How Stocks Tend to Perform After Stock Splits

Stock splits have seemed to be out of favor for the past several years, but that could soon be changing. FAANG name Apple, Inc (NASDAQ:AAPL) surprised investors in its July 30 earnings call announcing a four-for-one stock split. That means investors will now own four times more shares than they have now. The stock price, of course, will fall by a proportionate amount so the market value of their holdings won't change. Fundamentally, nothing changes, but the shares may be affordable for more investors with their lower pricing. A few days later and with a lot less fanfare, Trex Company Inc (NYSE:TREX) also announced an upcoming stock split. If stock splits are making a comeback, it is worth looking at how stocks tend to perform after making their shares cheaper.

Stock Returns After Splits

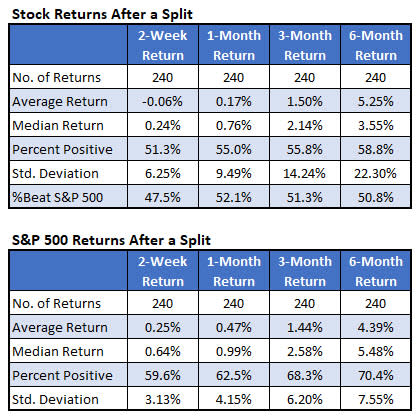

Looking at current optionable stocks and going back to 2010, I found 240 stock splits. The table below summarizes how the stocks performed following those splits. The second table is for comparison and shows what the returns would have looked like if instead of buying the stocks, you bought the broad-market S&P 500 Index (SPX) instead.

The stock returns aren't particularly bullish. In fact, I would say they're slightly bearish. The short-term returns (out to a month) have a lower average return and percent positive than the general market. Going out three to six months shows an average return that is only slightly better than the SPX, but with a smaller chance at a positive trade. The bottom row of the table shows the percentage of stock returns that would have beat the SPX over each time frame. The very short time frame shows a less than 50% chance of beating the general market. After that, the percentage is just barely over 50%.

In general, stock splits don't seem to mean a whole lot for their performance going forward.

Layering on Sentiment

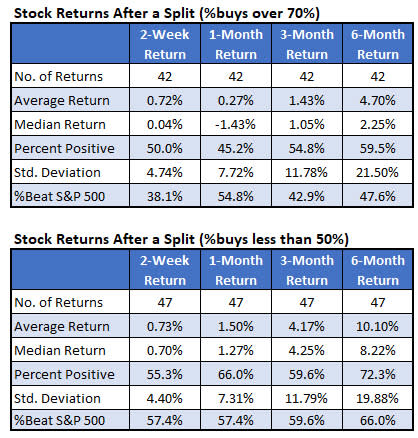

At Schaeffer's, we heavily consider sentiment as a driver for stock returns. We consider negative sentiment toward a stock as bullish, because just a small amount of good news has the potential to greatly increase buying pressure if it causes a lot of bears change sides. I decided to separate the stock splits by whether the sentiment toward the stocks were bullish or bearish. To gauge sentiment, I used the percentage of analyst "buy" recommendations on the day of the split, which we get from Zacks Investment Research. Stocks with more than 70% of analysts with a buy recommendation I defined as having bullish sentiment. Stocks where fewer than half of analyst recommendations were a buy I defined as having bearish sentiment.

Looking at the tables below, stocks that had bearish sentiment on the day of the stock split outperformed the stocks with bullish sentiment. For example, six months after a stock split, the stocks in which analysts were bullish gained an average of 4.7% over the next six months with about 60% of the returns positive and less than half of the stocks beating the SPX over the time frame. For the stocks that analysts were bearish towards, the six-month return averaged double-digits, with 72% positive and 66% of them beating the benchmark. Perhaps the stock split was the catalyst needed to spur buying in these stocks that are looked at unfavorably.

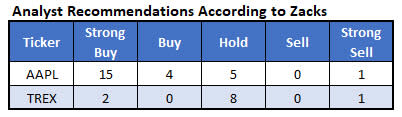

You might be wondering where the analysts stand on AAPLand TREX, the two aforementioned stocks that recently announced stock splits. Analysts are very bullish on AAPL, with 76% of analysts rating it a buy (19 buys out of 25 analysts). TREX, on the other hand, shows very bearish sentiment, with just 18% of analysts rating it a buy (2 buys out of 11 ratings). So, while AAPL will get all the headlines and ballyhoo, based on this, TREX could be a better option going forward.