Stock market news live: Wall Street tumbles despite Fed's 'Big Bertha'; stimulus fails in Senate

Stocks sank to new lows on Monday, as world policymakers race to contain the fallout from the coronavirus pandemic, with an eagerly-anticipated U.S. stimulus package becoming engulfed in partisan rancor.

[Click here for what’s moving markets on Tuesday, March 24.]

Unprecedented levels of volatility and an economy in free-fall prompted the Federal Reserve to announce a broad new, open-ended effort to calm markets, which will include buying unlimited amounts of government and investment grade corporate debt.

However, Wall Street traders were unimpressed with what JPMorgan Chase economist called the Fed’s “Big Bertha” — and continued a slide that began in the overnight futures market. Intraday, the Dow sank more than 4% to below 18,332.74 – the level the index had closed at November 8, 2016, or the presidential election day for 2016.

“The actions taken this morning, while probably of inadequate size, are a good start and give an indication of the types of things the Fed can do if it gets more financial support from Treasury,” JPMorgan’s Michael Feroli wrote.

The Fed’s cumulative efforts to calm markets have faltered, with indexes plunging to their lowest levels in years. Meanwhile, the stimulus bill being debated in the Senate failed on a key procedural vote, hampered by political divisions even as the economic outbreak grows more alarming.

“Fed policy is shifting into a higher gear to try to help support the economy which looks like it is in freefall at the moment,” Chris Rupkey, chief financial economist at MUFG Union Bank, wrote in an email. “The central bank is shifting from being not just the lender of last resort, but now it is the buyer of last resort. Don't ask how much they will buy, this is truly QE [quantitative easing] infinity.”

The Fed’s move “will go a long way to reassuring investors the Fed has their backs and will stop the growing credit crisis in its tracks,” Rupkey added. “Yield spreads should narrow and the stock market should rest easier now that the Federal Reserve is giving it all it's got.”

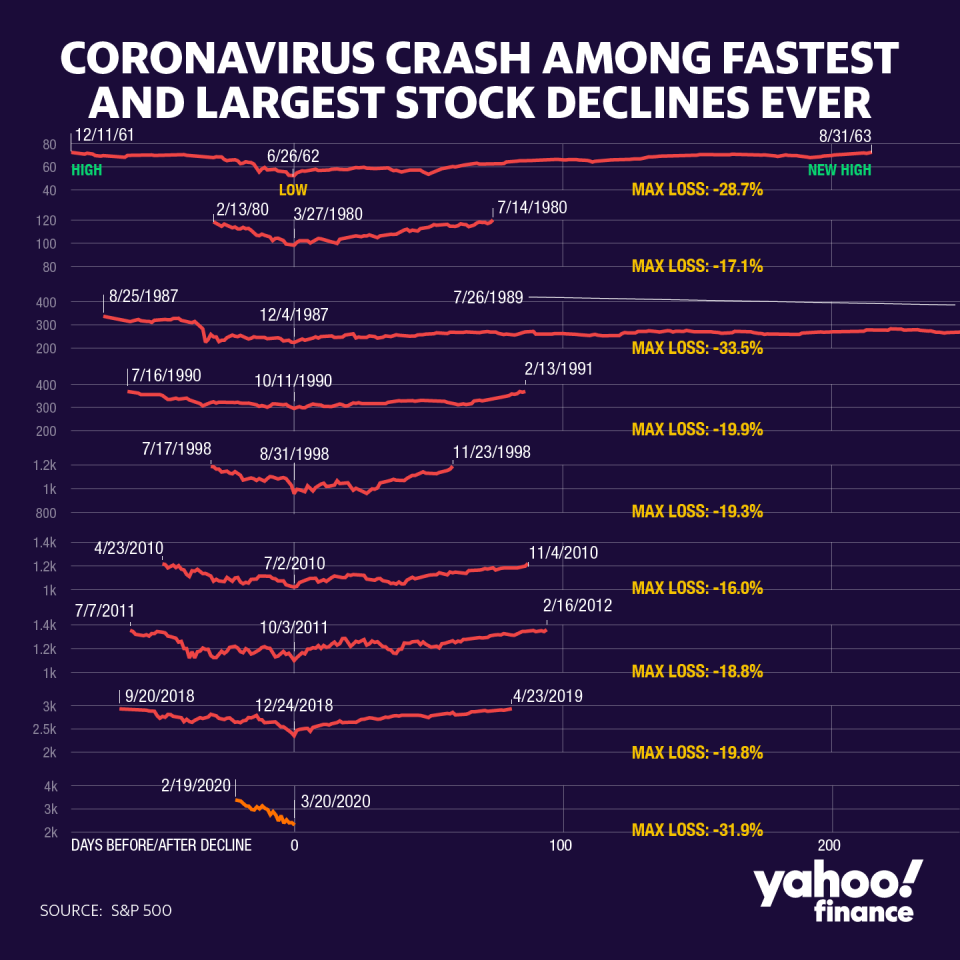

The virus’ rapid spread has led to social distancing policies that have all but brought America’s public life to a grinding halt — and pushed stocks from record highs into a bear market in record time.

Amid mass closures of private businesses, soaring layoffs and school shutdowns, economists all but expect the global economy — and the world’s largest — to plunge into a deep recession in the coming quarters, even as the Fed and Washington throw trillions of dollars at the problem.

—

4:01 p.m. ET: Stocks recoup some losses, Dow closes nearly 600 points lower after US coronavirus aid bill delayed

Here were the main moves in markets as of 4:01 p.m. ET:

S&P 500 (^GSPC): -68.22 (-2.96%) to 2,236.70

Dow (^DJI): -597.94 (-3.12%) to 18,576.04

Nasdaq (^IXIC): -18.84 (-0.27%) to 6,860.67

Crude (CL=F): +$0.71 (+3.14%) to $23.34 a barrel

Gold (GC=F): +$79.30 (+5.34%) to $1,563.90 per ounce

10-year Treasury (^TNX): -17.4 bps to yield 0.7640%

—

3:20 p.m. ET: Instacart says it will bring on 300,000 gig economy workers as grocery delivery demand surges

Grocery delivery service Instacart announced Monday it plans to bring on 300,000 gig economy shoppers over the next three months to meet a spike in demand, as customers increasingly turn to at-home grocery delivery as the coronavirus outbreak keeps individuals indoors.

The largest chunk, or 54,000, of these workers will be brought on in California. Hiring will also be conducted in New York, Texas, Florida, Illinois, Pennsylvania, Virginia, New Jersey, Georgia and Ohio, Instacart said. In total, the 300,000 new shoppers will more than double the company’s current base.

The San Francisco-based company said it’s seen order volume grow by more than 150% over last year in the past several weeks, and average customer basket size increased by 15%.

“The last few weeks have been the busiest in Instacart's history and our teams are working around the clock to reliably and safely serve all members of our community," Instacart CEO Apoorva Mehta said in a statement.

—

2:21 p.m. ET: Dow drops 600 points after US aid bill delayed

A Senate bill that would provide more than $1 trillion in aid to the US economy failed again to make it past a regulatory hurdle, Reuters reports. Stocks fell after the report.

According to Politico, Democrats blocked the measure with a variety of concerns, including that the bill fails to adequately prevent airlines from excessively profiting from a bailout.

Here’s where the major indices stood as of 2:27 p.m. ET:

S&P 500 (^GSPC): -67.26 (-2.92%) to 2,237.66

Dow (^DJI): -597.62 (-3.12%) to 18,576.36

Nasdaq (^IXIC): -52.00 (-0.76%) to 6,827.51

Crude (CL=F): -$0.15 (-0.66%) to $22.48 a barrel

Gold (GC=F): +$77.20 (+5.20%) to $1,561.80 per ounce

10-year Treasury (^TNX): -18.3 bps to yield 0.7550%

—

12:50 p.m. ET: Boeing to temporarily halt production at Puget Sound for 14 days

Aircraft-maker Boeing said Monday it will temporarily halt production at its Puget Sound regional facilities in light of the state of emergency Washington state declared earlier this month as the coronavirus outbreak spreads. Boeing had previously shut production at its Renton, Washington facility in January amid the global 737 Max groundings.

Boeing said it will reduce production activity starting today at the facilities. It expects suspension of operations will take place Wednesday.

“The suspension of production operations will last 14 days, during which Boeing will continue to monitor government guidance and actions on Covid-19 and its associated impacts on all company operations,” the company said in a statement. “During this time, we will be conducting additional deep cleaning activities at impacted sites and establishing rigorous criteria for return to work.”

Employees in the area who can work from home will do so, the company added.

“Those who cannot work remotely will receive paid leave for the initial 10 working days of the suspension – double the company policy – which will provide coverage for the 14 calendar day suspension period,” Boeing said.

Shares of Boeing were halted ahead of the press release.

—

—

11:46 a.m. ET: Dow erases gains since Trump’s election

The Dow sank more than 4% just before noon in New York to as low as 18,213.46. This was below the 30-stock index’s closing level of 18,332.74 from November 8, 2016, or the day of the 2016 presidential elections.

—

11:17 a.m. ET: Stocks hold onto losses as energy shares slide

The three major indices remained lower as trading wore on during Monday’s session, led by a decline in the Energy sector. U.S. crude oil prices, which had briefly shot higher after the Fed announced its emergency stimulus plans, fell anew.

Here were the main moves in markets, as of 11:17 a.m. ET:

S&P 500 (^GSPC): 2,243.63, -61.29 points (-2.66%)

Dow (^DJI): 18,652.03, -573.48 points (-2.99%)

Nasdaq (^IXIC): 6,785.10, -93.85 points (-1.37%)

Crude (CL=F): $22.46 per barrel, -$0.17 (-0.75%)

Gold (GC=F): $1,537.00 per ounce, +$52.40 (+3.53%)

10-year Treasury (^TNX): -20.7 bps to yield 0.731%

—

10:45 a.m. ET: Whither airlines? ‘An unprecedented hit’

However badly you think major air carriers are doing, Bank of America has a message: It’s worse.

The bank’s analysts see “a severe deterioration in fundamentals” (no kidding) that prompts a cut in estimates and a forecast of a stunning 36% pace this year:

If our -36% revenue estimate for 2020 holds, it would be meaningfully worse than the four quarters after 9/11 (-19%) and during the financial crisis (-17%). However, booking trends are very concerning as [Delta] said 2Q20 revenues could be down -80% after saying less than two weeks ago it could be free cash flow positive through the crisis. This is a ferocious decline no company could be fully prepared for, and we materially cut all our airline estimates to losses for the full year for all carriers (see inside for changes).

According to BofA, the lone bright spot at this point is domestic airline Southwest (LUV), which isn’t as reliant on international travel as its cohorts. The bank actually upgraded LUV (up over 1% on the day) to Buy from Neutral, while cutting United (UAL) to Neutral from Buy.

—

10:30 a.m. ET: Uber seeking stimulus help for workers

Uber (UBER), whose business model has come to define the gig economy, is looking to the government to backstop its vast front line network of drivers and delivery workers.

In a newly released letter, CEO Dara Khosrowshahi called for “immediate protection and support” for its contractors, and called for a new framework for independent workers, even as it battles California over a new gig worker law. “Together we can create a new standard for flexible work that benefits all who choose it and is available to as many people as possible,” he added.

1/2 My request of America’s leaders: make sure @Uber drivers & delivery people, along with all independent workers in the gig economy and beyond, get immediate protection and support in COVID-19 stimulus packages 👉https://t.co/SKBlOubxyY pic.twitter.com/U2xHPxQmyh

— dara khosrowshahi (@dkhos) March 23, 2020

—

10:15 a.m. ET: COVID-19 has ‘pushed the world into a deep recession’

Goldman, which last week estimated that U.S. growth would collapse by 24% in Q2 as lockdowns and ‘stay in place’ orders keep workers at home, and quite possibly unemployed.

The bank has an even worse forecast for the China, where the coronavirus crisis originated:

The extent to which the global economy is experiencing not just a recession but a "sudden stop" becomes clearer when we focus on sequential numbers for the major economies. Based on the hard data for January/February activity in China, we now estimate that Q1 real GDP there contracted 42% in terms of the quarter-on-quarter annualized rate.

Saying the pandemic has propelled the globe into “a deep recession” the banking giant sees a 1% contraction of gross domestic product (GDP) this year — even worse than the year after the financial crisis.

—

—

10:07 a.m. ET: GE Aviation announces plan to slash 10% of U.S. workforce amid coronavirus outbreak

General Electric’s Aviation business unit is planning to cut about 10% of its total U.S. workforce in a move to help cut costs as the coronavirus outbreak weighs heavily on U.S. air travel and aircraft manufacturing businesses. GE Aviation employed about 52,000 people globally at the end of 2019, including those both in and outside of the U.S.

In another cost-cutting move, GE Aviation also said its president and CEO David Joyce will forgo half of his salary.

The company expects its combination of efforts, along with its previously announced hiring freeze and other personnel measures, to preserve as much as $1 billion in 2020.

“With regard to our financial position, our company is sound,” GE said in a statement. “However, what we don’t know about the magnitude and duration of this pandemic still outweighs what we do know.

Shares of GE were little changed Monday morning.

—

9:34 a.m. ET: Stocks open lower even after Fed’s massive stimulus package announcement

Here were the main moves in markets, as of 9:34 a.m. ET:

S&P 500 (^GSPC): 2,269.12, -35.8 (-1.55%)

Dow (^DJI): 18,890.78, -282.2 (-1.48%)

Nasdaq (^IXIC): 6,831.61, -47.9 (-0.58%)

Crude (CL=F): $22.83 per barrel, +$0.20 (+0.88%)

Gold (GC=F): $1,522.00 per ounce, +37.40 (+2.52%)

10-year Treasury (^TNX): -11 bps to yield 0.838%

—

—

9:16 a.m. ET: CVS to hire 50K amid coronavirus demand surge

Drug store chain CVS announced plans to go on a hiring spree. The company plans to hire a mix of 50,000 full-time, part time and temporary workers, as the COVID-19 outbreak pushes up demand for pharmaceutical services and health goods.

—

8:00 a.m. ET: Fed announces new round of broad open-ended bond buying

In a surprise announcement, the central bank unveiled a number of new and unprecedented measures to expand the Fed’s efforts to calm corporate debt markets.

With turmoil continuing in corporate financing markets, the Fed expanded the scope of its asset purchases under its quantitative easing program and announced four new measures to grease the commercial paper, corporate bond, and even ETF markets.

Stock futures curbed earlier losses, which at one point had been down by over 5%.

—

—

7:23 a.m. ET Monday: Stock futures fall as investors await further government stimulus package

Contracts on each of the S&P 500, Dow and Nasdaq held lower in early trading Monday morning as investors monitored developments in the Covid-19 outbreak in the U.S. and the federal government’s response.

After the Senate’s trillion dollar coronavirus relief package failed to pass a key procedural vote Sunday night, market participants have been anxiously awaiting signs that a rescue deal would soon come through. Senate Republicans and Republicans have struggled to hammer out their differing viewpoints on how the massive sum should be allocated to individuals, businesses and other relief efforts.

The House of Representatives is poised to push ahead with writing its own rescue proposal as talks in the Senate break down, Speaker of the House Nancy Pelosi signaled Sunday.

Here were the main moves in markets, as of 7:23 a.m. ET:

S&P 500 futures (ES=F): 2,228.5, -2.62% or -60 points

Dow futures (YM=F): 18,543.00, -2.61% or -497 points

Nasdaq futures (NQ=F): 6,825.5, -2.06% or -143.5 points

Crude oil prices (CL=F): $22.23 per barrel, -$0.40 or -1.77%

10-year Treasury note: yielding 0.815%, down 12.3 basis points

—

6:04 p.m. ET Sunday: Stock futures tumble, hit lower trading limit minutes after overnight trading begins

Futures for each of the three major indices sank Sunday evening, after Wall Street closed out its worst week since the 2008 financial crisis.

Here were the main moves in markets, as of 6:04 p.m. ET:

S&P 500 futures (ES=F): 2,174.00, -5.00% or -114.5 points

Dow futures (YM=F): 18,086.00, -5.01% or -954 points

Nasdaq futures (NQ=F): 6,628.75, -4.88% or -340.25 points

Monday’s opening bell will be closely watched for investor reaction to the coronavirus stimulus package being hashed out in Washington, as well as the New York Stock Exchange’s plan to temporarily shutter its iconic trading floor and transact in a completely electronic way. Some say the move could ramp up volatility in an already unsettled market.

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay