Strong week for Vertex (NASDAQ:VERX) shareholders doesn't alleviate pain of one-year loss

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. For example, the Vertex, Inc. (NASDAQ:VERX) share price is down 46% in the last year. That falls noticeably short of the market return of around 6.0%. Vertex hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Shareholders have had an even rougher run lately, with the share price down 16% in the last 90 days. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

On a more encouraging note the company has added US$72m to its market cap in just the last 7 days, so let's see if we can determine what's driven the one-year loss for shareholders.

View our latest analysis for Vertex

Because Vertex made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last twelve months, Vertex increased its revenue by 14%. That's not a very high growth rate considering it doesn't make profits. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 46% in a year. In a hot market it's easy to forget growth is the life-blood of a loss making company. So remember, if you buy a profitless company then you risk being a profitless investor.

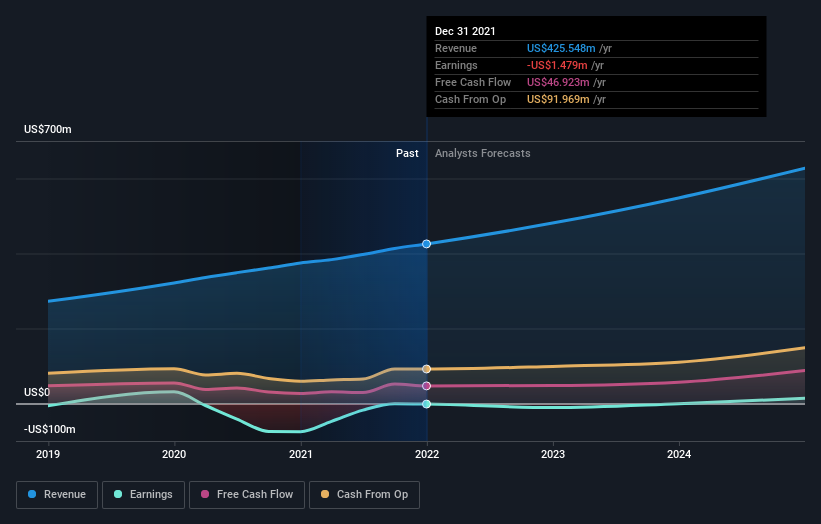

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So it makes a lot of sense to check out what analysts think Vertex will earn in the future (free profit forecasts).

A Different Perspective

While Vertex shareholders are down 46% for the year, the market itself is up 6.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 16% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. It's always interesting to track share price performance over the longer term. But to understand Vertex better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Vertex , and understanding them should be part of your investment process.

Vertex is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.