Stock Market Live Updates: Wall Street lower, traders book profits after record-breaking year

Follow Yahoo Finance here for up-to-the-minute briefings on the financial markets, breaking news and other topics of interest to investors and traders. Please check back for continuing coverage.

4 p.m. ET: Dow falls 183 points on second-to-last day of trading in 2019

Here’s how markets settled at the end of regular trading Monday:

S&P 500 (^GSPC): 3,221.29, down 18.73 points or 0.58%

Dow (^DJI): 28,462.14, down 183.12 points or 0.64%

Nasdaq (^IXIC): 8,945.99, down 60.62 or 0.67%

Crude oil (CL=F): $61.62 per barrel, down $0.10 or 0.16%

Gold (GC=F): $1,518 per ounce, down $0.10 or 0.01%

—

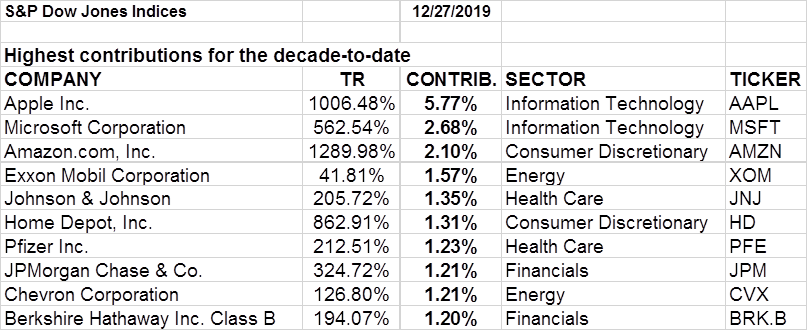

12:30 p.m. ET: Apple, Microsoft had a big impact on the S&P 500 Index

According to S&P Global data, there were 2 stocks that accounted for over 8% of the broader market’s gains over a 10-year period: AAPL and MSFT. From 2009, information technology was a big gainer for the broader market overall, comprising 31.3% of the year-to-date (YTD) 2019 total return, S&P found.

Yet taken together, Apple and Microsoft accounted for 14.8% (17.8% for MTD December 2019) and 8.45% from 2009:

—

10:43 a.m. ET: Dow off 200

The Dow was down by as much as 216 points at about 10:30 before recovering some of those losses.

—

10:30 a.m. ET: Texas area manufacturing falls deeper into contraction

The Dallas Fed’s Texas Manufacturing Outlook Survey disappointed, with the headline index unexpectedly falling to -3.2 in December from -1.3 in November. Economists were expecting the index to improve to 0.0. Any number below 0 signals contraction in the sector.

However, some of the key forward-looking subindices are looking up. From the report: “he new orders index rose from -3.0 to 1.6... the company outlook index inched up three points to 1.3... The employment index rose from 0.9 to 6.2, indicative of a pickup in hiring. Eighteen percent of firms noted net hiring, while 12 percent noted net layoffs. The hours worked index rebounded to 2.6 after dipping into negative territory last month.“

—

10:00 a.m. ET: Pending home sales climb

According to the National Association of Realtors, pending home sales climbed by 1.2% in November, falling short of the 1.4% expected by economists.

“Despite the insufficient level of inventory, pending home contracts still increased in November,” NAR chief economist Lawrence Yun said. “The favorable conditions are expected throughout 2020 as well, but supply is not yet meeting the healthy demand.”

“Sale prices continue to rise, but I am hopeful that we will see price appreciation slow in 2020,” Yun added. “Builder confidence levels are high, so we just need housing supply to match and more home construction to take place in the coming year.”

—

9:45 a.m. ET: Midwest activity improves

The MNI Chicago PMI improved to 48.9 in December from 46.3 in November. This was better than the 47.9 expected by economists. However, any reading below 50 signals contraction.

The new orders and employment subindices deteriorated at a faster pace.

—

9:40 a.m. ET: Stocks fall

Markets opened lower to kick off a holiday-shortened week. Here were the main market moves, as of 9:40 a.m. ET:

S&P 500 (^GSPC): 3,226.83, down 13.19 points or 0.41%

Dow (^DJI): 28,531.68, down 113.58 points or 0.40%

Nasdaq (^IXIC): 8,959.00, down 47.52 or 0.53%

Crude oil (CL=F): $62.13 per barrel, up $0.41 or 0.66%

Gold (GC=F): $1,516.80 per ounce, down $1.30 or 0.09%

—

7:30 a.m. ET: Stock futures point higher

U.S. stock futures indicted marginally higher open for the major indices Monday with just two full trading days left until the new year.

Here were the main pre-market moves, as of 7:30 a.m. ET:

S&P futures (ES=F): 3,240.25, up 2.75 points or 0.08%

Dow futures (YM=F): 28,629, up 19 points or 0.07%

Nasdaq futures (NQ=F): 8,789.25, up 6 points or 0.07%

Crude oil (CL=F): $62.09 per barrel, up $0.37 or 0.60%

Gold (GC=F): $1,514.50 per ounce, down $3.60 or 0.24%

Stocks have been in rally mode in December. The S&P and Dow both closed at record highs Friday, and the Nasdaq broke above the key 9,000 level Thursday. Tech has been leading the charge this year. The S&P Tech sector surged 48% in 2019 and is on pace to close out its best year in a decade.

In less than a year, Tesla (TSLA) delivered its first batch of Model 3 cars built in its Shanghai gigafactory Monday. Fifteen Model 3 cars were delivered to the gigafactory’s employees, and more workers are set to receive their vehicles in the coming days. This is seen as a huge milestone for Tesla. The new facility cements the electric carmaker’s vision to become a global company with factories around the world. Last month, Tesla announced that it plans to open another gigafactory in Germany. Tesla shares have skyrocketed over the past three months — jumping a whopping 78%.

—

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

More from Heidi:

From fruit-flavored Coke to Hershey Kisses: The reason behind the flavor variety boom

McDonald's could be the key to $1 billion in sales for Beyond Meat, UBS says

Find live stock market quotes and the latest business and finance news

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.