Student Loan Debt Payments Hit HBCU Graduates Especially Hard

(Bloomberg) -- The return of federal student loan payments this month threatens to derail prospects for graduates of Historically Black Colleges and Universities, a cohort already facing steep economic disadvantages.

Most Read from Bloomberg

Innovent, Lilly Obesity Drug Spurs More Weight Loss in Trial

Israel Latest: Netanyahu Vows to Stay On; Targets Hit in Lebanon

Apple Unveils New Laptops, iMac and Trio of More Powerful Chips

Aid makes college possible for many HBCU students: 85% of their graduates in 2020 used federal loans, versus 59% of non-HBCU students, according to the National Postsecondary Student Aid Study, with HBCU graduates and their parents on average holding almost $21,000 more in federal loan debt.

The nation’s more than 100 HBCUs, including Spelman College in Atlanta and Howard University in Washington, DC, serve more low-income and first-generation students than traditional schools and aim to help close the wealth gap between Black households and their White counterparts.

Parents of HBCU students are also more likely to take on loans to support their kids, on average. With payments resuming amid high prices and mortgage rates, entire families are forced to cut back.

Jasmine Payne, a 2015 graduate of Spelman who took on $36,000 in federal undergraduate debt, said the pause allowed her to pay off her car. Now, she faces a $342 student loan bill each month — a burden she said has forced her to delay plans to buy a new car and house and rethink traveling.

Read more: Why Student Loan Payments Are Back, and What It Means: QuickTake

Andre Perry, a senior fellow at the Brookings Institute, said the pause allowed Black borrowers like Payne to both invest in and save for their futures.

“When students have to repay these loans, it also throttles our ability to own homes, to purchase cars, to start businesses,” Perry said. “We’re also going to see those issues come about.”

Underfunded

From 2019 to 2022, the wealth of Black families grew faster than that of White families, according to the Federal Reserve, but that was thanks to temporary, pandemic-era government aid and lower interest rates. And while that helped narrow the ratio of Black wealth to White wealth, Black household wealth still lags far behind that of their White counterparts.

Watch: Payments Return Threatens to Derail Prospects for HBCU Graduates

Helene Gayle, the president of Spelman, said that nearly half the school’s students in any given year are eligible for a Pell Grant, a need based aid reward — meaning half the student body has high financial needs.

Despite all this, HBCUs do not receive the same levels of government aid and endowments that other institutions do. These funds would enable them to provide scholarships and grants. “We have to continue to do more with less,” Gayle said.

In one vivid example, non-HBCU land-grant schools have received $12 billion more in government aid than HBCU land-grant schools, according to letters sent by the Education Department to 16 governors that urged them to address the issue.

Despite the funding shortfall, HBCUs continue facilitating upward economic mobility for the Black community. HBCUs support more low-income students in earning their way into higher income categories later in life than the national average for colleges, according to a 2021 United Negro College Fund report.

“Even with all of those factors that work against us,” Gayle said, “we still are able to provide students with an economic foothold that they wouldn’t have otherwise.”

‘No extra money’

To help pay for her daughter’s tuition, Payne’s mother, a pre-school teacher, took out about $15,000 in Parent PLUS loans, federal loans issued to parents of dependent undergraduate students.

The downside is these loans come with higher interest rates and origination fees than loans issued directly to the student. They’re also ineligible for repayment plans based on the size of one’s income, such as the Biden administration’s new SAVE plan.

Deanna Folefac, a graduate of Bowie State University, said she is focused on paying back the $8,000 Parent PLUS loan her mother took out before turning to her own $25,000 in loan debt.

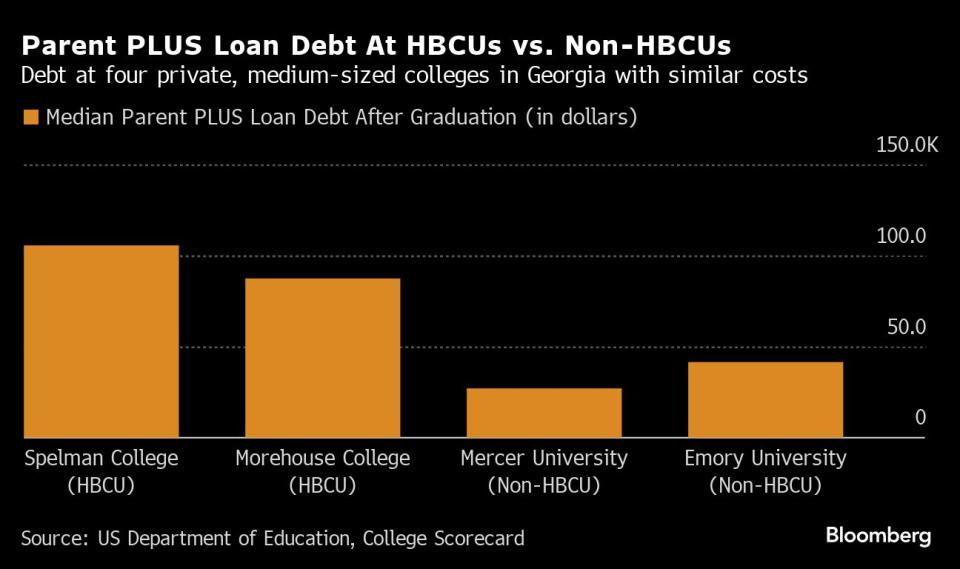

While some 13% of all 2020 college graduate families took out Parent PLUS loans, HBCU graduates make up 42% of those borrowers. Of Spelman graduates who used these loans, the median size of the loan to fund their undergraduate career is almost $106,000 — among the highest in the nation, according to the Education Department.

Due to a lack of financial aid, Dyonne Diggs, a 2017 graduate of North Carolina Agricultural and Technical State University, an HBCU, went on a two-year leave from her education. Ultimately, she took on $58,000 in debt. Her stepfather also took out an additional $3,000 in Parent PLUS loans.

She said she will utilize the Biden administration’s 12-month payment on-ramp and hold off on paying her $400 monthly student loan bill. “I’m an educator so there’s literally no extra money,” Diggs said.

‘We’re used’

In June, the Supreme Court struck down President Joe Biden’s plan to cancel as much as $20,000 in federal student loan debt per borrower for those making under $125,000 a year.

Though Biden will reportedly unveil a new forgiveness plan next year, his options to help student borrowers — and HBCU students, in particular — remain limited.

He could broaden his SAVE plan to help lower payments and make Parent PLUS loans eligible for this plan, Perry said, but the Supreme Court’s ruling likely spoils any further broad-based forgiveness.

Diggs said she voted for Biden in 2020 after he promised to forgive some student loan debt, but plans to sit out in 2024.

“Every four years, we’re used as a scapegoat,” she said. “We’re used as, you know, ‘vote for your lives and all of these things are going to happen.’ And they don’t happen.”

Most Read from Bloomberg Businessweek

America’s Culture Wars Have Liberal Parents Opting for Home-Schooling

Hollywood Loves Halloween: Inside the Lucrative Business of Horror Movies

©2023 Bloomberg L.P.