Stock market selloff: A single chart may explain why investors are a bit freaked out

The most important part of the U.S. economy is showing signs of trouble.

The ISM’s non-manufacturing index, aka the services index, fell to a three-year low of 52.6 in September from 56.0 in August. This was worse than the 55.0 expected by economists.

Following the report, stock markets plunged with the Dow (^DJI) dropping by as much as 335 points or 1.3%.

Earlier this week, we learned that the ISM manufacturing index fell to a ten-year low of 47.8 in September from 49.1 the month prior. A reading below 50 signals contraction.

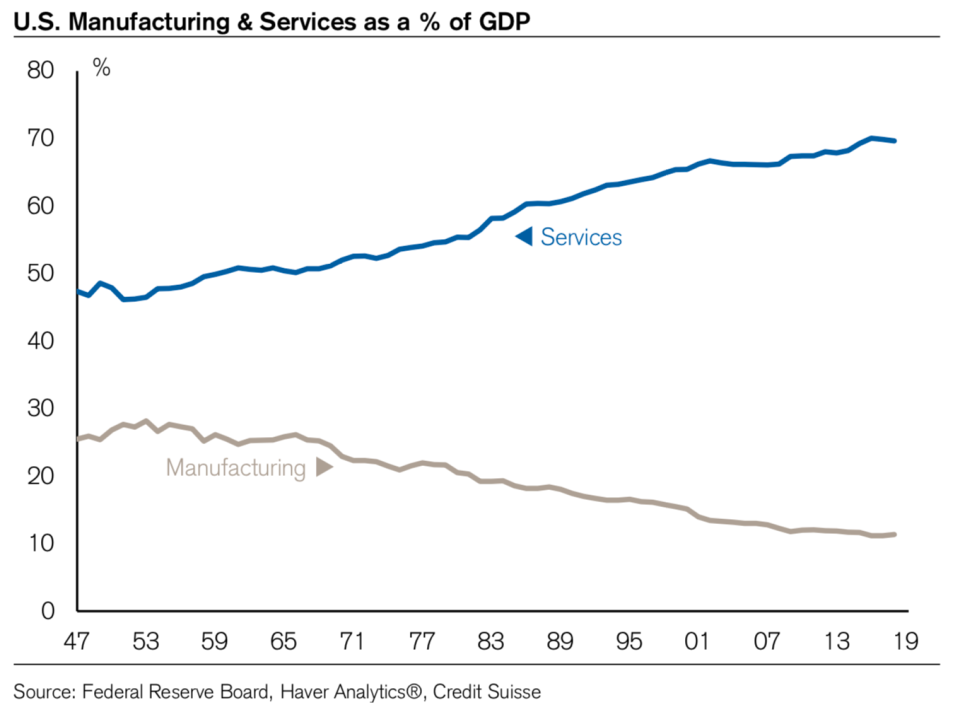

While the services index continues to signal expansion, albeit at a decelerating rate, the services sector represents a much bigger part of the economy. This is illustrated clearly in the chart below from Credit Suisse.

“With the yield curve inverted at the short end, the ISM Mfg. in contraction territory, and a year- long deceleration in industrial production, recessionary risks are clearly rising,” Credit Suisse’s Jonathan Golub wrote on Wednesday.

Thursday’s services report certainly doesn’t quell concerns.

“The sharp drop in the ISM non-manufacturing index last month to a three-year low, together with the already-reported fall in the manufacturing index to a decade low, leaves a weighted average of the two at a level that has historically been consistent with a recession,” Capital Economics’ Michael Pearce said.

But it’s still too early to throw in the towel on the economy.

“Nevertheless, this is not a perfect recession indicator – with that weighted average producing false positives in both 2012 and 2016,” Pearce added.

The stock market has already recovered some of its post-ISM report losses.

—

Sam Ro is managing editor at Yahoo Finance. Follow him on Twitter: @SamRo

Read more:

UBS warns of a 'major surprise this year' that'll send stocks down 9%

How Charlie Munger pulled Warren Buffett away from 'cigar butt' investing

Warren Buffett decries accounting rule change that has made a mess of Berkshire's earnings

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.