A suggested 1-mill decrease in Topeka property taxes would mean a tax cut for some residents

Topeka's mayor and city council are expected this week to begin discussing a potential 2023 city budget that, if adopted in its initial form, would cut the city's property tax levy by 1 mill.

A budget in that amount would reduce city taxes for property owners whose appraisal values have stayed the same — but most haven't.

Appraisal values rose by an estimated 13.5% on average last March for residential properties in Shawnee County, county appraiser Steve Bauman announced that month.

"Approximately 89% of properties will see an increase in appraised value," Bauman told county commissioners at the time.

Appraisal values are paired with mill levy levels to determine how much local property owners will pay in property taxes.

Topeka City Councilman Tony Emerson told The Capital-Journal in March that he hoped all taxing authorities in Shawnee County would lower their mill levies to blunt the impact of the increased appraisal values.

Topeka has consistently kept the mill levy the same, but that may change

Emerson has served since May 2016 on Topeka's governing body, which for nine straight years has approved a budget for the following year aimed at keeping the city's property tax mill levy the same.

This year that might change.

The governing body, which consists of the mayor and city council, on June 21 directed the city staff to make a one-mill decrease in the city levy part of the document it will use as a starting point for crafting the city's 2023 budget.

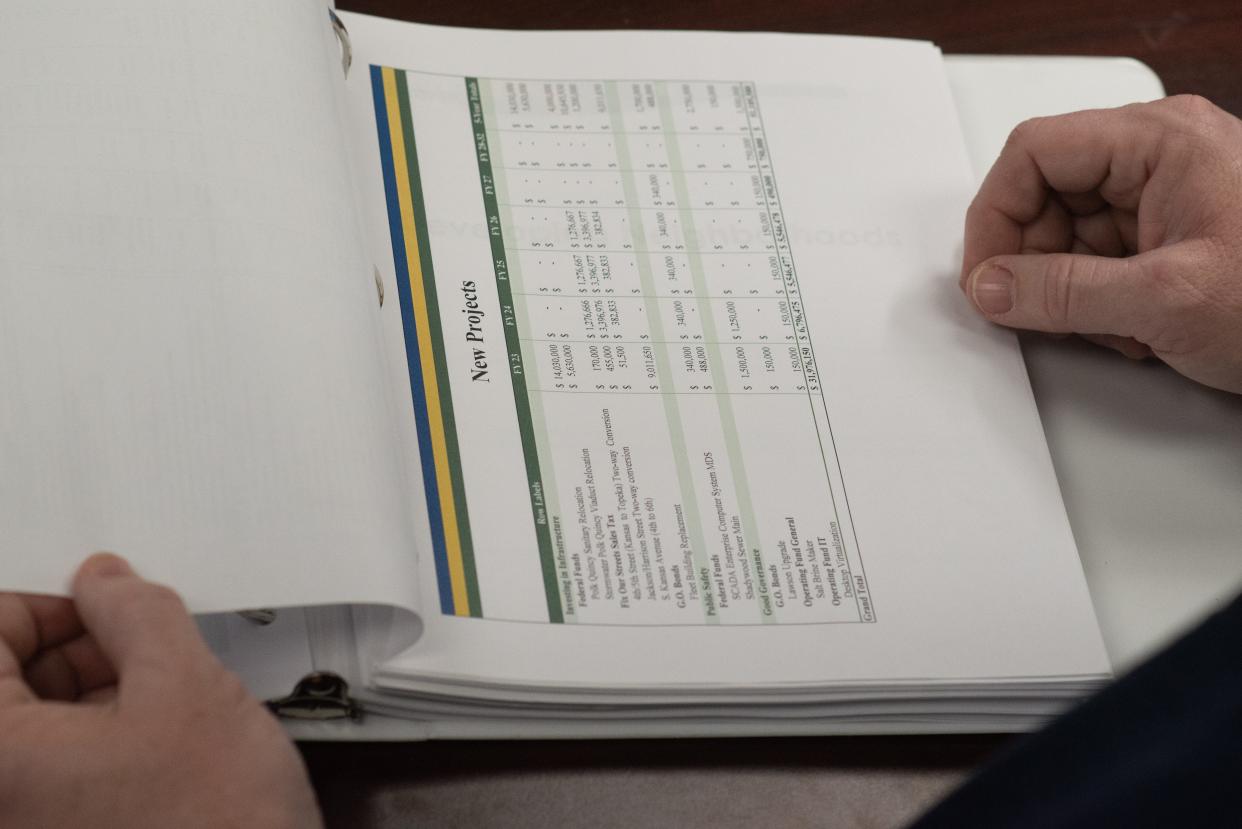

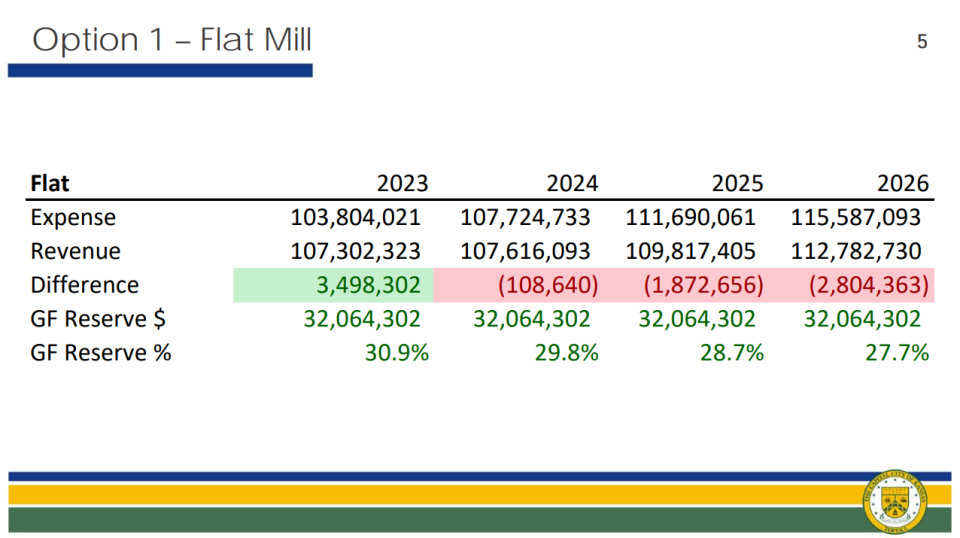

That body was offered three potential starting points for crafting the 2023 city budget at its June 21 meeting by Stephen Wade, the city's administrative and financial services director.

The mayor and council rejected two of those budget options.

One would have lowered the city's mill levy by two mills.

Another would have kept the levy at its current level of 39.939 mills, which amounts to $459.30 in city property taxes for the owner of a $100,000 home.

The mayor and council instead chose that day to make its starting point a third option, described by Wade as "a bit of a compromise," which would lower the city levy by one mill.

Councilmen Spencer Duncan, Neil Dobler and Tony Emerson expressed support for that option.

But Mayor Mike Padilla and Councilwoman Karen Hiller said they supported keeping the mill levy the same.

Councilwoman Hannah Naeger said she could see some value in doing that and would support whatever the majority of the governing body wanted to do.

After no other council members voiced opinions, Padilla said it seemed the governing body was directing the city staff to put forth a proposal featuring a one-mill decrease.

City of Topeka's levy has changed little since 2014

The city of Topeka levy is part of a total property tax bill that includes levies that help finance other government entities, including Shawnee County, Washburn University, public school districts and local transit, library and airport authorities.

City officials are seeking to adopt an outcome-based budget for 2023, in a process aimed at opening a direct line of dialogue between the city and those who live in it.

Topeka’s city manager since the summer of 2013 has consistently proposed budgets that would arrange for property tax levels to stay the same. In each of those years, the mayor and council then approved spending limits aimed at maintaining the same levy.

After property valuation numbers were finalized, the city’s levy went down slightly in 2014, up slightly in 2015 and 2016, down slightly in 2017 and 2018, up slightly in 2019, down slightly in 2020 and up slightly in 2021.

The levy the city assesses consequently rose from 39.733 mills in 2014 to 39.939 mills in 2022.

That amounted to an annual property tax increase of $2.37, from $456.93 to $459.30, for a $100,000 house that saw no increase in its appraisal value.

Topeka's expenses expected to rise near year by 5.8%

The city of Topeka will need more money next year than it had this year, council members learned at its June 21 meeting.

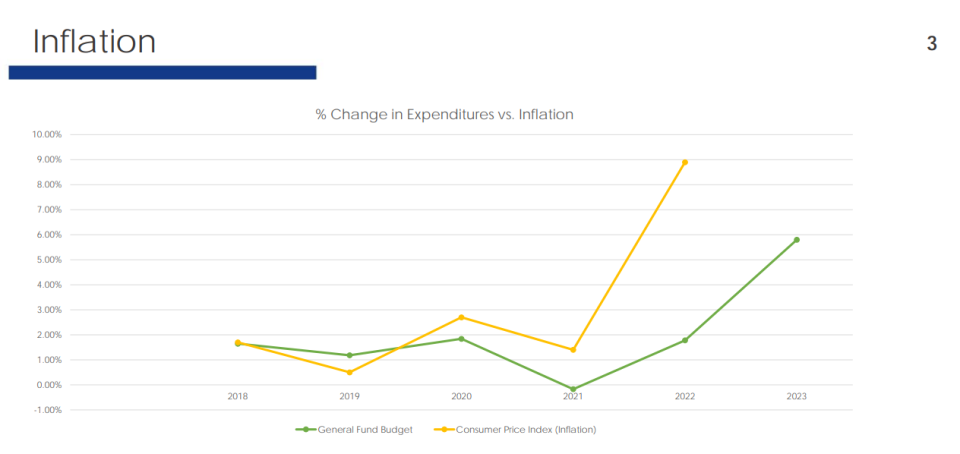

The city's expenses are expected to rise in 2023 by 5.8%, Wade told the mayor and council that evening.

Meanwhile, inflation — as is reflected by the consumer price index — has recently increased at a faster rate than city expenditures, according to a document Wade showed the mayor and council on June 21.

What happens next?

That proposed budget being submitted to the mayor and council will be available for public view beginning Tuesday on the city's website, interim city manager Bill Cochran said at a news conference last week.

The mayor and council then plan to spend most of the summer discussing that document before finalizing it.

Tim Hrenchir can be reached at threnchir@gannett.com or 785-213-5934.

This article originally appeared on Topeka Capital-Journal: 1-mill tax levy cut suggested as starting point in Topeka budget talks