Stratasys Q1 Earnings Preview: What to Watch

Stratasys (NASDAQ: SSYS) is slated to report its first-quarter 2019 results before the market opens on Thursday, May 2.

Unlike in recent quarters, it's on track to be the first of the two leading publicly traded, pure-play 3D printing companies to report. Rival 3D Systems (NYSE: DDD) is scheduled to release its results after the market closes on Tuesday, May 7. (Here's what to watch in 3D Systems' report.)

Shares of Stratasys are up a whopping 32.2% in 2019 through Thursday, April 18. (The market was closed on April 19.) For context, shares of 3D Systems are up 7.1% and the S&P 500 has returned 16.6% over this period. Stratasys stock has also outperformed 3D Systems' over the last year.

While both companies are still in the turnaround process, Stratasys has generally been performing better, so it's not surprising that the market has rewarded it for doing so.

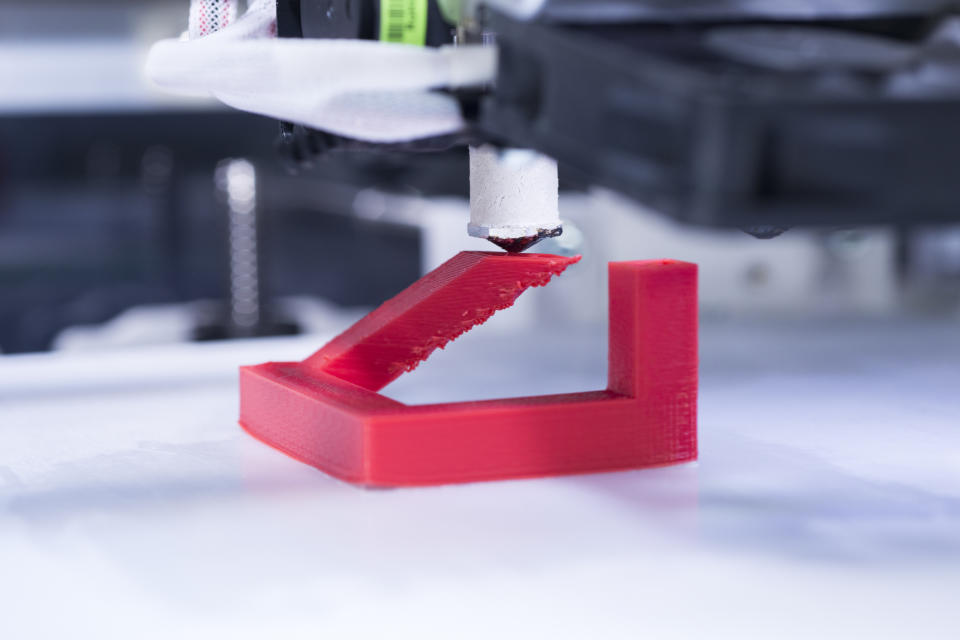

Image source: Getty Images.

Key quarterly numbers

Here are Stratasys' year-ago results and Wall Street's estimates to use as benchmarks.

Metric | Q1 2018 Result | Wall Street's Q1 2019 Consensus Estimate | Wall Street's Projected Change (YOY) |

|---|---|---|---|

Revenue | $153.8 million | $152.8 million | (0.7%) |

Adjusted earnings per share (EPS) | $0.05 | $0.06 | 20% |

YOY = year over year. Data sources: Stratasys and Yahoo! Finance.

Analysts are expecting Stratasys' performance in the first quarter to be quite similar to its performance last quarter: revenue slightly contracting and adjusted earnings growing solidly year over year. In Q4 2018, revenue dipped 1.2% and adjusted EPS jumped 31% from the prior-year period. Moreover, GAAP earnings flipped from negative to positive.

While long-term investors shouldn't place too much importance on the Street's near-term estimates, they're helpful to keep in mind because they often help explain market reactions.

CEO search

On the earnings call, investors should expect an update on the progress of the CEO search. Stratasys has been without a permanent CEO since last June, when Ilan Levin resigned after serving nearly two years in this position. He had succeeded longtime CEO David Reis.

Elan Jaglom, the company's chairman of the board, has been serving as interim CEO. He's being assisted by Reis, vice chairman of the board and executive director. Jaglom had this to say on the topic during last quarter's call:

Victor Leventhal, chairman of our compensation committee, and I, as the company's executive search committee, have been actively interviewing CEO candidates. They are all outstanding leaders with global operational experience and a strong history of growing large public companies and delivering significant shareholder value.

3D printer revenue

Investors should continue to focus on sales of 3D printers. This business is much more important than it might initially seem. That's because sales of 3D printers drive sales of print materials, which sport high profit margins.

Last quarter, 3D printer revenue fell 7% year over year, which was disappointing since this metric was flat in the third quarter, after declining 8.2% and 21% in the second and first quarters, respectively.

Gross margin

Investors should also continue to focus on gross margin. Last quarter, Stratasys' gross margin as reported (GAAP) was 49.1%, up from 48.7% in the fourth quarter of 2017. Its adjusted gross margin came in at 52.2%, down slightly from 52.5% in the year-ago period but up a tick from the previous quarter's 52.1%.

For context, 3D Systems' GAAP gross margin was 45.7% last quarter, down from 48.2% in the year-ago period.

Gross margin reflects pricing pricing power so it can often help gauge competitive pressures.

More From The Motley Fool

Beth McKenna has no position in any of the stocks mentioned. The Motley Fool recommends 3D Systems and Stratasys. The Motley Fool has a disclosure policy.