Stock market resilience suggests more upside ahead as investor sentiment remains 'the most bullish factor' for equities, Bank of America says

Resiliency in the stock market suggests that the rally can continue, according to Bank of America.

Depressed investor sentiment and bullish technical breadth bode well for stock market bulls.

"[The] S&P 500 rallied after support at 3,900 bent but did not break," Bank of America said.

The S&P 500's ability to rally off of support at 3,900 last week bodes well for continued upside in the stock market as investor sentiment remains depressed, according to Bank of America.

"[The] S&P 500 rallied after support at 3,900 bent but did not break," Bank of America technical research strategist Stephen Suttmeier said in a Monday note.

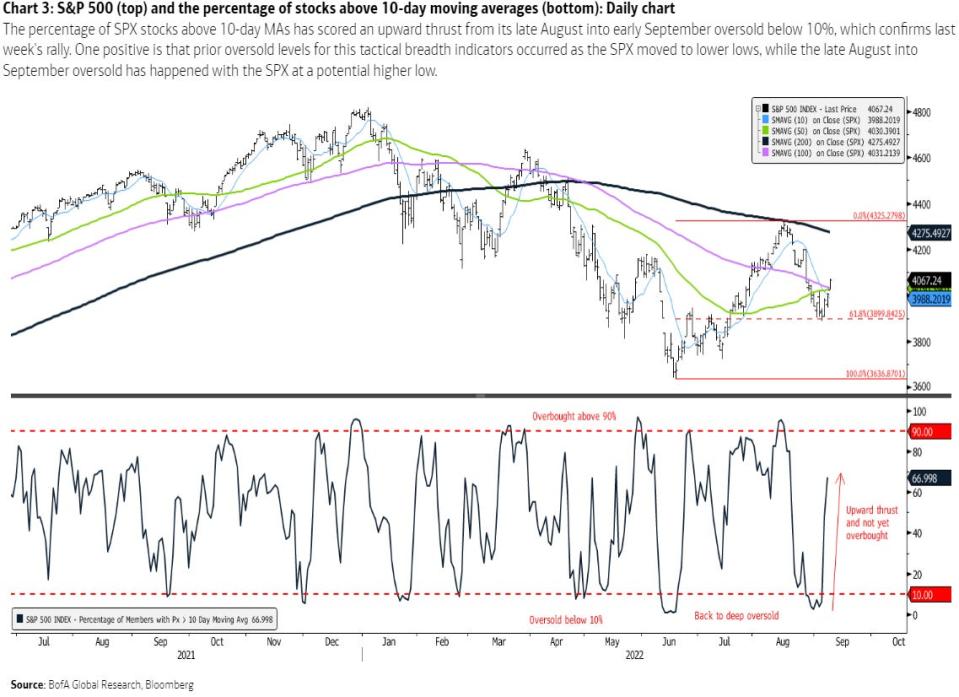

After reclaiming its 50-day moving average on Friday, the next stop for the S&P 500 in the short-term is as high as 4,219, according to Suttmeier. A rally to that level represents potential upside of 3% from current levels and coincides with a downside gap seen during the mid-August decline in stocks.

A continued rally to just above 4,200 in the S&P 500 would also put the index within striking distance of its falling 200-day moving average, a level that served as key resistance on August 16.

Aiding bulls potential for a continued rally in stocks is the fact that sentiment indicators continue to show an overwhelmingly sour mood towards stocks among investors, and that has reliably served as a bullish contrarian indicator for the market.

"BofA Bull & Bear indicator back to zero... extreme bear sentiment remains [the] most bullish factor for credit and stocks," BofA's Michael Hartnett said in a Friday note. It's not just BofA's sentiment indicator that is seeing a lot of bearish sentiment among investors.

Last week's AAII weekly sentiment survey revealed just 18% of its survey respondents were optimistic about the stock market over the next six months, representing its lowest level since late-April. Meanwhile, 53% of respondents were bearish on the market, representing a big jump from last month's reading of just 37%, and well above historical averages of 30%.

That bearish sentiment could turnaround quickly and lead to renewed buying pressure if the stock market rally continues to broaden and see increased participation among different sectors. Aiding Suttmeier's short-term bullish view on stocks is that the recent rally was "confirmed by breadth."

Upside participation in the recent rally was so strong that it generated an upward thrust from oversold levels for the percentage of S&P 500 stocks trading above its 10-day moving average.

"One positive is that prior oversold levels for this tactical breadth indicators occurred as the SPX moved to lower lows, while the late August into September oversold happened with the SPX at a potential higher low," Suttmeier said. That's known as a positive divergence, and it's a technical signal that often adds to the conviction of bullish traders.

Read the original article on Business Insider