Stumbling CVS Could Stage a Climb

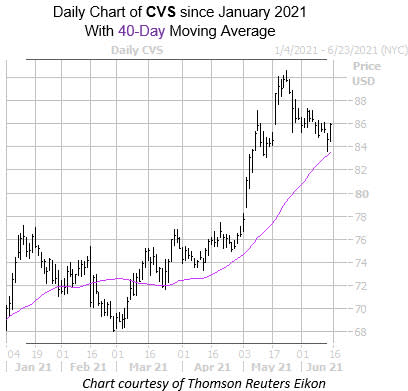

The shares of CVS Health Corporation (NYSE:CVS) have been falling since their recent May 24 four-year high of $90.61, which the stock climbed to after three-straight months of gains. Up 1.6% to trade at $85.98 at last check, CVS is flashing a historically bullish signal on the charts.

More specifically, the equity just came within one standard deviation of its ascending 40-day moving average, after spending several months above it. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, six similar signals have occurred in the past three years. CVS Health stock enjoyed a positive return one month later in 67% of those cases, averaging a 5% gain. From its current perch, a comparable move would put CVS above the $90 level and close to its aforementioned four-year high.

Puts have been more popular than usual, too, leaving plenty of pessimism to be unwound in the options pits. This is per CVS' 10-day put/call volume ratio at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which sits in the 97th percentile of its annual range.

What's more, CVS is seeing attractively priced premiums at the moment. The security's Schaeffer's Volatility Index (SVI) of 19% sits in just the 2nd percentile of its annual range, indicating options players are pricing in low volatility expectations right now.