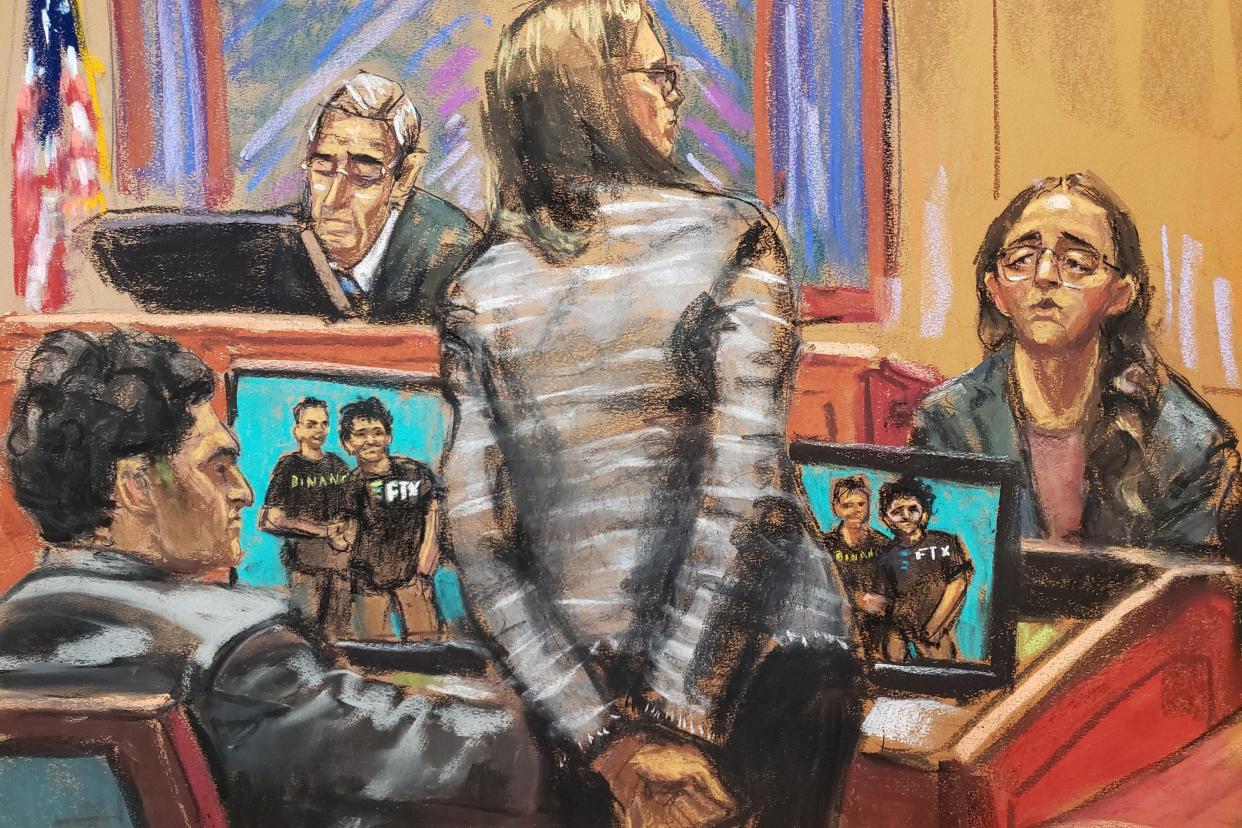

The Stunning Revelations From Caroline Ellison’s Second Day on the Stand

- Oops!Something went wrong.Please try again later.

This is part of Slate’s daily coverage of the intricacies and intrigues of the Sam Bankman-Fried trial, from the consequential to the absurd. Sign up for the Slatest to get our latest updates on the trial and the state of the tech industry—and the rest of the day’s top stories—and support our work when you join Slate Plus.

This article has been updated following Ellison’s Wednesday afternoon testimony.

Folks, it’s Wednesday afternoon, and the vibes at the Southern District of New York are nothing less than scandalous. The second day of the much-hyped testimony from former Sam Bankman-Fried partner/direct report/confidante Caroline Ellison is, so far, even more stunning than what she revealed on Tuesday. This round, we’ve ventured beyond the glitz of American finance and Bahamian luxury into the thick of foreign-bribery allegations.

To be very clear, as Judge Lewis A. Kaplan stated outright, Sam Bankman-Fried himself is not facing charges to that effect in this trial; the focus is on his alleged fraud and domestic conspiracies. That being said, Assistant U.S. Attorney Danielle Sassoon thought it, well, pertinent to question Ellison on SBF’s possible foreign entanglements, primarily as a means of 1) spelling out the defendant’s possible motives for the charges being currently tried, and 2) demonstrating Ellison’s viability as a witness, not least through her familiarity with both FTX’s various tendrils of (alleged!) criminal activity and the language by which SBF and co. discussed such matters.

Some important background: As the prosecution pointed out, various communications between SBF and Caroline Ellison (among others at FTX and Alameda Research) no longer exist. Bankman-Fried insisted on keeping “sensitive” work communications in encrypted Signal group chats that would disappear after a week. However, the evidence so far has included some preserved Signal messages, Telegram chats, Google Suite interactions, and—most explosively—the sworn word of Caroline Ellison, who chatted with SBF in “coded terms” that she’s now decoded for us. Here’s what she said Wednesday:

• First up, Ellison told the court that “Alameda paid a large bribe to Chinese government officials to get its accounts unlocked.” This allegation had been previously aired, thanks to a March Department of Justice indictment of SBF that laid it out somewhat hazily. Ellison’s answers offered new details. You see, she says, Alameda had accounts on “dozens of exchanges,” including OKX, an FTX-like crypto business originally headquartered in China. In November 2021, the Chinese government—already in the middle of a wide-scale cryptocurrency crackdown—froze Alameda’s accounts on OKX because it was investigating someone (still unnamed) who’d traded with Alameda. This meant Alameda could not withdraw any money from OKX and, later, it also meant that it could no longer engage in OKX trades. This put $1 billion out of reach, which, as Ellison put it, was a “substantial amount of Alameda trading capital.” An FTX-Alameda brain trust that then gathered to workshop solutions to this problem included the usual suspects (SBF, Ellison, Gary Wang, Nishad Singh) as well as FTX Chief Operating Officer Constance Wang, FTX Business Development Manager David Ma, and another employee referred to simply as “Handi.” (Here is a possible X/Twitter account for Handi?) These last three were included, Ellison noted, because they were “all Chinese and had connections with China” and its government. Specifically, Handi’s father (also not identified) was a mainland government official. The group proposed various strategies, including 1) making several sock-puppet OKX accounts named for real Thai prostitutes so Alameda traders could sidestep the freeze, 2) hiring a lawyer so that the company could negotiate with Chinese officials, which ultimately proved fruitless, and 3) in what Ellison said was Ma’s suggestion, sending at least $100 million of cryptocurrencies, in piece-by-piece installments, to specific wallet addresses whose owners, it was presumed, would help solve the issue. In other words: a bribe. SBF initially resisted this tack, according to Ellison, but later came to embrace it. Handi, however, was quite upset about the whole thing, which apparently led Bankman-Fried to yell at her to “shut the fuck up,” as Ellison stated.

• In a January 2022 Signal group chat, a screenshot from which was presented to the jury, SBF, Ellison, and Alameda co-CEO Sam Trabucco discussed the China/Handi issue. The Bankman-Fried message seen by the court led off with “btw, Handi’s being pretty shitty/antagonistic.” By that time, Ellison said, Handi had already quit Alameda. In a February 2022 chat, Trabucco wrote, “did Handi’s father immediately turn us in or something,” to which SBF responded, “lol.” (Ellison pronounced the message “lawl,” and she was asked to explain to the court what the abbreviation meant.)

• In another document from late 2021, an Alameda balance sheet prepped by Ellison and shared with SBF, a bullet point headed a list of “notable/idiosyncratic pnl stuff”—which, the witness explained, referred to factors affecting Alameda’s business. One of the list items read: “−150m from the thing?” “The thing,” Ellison declared, was referring to the alleged Chinese crypto bribe, in an example of the “coded terms” alluded to earlier.

• One more! When you run out of money, whom do you usually turn to? If your answer to that is Saudi Arabian Crown Prince Mohammed bin Salman, well, you and SBF have similar minds. In the fall of 2022, after the summer’s crypto-market downturns had worsened Alameda’s already precarious financial situation, SBF was apparently considering raising further capital by selling FTX equity shares to the, um, controversial Saudi royal. In an Ellison-penned to-do list from that time, which included a leading section on “hedging/getting more capital” for the embattled Alameda, one of the listed options was “raising from Saudis,” an idea that was entirely SBF’s, Ellison said. Another Ellison list shown to the jury was an “often-updated” log entitled “things Sam is freaking out about.” What was Sam freaking out about? Well, for one, he was really antsy about hedging Alameda/FTX losses by “raising from MBS” and “getting regulators to crack down on Binance.” This also popped up in another piece of evidence from Oct. 1, 2022, a separate Alameda balance sheet from Ellison that included a note for a fundraising “plan”—to sell a couple billion dollars’ worth of Bitcoin at a point when its price exceeded $20,000, as well as a method by which “FTX may raise.” This, Ellison informed us, was pointedly referring to SBF’s plan to sell off FTX equity shares to potential investors including … Saudi Arabia’s MBS.

The prosecution finally ended its questioning of Caroline Ellison—its “longest witness,” as the government lawyers put it—close to 4 p.m. on Wednesday. Next up, the defense’s cross-examination of this closely watched testifier, which will kick off in earnest Thursday morning. Outside of “the thing” and the other international tangos detailed above, the former Alameda CEO offered several other noteworthy revelations. To catch you up:

• In June 2022, with the entire crypto industry struggling, execs from the now-bankrupt Genesis crypto exchange hit up Ellison and Bankman-Fried on the Telegram messaging app to call back the hefty cash bags it’d previously loaned to Alameda, citing its own business troubles. Ellison attempted to hold off the Genesis guys for a bit, letting them know that Alameda was “getting loans called from everyone across the board” (which, true!). But eventually, she knew she’d have to repay the crypto lenders with … wait for it … be patient … keep waiting … say it with me now … FTX customer funds, especially since SBF kept directing her to pay back loans. “I was in sort of a constant state of dread at that point,” Ellison stated on the stand, calling this period a “time of crisis for Alameda.”

• (A key side note: Genesis, you might recall, is a subsidiary of Digital Currency Group, the influential asset-management company that also owns CoinDesk, the outlet that published a leaked Alameda balance sheet in November 2022 and helped set off the ensuing FTX-Alameda collapse. Unfortunately, it appears CoinDesk’s own reporting blew back on DCG, which had multiple subsidiaries with financial exposure to the Alameda tree; as a result, the parent company laid off 16 percent of CoinDesk’s staff in August. DCG has been purportedly exploring options for selling off the website altogether.)

• Ellison told the court she “lived in fear” of the prospect that customers would pull their money from FTX en masse and thus screw up Alameda’s balances (which, again, consisted of ample FTX customer trusts). Despite the significant deficit, SBF ordered Ellison to keep paying off Alameda’s multibillion-dollar loans, which involved more dips into—yep!—the FTX customer pot.

• When Genesis asked for a snapshot of Alameda’s balances, Ellison submitted to it a cooked-up Google Sheet that, per SBF’s direction, combined plenty of Alameda third-party loans into general assets, including long-term “investment in equity securities.” (Needless to say, these were not actually liquid assets.) This sheet was just one of seven different alternative records Ellison put together for this purpose. She showed them to SBF, who picked his favorite.

• Ellison told SBF that this move seemed dishonest, after which her ex-boyfriend explained to her his “utilitarian” outlook on the whole thing. TL;DR: Telling people not to lie or steal is not a workable strategy, and the “greater moral good” (in SBF’s case, the Future of Humanity) matters far more than the means used to get there. As such, Ellison said, “over time, [lying] became something I was more comfortable with.”

• Notably, this all sounds quite similar to how SBF’s mother, the legal scholar Barbara Fried, also approaches the utilitarian philosophy—i.e., that good ends tend to justify their means.

• SBF approached written communications with what he called the “New York Times test”: Anytime an employee sends a message in an internal company forum, it should be something they’d feel comfortable having published on the Times’ front page (i.e., something that’s not incriminating).

• Bankman-Fried was also really, really touchy about PR and about shaping his image. Group chats displayed in the courtroom showed how SBF embraced the idea of Michael Lewis shadowing him for a book project—despite Ellison’s skepticism—because, the effective altruist Will MacAskill told him, if Bankman-Fried was going to attract more attention to himself anyway, then “getting ahead of the game and controlling the narrative is necessary.” This also fueled SBF’s interest in backing Elon Musk’s Twitter acquisition, as he believed that the network was essential to “control the narrative around FTX.” Too bad, then, that SBF apparently reneged on supporting the deal and Binance instead helped Musk cover the price tag, eh?

• SBF apparently claimed to Ellison that his shaggy hairstyle had earned him bonuses while he was a trader at Jane Street Capital. Sure, why not.

• There was one document presented as evidence in which SBF seemed to have penned his own “All work and no play makes Jack a dull boy” typewriter sheet, forgoing The Shining for a 10-times-repeated emphasis on how “what matters” most is “being aligned and always doing what you think is best for the company.”

• When the FTX-Alameda house finally buckled under (as she recounted the saga, Ellison choked up on the stand), SBF floated a bunch of potential investors who could maybe bail out the company—including Silvergate Bank, the California entity that hosted the Alameda bank account in which FTX depositors were directed to wire their money.

• Yes, that’s the same Silvergate Bank that went under earlier this year and foreshadowed the falls of Silicon Valley Bank, Signature Bank, and First Republic. A pretty nasty fallout from an ill-advised crypto bet.