These Are the Stocks to Watch as Australia Resets Relations With China

(Bloomberg) -- Improving relations between Beijing and Canberra are brightening the outlook for Australian stocks that have faced trade restrictions, with winemakers and some agricultural sectors seen as major beneficiaries.

Most Read from Bloomberg

Vietnam Tycoon Lan Sentenced to Death Over $12 Billion Fraud

US Slams Strikes on Russia Oil Refineries as Risk to Oil Markets

Apple Plans to Overhaul Entire Mac Line With AI-Focused M4 Chips

Russia Destroys Largest Power Plant in Ukraine’s Kyiv Region

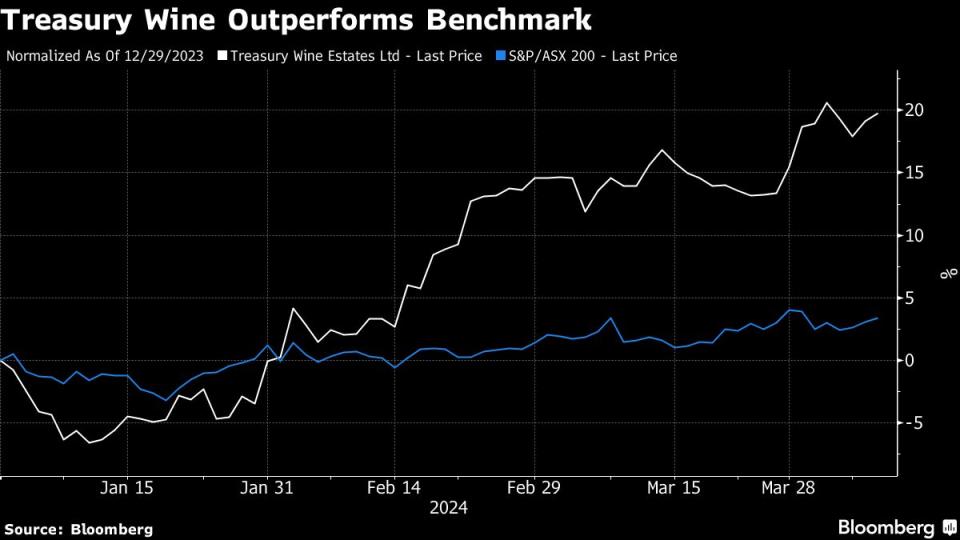

Treasury Wine Estates Ltd. rallied 15% last quarter as expectations mounted that China will lift punitive tariffs on Australia’s wine exports. Analysts expect the stock to gain another 7.9% from Wednesday’s close, according to price targets compiled by Bloomberg. Some curbs still remain on products like beef and lobsters, the removal of which may support related stocks.

The upside for miners is less clear with the sector at the heart of national security concerns. While China has aimed to bolster investment in Australia’s vast and lucrative mining sector, Canberra also has a need to secure its domestic supply chain and maintain cooperation with the US on key minerals.

“Australia’s geopolitical position is a balancing act, with a reliance on China to support the export market, but also as a strong US ally,” said Anna Milne, an analyst at Wilson Asset Management in Sydney. “Continuing to walk this tightrope is strategically very important to Australia, given the potential benefits from both sides of the equation.”

Read: China, Australia Face Tricky Diplomatic Road After Trade Row

Here are the stocks to watch:

Australian Vintners and Bottle Makers

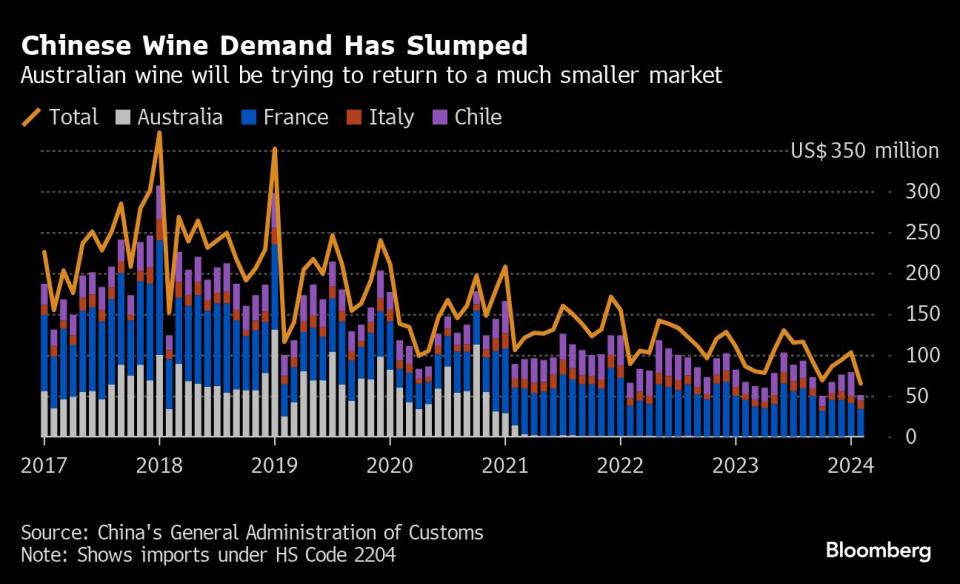

China imposed duties of up to 218% on Australian wine in March 2021, after then-Prime Minister Scott Morrison called for an international probe into the origins of Covid-19. Relations began improving after the May 2022 election of Prime Minister Anthony Albanese’s government.

Treasury Wine and Australian Vintage Ltd. climbed in the lead up to the decision to axe tariffs last month. Treasury has said it plans to reallocate some wines from other markets to China, which accounted for 30% of the company’s earnings prior to the levies.

The scrapped tariffs may also increase bottle maker Orora Ltd.’s earnings as wine exports pick up, according to Morgan Stanley.

Still, demand for wine in China has roughly halved versus 2019 levels amid changing consumer preferences and an economic slowdown. The market will take time to recover, Jarden Securities Ltd. analysts led by Ben Gilbert wrote in a note.

Key stocks to watch: Treasury Wine, Australian Vintage, Orora

Agribusiness

While trade restrictions on barley and wine have already been withdrawn, those on some beef exporters and lobsters remain in place.

A number of meat exporters still face suspensions following China’s move to bar imports from some Australian companies in mid-2020 and early-2022. The agriculture department has said it’s working with China to resolve trade impediments after bans on several exporters were dropped.

Key stocks to watch: Elders Ltd., Australian Agricultural Co., Wellard Ltd.

Nickel

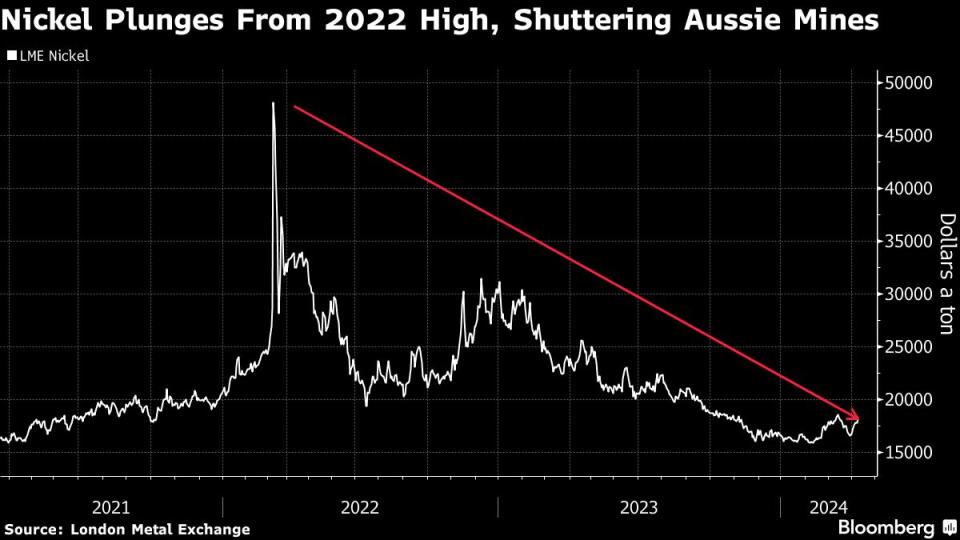

The easing tensions may have come too late to benefit Australia’s ailing nickel market following China’s huge investment in Indonesia. Prices of the metal have plunged more than 60% from a 2022 peak after Chinese-backed Indonesian companies suddenly brought a vast amount of nickel production online.

Ballooning supplies prompted billionaire Andrew Forrest’s Wyloo Metals Pty Ltd. to shut down its Western Australian mines in January. BHP Group Ltd., the world’s biggest miner, posted a slump in first-half income after writing down the value of nickel assets. The stock has rebounded in recent weeks amid hopes that China’s economic recovery will boost metals demand.

Read: Australia Adds Nickel to Critical Minerals List in Funding Boost

Key stocks to watch: Nickel Industries Ltd., BHP

Lithium Producers

Beijing has pushed for greater investment access to Australia’s lithium market as relations brighten, which may spur more partnerships between Chinese refiners and domestic miners.

For producers, “the main benefit of having a refiner as a joint venture partner is a long-term, dependable customer,” said Mohsen Crofts, a Bloomberg Intelligence analyst in Sydney. Some smaller lithium projects could also become potential takeover targets.

Better ties may also alleviate miners’ worries about being swept up in potential trade spats. In a July sales call, Mineral Resources Ltd. Chief Executive Officer Chris Ellison said he didn’t want to “trap money in China” amid geopolitical rifts.

Read: Ganfeng and Pilbara Minerals Explore Building Lithium Refinery

Key stocks to watch: Liontown Resources Ltd., IGO Ltd., Pilbara Minerals Ltd., Mineral Resources

Rare Earths

Australia’s rare earth miners are also in focus as China seeks to ink deals. Last year, Australia quietly blocked a bid by a Chinese-linked company to increase its ownership in supplier Northern Minerals Ltd., testing the nations’ thawing relationship.

Regardless of partnership with China, Australian miners can benefit as Western governments seek to lessen Beijing’s stranglehold on critical minerals.

UBS Group AG is bullish on Lynas Rare Earths Ltd. as it has a “head start in the ex-China race” and a “high chance of more positive surprises by way of policy or strategic investments,” analysts led by Dim Ariyasinghe wrote last month.

Key stocks to watch: Australian Strategic Materials Ltd., Arafura Rare Earths Ltd., Northern Minerals, Lynas Rare Earths

--With assistance from Ben Westcott and Paul-Alain Hunt.

Most Read from Bloomberg Businessweek

Toyota Pins Its Hopes on Revamped 4Runner to Beat Ford and Hyundai

Race for AI Supremacy in Middle East Is Measured in Data Centers

Everyone Is Rich, No One Is Happy. The Pro Golf Drama Is Back

©2024 Bloomberg L.P.