Stock Market Live Updates: S&P climbs 29% in 2019, best gain since 2013

Follow Yahoo Finance here for up-to-the-minute briefings on the financial markets, breaking news and other topics of interest to investors and traders. Please check back for continuing coverage.

4:06 p.m. ET: S&P climbs 29% in 2019, best gain since 2013: report

The S&P 500 climbed 29% in 2019 in the best annual gain since 2013, Bloomberg reports. The S&P added a record $5.9 trillion in market value in 2019.

Here’s where markets stood as of 4:06 p.m. ET:

S&P 500 (^GSPC): 3,230.78, up 9.49 points or 0.29%

Dow (^DJI): 28,538.44, up 76.30 points or 0.27%

Nasdaq (^IXIC): 8,972.60, up 26.61 points or 0.30%

Crude oil (CL=F): $61.15 per barrel, down $0.53 or 0.86%

Gold (GC=F): $1,520.40 per ounce, up $1.80 or 0.12%

3:40 p.m. ET: The past decade for stocks

Here’s how the major indices performed over the past decade since Dec. 31, 2009:

—

2:47 p.m. ET: Stocks mixed

Here were the main market moves, as of 2:47 p.m. ET:

S&P 500 (^GSPC): 3,220.52, down 0.77 points or 0.02%

Dow (^DJI): 28,432.51, down 29.63 points or 0.10%

Nasdaq (^IXIC): 8,957.68, up points 11.68 or 0.13%

Crude oil (CL=F): $61.16 per barrel, down $0.52 or 0.84%

Gold (GC=F): $1,523.20 per ounce, up $4.60 or 0.30%

—

10:30 a.m. ET: Wages keep rising as 2019 draws to a close

Flat worker wages, which has figured prominently in the debate over income inequality, has been on the rise lately. New data from Paychex | IHS Markit Small Business Employment Watch confirms the trend of rising wages, with workers both working longer and earning more in December.

Paychex-IHS noted “steady growth in hourly earnings and hours worked” -- with the latter posting the strongest gains since 2012. Meanwhile, weekly earnings growth to new highs for small businesses:

“Small business job gains have flattened in the second half of the year as labor markets prove very tight,” said James Diffley, chief regional economist at IHS Markit. “In response, weekly earnings have accelerated, surging from 2.49 percent mid-year to 4.13 percent at year-end.”

“The new high seen in weekly earnings growth this month is certainly positive news for the employees of small businesses,” said Martin Mucci, Paychex president and CEO. “Not only are businesses raising wages, but they’re also increasing hours for their current employees, a sure sign employers are responding to the pressures of the tight labor market.”

Paychex-IHS’s figures also found that the South is the best region for small business jobs, while the West has seen the strongest earnings growth.

—

10:00 a.m. ET: Consumer confidence climbs, but disappoints

The Conference Board’s index of consumer confidence climbed to 126.5 in December from 125.5 in November. This was just shy of the 128.5 economists were expecting.

“While consumers’ assessment of current conditions improved, their expectations declined, driven primarily by a softening in their short-term outlook regarding jobs and financial prospects,” the Conference Board’s Lynn Franco said. “While the economy hasn’t shown signs of further weakening, there is little to suggest that growth, and in particular consumer spending, will gain momentum in early 2020.”

—

9:37 a.m. ET: Stocks open flat

Markets opened lower to kick off a holiday-shortened week. Here were the main market moves, as of 9:40 a.m. ET:

S&P 500 (^GSPC): 3,222.13, up 0.84 point or 0.03%

Dow (^DJI): 28,460.51, down 1.63 points or 0.01%

Nasdaq (^IXIC): 8,953.32, up 7.32 points or 0.08%

Crude oil (CL=F): $60.71 per barrel, down $0.97 or 1.57%

Gold (GC=F): $1,524.90 per ounce, up $6.30 or 0.41%

—

9:16 a.m. ET: Trump says the Phase 1 trade deal will be signed January 15

From President Trump’s Twitter account: “I will be signing our very large and comprehensive Phase One Trade Deal with China on January 15. The ceremony will take place at the White House. High level representatives of China will be present. At a later date I will be going to Beijing where talks will begin on Phase Two!”

I will be signing our very large and comprehensive Phase One Trade Deal with China on January 15. The ceremony will take place at the White House. High level representatives of China will be present. At a later date I will be going to Beijing where talks will begin on Phase Two!

— Donald J. Trump (@realDonaldTrump) December 31, 2019

—

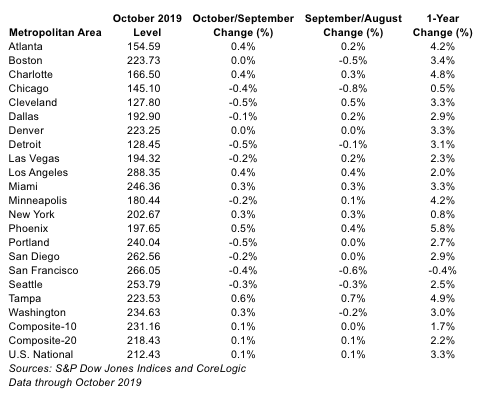

9:00 a.m. ET: Home prices climb

According to the S&P Corelogic Case-Shiller monthly home price report, the average price of a home in 20 major metro areas climbed by 0.43% month over month in October, which was a bit hotter than the 0.30% forecast by economists.

"October's U.S. housing data continue to be reassuring," S&P Dow Jones Indices’ Craig Lazzara said. "With October's 3.3% increase in the national composite index, home prices are currently more than 15% above the pre-financial crisis peak reached July 2006. October's results were broad-based, as both our 10- and 20-city composites rose. Of the 20 cities in the composite, only San Francisco saw a year-over-year price decline in October.”

—

8 a.m. ET: Stock futures indicate lower open

U.S. stock futures indicted a lower open for the major indices Tuesday on the final day of trading this year.

Here were the main pre-market moves, as of 8 a.m. ET:

S&P futures (ES=F): 3,221, down 2.50 points or 0.08%

Dow futures (YM=F): 28,417, down 23 points or 0.08%

Nasdaq futures (NQ=F): 8,723.75, down 10 points or 0.11%

Crude oil (CL=F): $61.03 per barrel, down $0.65 or 1.05%

Gold (GC=F): $1,523.80 per ounce, up $5.20 or 0.34%

Despite the slight pullback from all-time highs, stocks are still on pace to close out their best year since 2013. The S&P 500 (^GSPC) rose 31% this year, while the Dow (^DJI) jumped 25% and the tech-heavy Nasdaq (^IXIC) advanced 36%.

The U.S. dollar (USD=X) was also in focus, as it weakened for the fourth straight day to its lowest level in nine months. Multinational companies struggled for much of the year on the back of a strong dollar, but Wall Street analysts expect the pressure to abate with a a weaker greenback in 2020.

—

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

More from Heidi:

Find live stock market quotes and the latest business and finance news

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.