The stocks to buy before the Budget

Chancellor Rishi Sunak will announce a slew of policies in tomorrow's Budget designed to support the economy. But the little red box contains consequences for the stock market which investors would do well to get ahead of.

Investors who act early and buy shares now could give their portfolios a Budget day bounce. We look at the businesses that could receive a boost.

Housebuilders

Mr Sunak is expected to extend the stamp duty holiday by three months, which would boost house sales. He may also announce a new government-backed mortgage scheme for properties under £600,000 for buyers with 5pc deposits, which fuel the housing market.

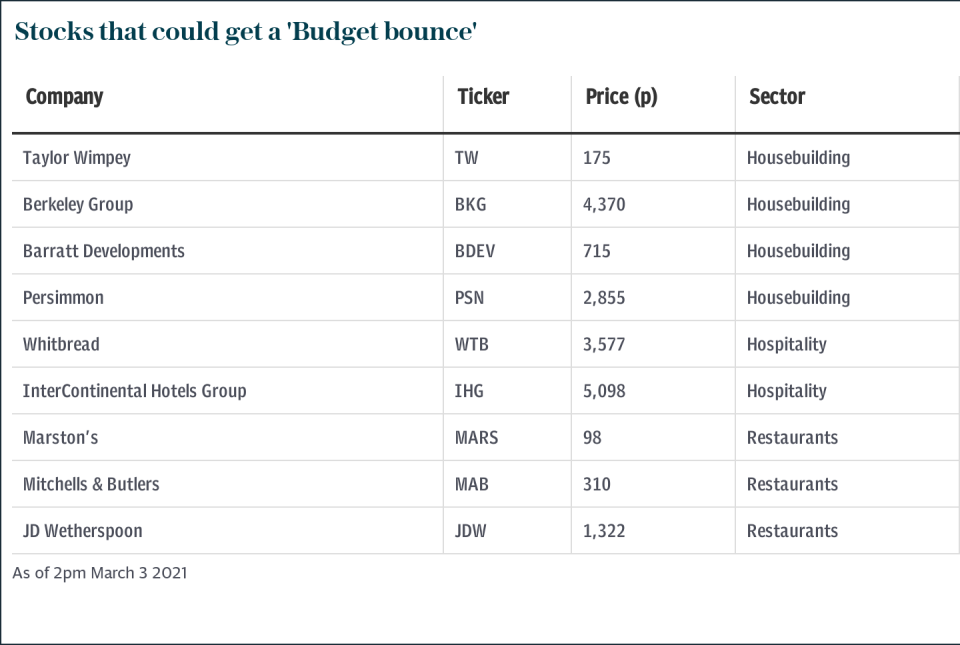

Housebuilders could therefore come out as the biggest winners from the Budget. There are four large players in the FTSE 100: Barratt Developments, Berkeley, Persimmon and Taylor Wimpey. Already investors have reacted positively to the news, with shares rising around 5pc yesterday.

Jefferies, the stockbroker, said the government's continued focus on "generation buy" was a positive for the sector.

“Testing new policies while Help to Buy still has two years to run, and with what looks like a pipeline of plans, is good for longer-term demand for housing. Our top picks of the big housebuilders remain Persimmon and Taylor Wimpey,” it said.

Pubs and restaurants

Mr Sunak could extend the VAT cut for hospitality and tourism until the end of July, according to Capital Economics, a consultancy. VAT for these sectors currently stands at 5pc, but under the current rules it would return to 20pc at the end of March.

The Government’s financial loss is the gains of businesses who would pay less tax and therefore make more money. Two of the biggest beneficiaries could be Premier Inn-owner Whitbread and InterContinental Hotels Group, according to Susannah Streeter, of stockbroker Hargreaves Lansdown.

"They will benefit from the double whammy of VAT cuts on accommodation and food. The biggest winners will be in companies that have a food service element to their business as that is where the biggest margins are," she said.

Pubs could also get an extra boost tomorrow. A group of Conservative MPs, led by Durham North West MP Richard Holden, have argued for a cut in beer duty to help support pubs which have had to close during the pandemic.

Alongside an extension to the VAT cut, this could supercharge profits at pub companies, such as J D Wetherspoon, Marston’s and Mitchells & Butlers.

Pandemic winners

The Treasury has suggested it will back away from a Covid windfall profits tax, which would have seen some of the pandemic’s biggest winners hit with a big bill, such as supermarkets and delivery firms.

The Treasury Select Committee advised this week that the Chancellor holds fire on tax rises in Wednesday's Budget to avoid jeopardising Britain’s recovery.

If Mr Sunak takes the Committee’s advice, this would be a surprise boost to some of the past year’s biggest stock market winners.

Ms Streeter said: "The complexity of levying a tax on pandemic winners is why it might not happen in this Budget. If it isn't announced then firms involved in delivery, such as supermarkets, Ocado, Asos and JustEat, would be winners on the day. It could appear in the future, however, so do not celebrate too soon," she said.

However, Jason Barefoot, of financial planner Ascot Lloyd, said successful investors only made changes to their portfolios if their financial plan changed, rather than to try and time markets.

"For the majority, a well-diversified global equity portfolio, combined with the discipline to stick to their plan and remain patient throughout all investment cycles, will provide greater long-term returns than merely swapping positions to time the market," he said.