Stock market news live updates: Stocks rise with earnings, stimulus talks in focus

Stocks rose Monday as investors considered another set of corporate earnings reports and awaited a slew of data on the state of the labor market this week as parts of the country continue to grapple with a rise in coronavirus cases.

[Click here to read what’s moving markets heading into Tuesday, August 4]

The Nasdaq outperformed, jumping 1.5% as big tech stocks extended last week’s gains. Microsoft (MSFT) surged to a record high, leading the Dow higher as the company engaged in talks with the White House over a potential acquisition of social media company TikTok’s US operations.

Stimulus discussions in Washington also remained a focal point. As of late last week, Democratic and Republican lawmakers were in a logjam over the details of a new virus-related economic relief package, with the enhanced $600 per week in unemployment benefits having expired last Friday.

Democrats have pushed for a more than $3 trillion stimulus plan to extend this benefit at the $600 per week level, and also offer direct payments and more aid for state and local governments for food and housing assistance, and funding for schools and virus testing. The Republican stimulus plan, which totals around $1 trillion, would also include direct payments, but a lower level of enhanced weekly federal unemployment benefits and smaller sums in aid for Covid-19 testing and other funding.

Some economists highlighted that the lapse in enhanced unemployment benefits as negotiations remain under way would generate a near-immediate negative impact on consumer spending.

“The expiration last week of enhanced unemployment benefits will take about $12 billion per week out of consumers’ spending power – that’s 3.3% of weekly GDP – until some form of replacement passes Congress,” Ian Shepherdson, chief economist for Pantheon Macroeconomics, estimated in a note Sunday.

“The gap between the two sides is so huge, to say nothing of the splits within the Republican ranks, that the chance of a deal before the recess, from August 10 through September 7, appears to be diminishing rapidly,” he added.

New coronavirus cases rose in some states over the weekend, with the ongoing outbreak further weighing on a linear economic recovery. California, the nation’s most populous state, on Sunday reported more than 9,000 new cases, in a total larger than the average over the previous 14 days of just under 8,900. The state has the highest number of total positive cases in the country, with the total breaching 500,000 for the first time this weekend.

But other areas that had seen resurgences recently, including Arizona and Florida, reported a slowdown in their numbers of new cases on Sunday.

Federal Reserve Bank of Minneapolis President Neel Kashkari, a voting member of this year’s Federal Open Market Committee, told CBS’s “Face the Nation” on Sunday advocated for tightened stay in place restrictions to help stem the spread of the coronavirus, and by extension, speed up the economic recovery in the US.

“If we were to lock down hard for a month or six weeks, we could get the case count down so that our testing and our contact tracing was actually enough to control it the way that it's happening in the Northeast right now,” Kashkari said, according to a transcript of the interview.

“Now, if we don't do that and we just have this raging virus spreading throughout the country with flare ups and local lockdowns for the next year or two, which is entirely possible, we're going to see many, many more business bankruptcies, small businesses, big businesses, and that's going to take a lot of time to recover from to rebuild those businesses and then to bring workers back in and re-engage them in the workforce,” he added. “That's going to be a much slower recovery for all of us.”

Elsewhere, corporate earnings season continues Monday with companies including Virgin Galactic (SPCE), Take-Two Interactive Software (TTWO) and Diamondback Energy (FANG) due after market close.

—

4:02 p.m. ET: Nasdaq jumps 1.5% to close at a record as Microsoft, Apple shares reach fresh highs

Here were the main moves in markets as of 4:02 p.m. ET:

S&P 500 (^GSPC): +23.49 (+0.72%) to 3,294.61

Dow (^DJI): +236.33 (+0.89%) to 26,664.65

Nasdaq (^IXIC): +157.52 (+1.47%) to 10,902.80

Crude (CL=F): +$0.55 (+1.37%) to $40.82 a barrel

Gold (GC=F): +$7.80 (+0.39%) to $1,993.70 per ounce

10-year Treasury (^TNX): +2.7 bps to yield 0.5630%

—

11:55 p.m. ET: Stocks add to gains, Dow jumps 200+ points

Stocks extended gains as Monday’s session rolled on, with the Dow’s more than 200-point gain led by a 4% gain in shares of Microsoft.

Here were the main moves in markets, as of 11:55 a.m. ET:

S&P 500 (^GSPC): +26.68 points (+0.82%) to 3,297.8

Dow (^DJI): +258.8 points (+0.98%) to 26,687.12

Nasdaq (^IXIC): +154.93 points (+1.44%) to 10,900.54

Crude (CL=F): +$0.82 (+2.04%) to $41.09 a barrel

Gold (GC=F): -$0.10 (-0.01%) to $1,985.80 per ounce

10-year Treasury (^TNX): +2.2 bps to yield 0.558%

—

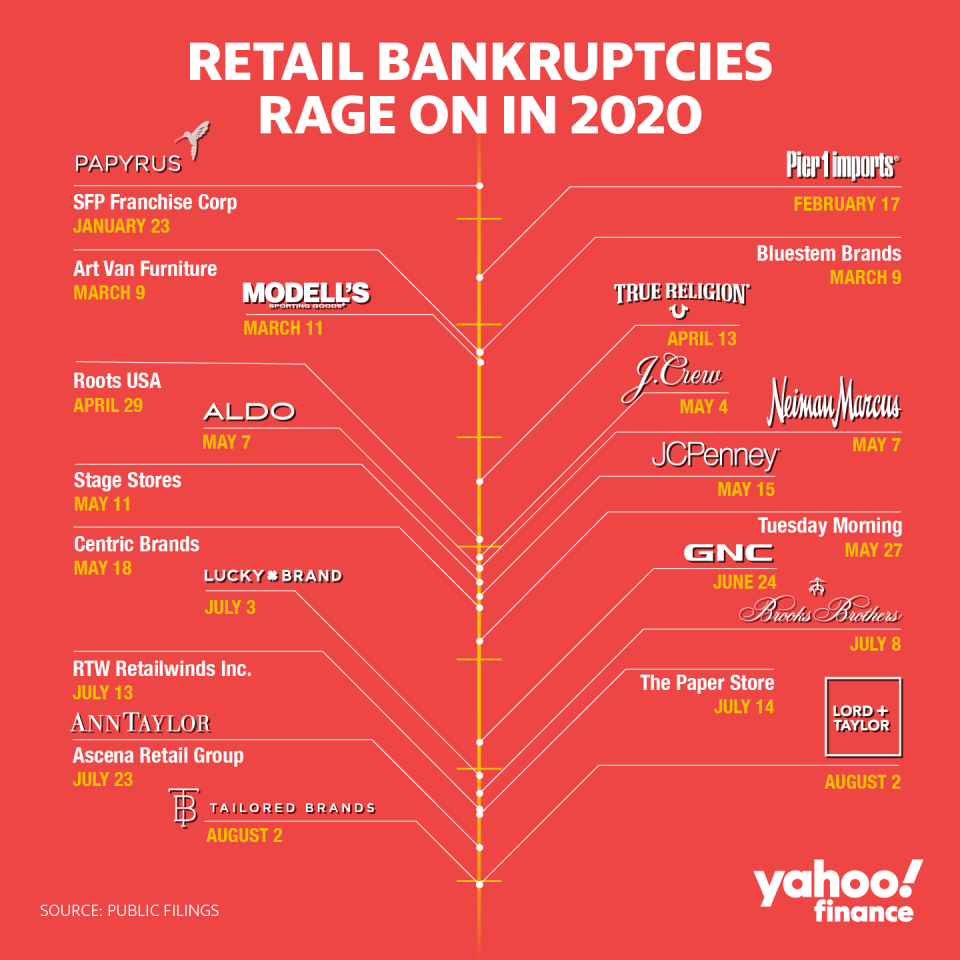

11:30 a.m. ET: The retail apocalypse means recovery ‘is being tested daily’

The number of retailers for sale, or seeking bankruptcy protection, is getting longer — and its jeopardizing the economy’s ability to recover, according to the National Retail Federation. The organization points out that uneven data is making it harder to figure out how the comeback will continue, NRF chief economist Jack Kleinhenz said:

“Optimism about the economy and retail spending is being tested daily with the spread of the coronavirus. “Big questions are looming, and we are all grappling to discern what incoming data is telling us about the health of the economy and consumers. Depending on the data selected, the answers are not entirely clear.”

“A key question is whether the pace of growth and momentum will carry forward over the next few months. Based on quarterly and monthly data, the U.S. economic recovery continues despite elevated COVID-19 cases. But in examining weekly data, the pace of improvement appears to be slowing. Could it be that we are at or heading back to the same spot we were at two months ago?

The NRF’s Monthly Economic Review showed monthly economic indicators improving in May and June, yet high frequency data revealed a flattening by mid-July.

—

10:00 a.m. ET: ISM manufacturing index rises to highest level since March 2019 as new orders, prices improve

The Institute for Supply Management’s (ISM) manufacturing purchasing managers’ index rose to 54.2 in July from 52.6 in June, topping expectations for an improvement to 53.6. The level indicated expansion in the manufacturing sector at the fastest rate since March of 2019, with readings above the neutral level of 50 indicating sector growth.

July’s reading marked the third straight month of expansion in the manufacturing sector after a contraction in April, based on ISM’s reports. July’s increase was led by an unexpected jump in new orders, with the subindex tracking these rising to 61.5 from 56.4 in June. Consensus economists had expected the new orders index to tick down to 55.1. A subindex tracking prices paid also improved to 53.2, from 51.3 in June.

—

9:45 a.m. ET: US manufacturing sector strengthened for the first time since February in July, but ‘remains worryingly weak’ amid pandemic: IHS Markit

IHS Markit’s US manufacturing sector purchasing managers’ index (PMI) registered at 50.9 in July, according to the firm’s final revision of the monthly index. This was an improvement from June’s PMI of 49.8, but a decline from the 51.3 reported in the preliminary July index. Readings above the neutral level of 50 indicate expansion in a sector, and July’s print was the first to breach 50 since February and the highest level since the beginning of the year.

“Although indicating the strongest expansion of the manufacturing sector since January, the IHS Markit PMI remains worryingly weak. Much of the recent improvement in output appears to be driven merely by factories restarting work rather than reflecting an upswing in demand,” Chris Williamson, chief business economist at IHS Markit, said in a statement.

“Growth of new orders remains lackluster and backlogs of work continue to fall, hinting strongly at the build-up of excess capacity,” Williamson added. “Many firms and their customers remain cautious in relation to spending in the face of re-imposed lockdowns in some states and worries about further disruptions from the pandemic.”

—

9:32 a.m. ET: Stocks open higher as August trading kicks off

Here were the main moves in markets, as of 9:32 a.m. ET:

S&P 500 (^GSPC): +18.5 points (+0.6%) to 3,290.75

Dow (^DJI): +142.84 points (+0.54%) to 26,571.16

Nasdaq (^IXIC): +102.26 points (+0.97%) to 10,849.94

Crude (CL=F): +$0.19 (+0.47%) to $40.46 a barrel

Gold (GC=F): -$1.00 (-0.05%) to $1,984.90 per ounce

10-year Treasury (^TNX): +3 bps to yield 0.566%

—

9:00 a.m. ET: Tyson Foods tops profit expectations, names new CEO

Tyson Foods (TSN), the biggest meat producer in the US, delivered adjusted earnings of $1.40 per share for its fiscal third quarter, or well above the 93 cent per share consensus estimate. Third-quarter sales of $10.02 billion were slightly below the $10.5 billion expected.

The profit beat came even as Tyson’s results were negatively impacted by about $340 million of direct incremental expenses related to COVID-19, with much of this relating to health and safety measures for Tyson workers. The company said it absorbed higher than normal operating costs due to Covid-19, and an increase in prices for beef and pork also boosted results.

While Tyson still faces challenges due to the pandemic, including production disruptions and a shift in consumption trends away from restaurants in favor of home cooking, the company said it still expects “worldwide demand to continue to increase” for products as a whole.

Tyson on Monday also announced that Dean Banks, current company president with a tech-heavy history working as project lead in a division of Google’s parent company Alphabet, was being promoted to CEO. He will succeed Noel White, who will remain on as executive chairman of Tyson’s board as of the effective date of the change on Oct. 3.

—

7:25 a.m. ET: Clorox fiscal 4Q results top expectations as consumers sought out more disinfectants during pandemic

Clorox (CLX) grew fiscal fourth-quarter net sales 22% over last year to $1.98 billion, topping estimates for $1.88 billion, according to consensus data compiled by Bloomberg. Adjusted earnings per share of $2.41 were better than the $1.99 expected. Shares of Clorox rose about 1.5% in pre-market trading.

Clorox’s health and wellness business unit led top-line sales growth after posting a 33% year over year jump.

“Growth was fueled by a broad-based increase in demand for disinfecting and cleaning products across the Cleaning and Professional Products portfolios related to COVID-19,” Clorox said in a statement.

However, the company suggested its pandemic-related surge in demand may not continue for the rest of the year. In guidance for fiscal 2021, Clorox said it “anticipates sales growth ranging from flat to low single digits, reflecting the expectation for continued elevated demand through the first half of the fiscal year and a deceleration in the back half from lapping of the initial spike in demand from COVID-19.”

In a separate statement, Clorox also said it promoted Linda Rendle to CEO, effective. Sept. 14. Current CEO Benno Dorer will continue serving as the Clorox board's executive chair.

—

7:23 a.m. ET Monday: Stock futures point to higher open

Here were the main moves in equity markets, as of 7:23 a.m. ET:

S&P 500 futures (ES=F): 3,278.5, up 15 points or 0.46%

Dow futures (YM=F): 26,405.00, up 86 points, or 0.33%

Nasdaq futures (NQ=F): 10,984.75, up 94.25 points, or 0.87%

Crude (CL=F): -$0.25 (-0.62%) to $40.02 a barrel

Gold (GC=F): +$1.30 (+0.07%) to $1,987.20 per ounce

10-year Treasury (^TNX): +1.2 bps to yield 0.548%

—

6:11 p.m. ET Sunday: Stock futures mixed at the open

Here were the main moves in equity markets, as of 6:11 p.m. ET:

S&P 500 futures (ES=F): 3,263.5, flat

Dow futures (YM=F): 26,324.00, up 5 points, or 0.02%

Nasdaq futures (NQ=F): 10,901.00, up 10.5 points, or 0.1%

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay