stevens Point residents need to know about the 2024 budget