Summit Carbon stands to benefit from Navigator's canceled pipeline project

As one chapter of the Midwest carbon capture pipeline saga closes, another appears open, for now.

Navigator CO2 Ventures, a Nebraska-based company that planned to build a $3.5 billion carbon dioxide pipeline in South Dakota and four other Midwest states, axed its project on Friday, citing "the unpredictable nature of the regulatory and government processes involved, particularly in South Dakota and Iowa" in a statement.

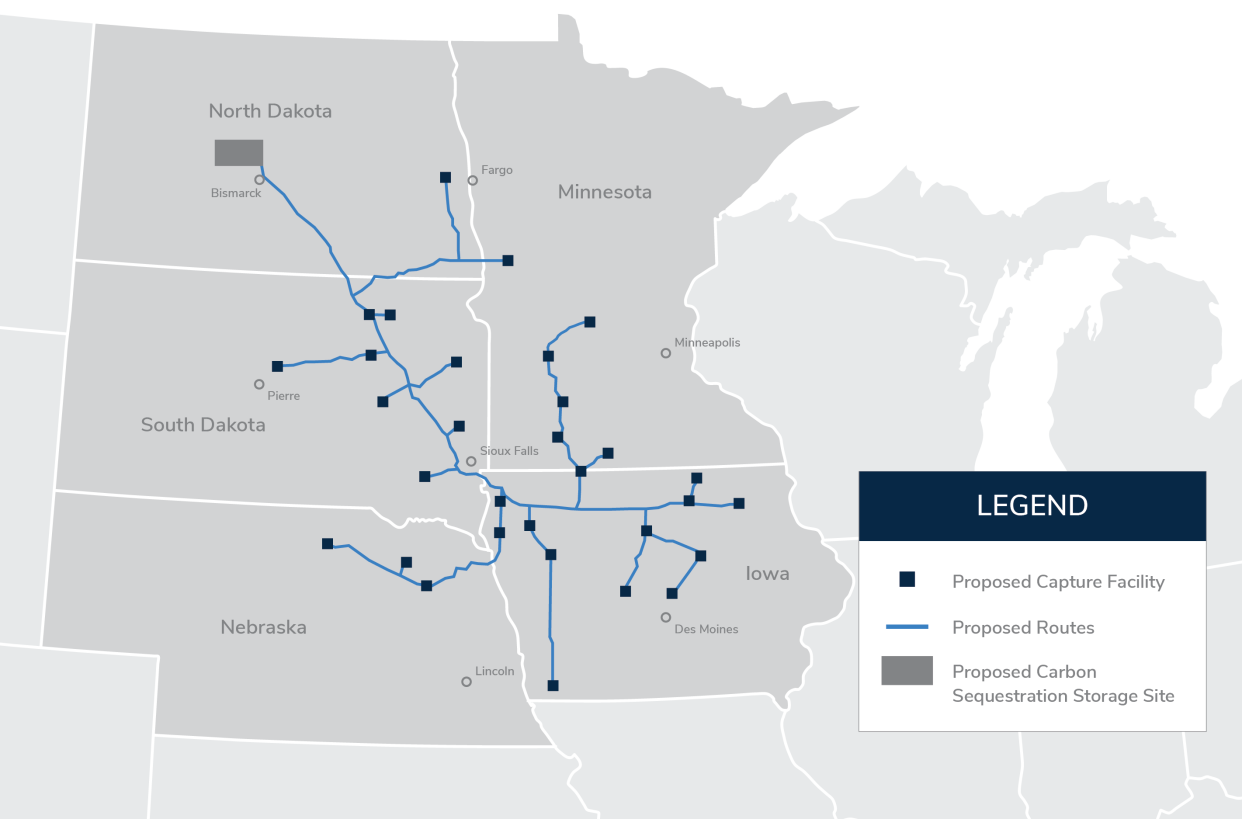

This leaves Summit Carbon Solutions, a once-rival carbon capture company also seeking to build a multi-billion dollar, five-state sequestration pipeline, in a position to benefit from Navigator's fall.

In a statement to the Argus Leader, a Summit Carbon spokesperson said the company "is well positioned to add additional plants and communities to our project footprint."

After Navigator's project cancelation, Summit Carbon is now the only game in town

The statement means that Summit Carbon has enough "capacity" to incorporate "all of Navigator's plants onto our line," Summit Carbon spokesperson Sabrina Zenor told Argus Leader.

This extends to POET, one of the largest biofuel companies in the U.S.

In July 2022, the South Dakota-based biorefiner signed a letter of intent to connect 18 affiliated ethanol plants throughout Iowa, Nebraska and South Dakota to Navigator's pipeline, signaling a major partnership between global biofuels magnate Jeff Broin and the ambitious carbon capture project.

Without Navigator's pipeline, however, POET will likely have to forge an agreement with Summit Carbon or find other means of sequestering carbon from its ethanol facilities, as no other pipeline project has been proposed near the biorefiner's ethanol plants in South Dakota and Iowa.

If POET decides not to sign with Summit Carbon, each of its 18 plants could lose out on potentially tens of millions of dollars in federal clean fuel tax credits associated with the carbon capture initiative.

Zenor acknowledged Summit Carbon stands to gain from Navigator's canceled project, saying the business impact "might end up being positive for Summit's bottom line."

"In the long run … for the industry as a whole, it's a good thing to have a lot of carbon capture and sequestration projects be successful," Zenor said in a phone call. "This is not a good day for Navigator. … Certainly, they were a competitor, but in the industry of carbon capture and sequestration, you know, a rising tide really does raise all ships, and … it's unfortunate."

POET did not immediately respond to requests for comment about its future plans as Navigator shutters its project, but the company did regard the news with some disapproval.

“As a company, POET remains committed to pursuing viable technologies that help us maintain access to fuel markets and increase value for farmers," a POET spokesperson said. "We believe that states that are slow to adopt these technologies risk being left behind.”

As far as a potential acquisition of Navigator is concerned, Zenor said "we're not in the process of buying the company."

Navigator's land agreements set to expire in 'a few years,' company says

Despite the closure of Navigator's $3.5 billion pipeline project, the company still maintains the option agreements it signed with landowners in all five states as a company asset.

Such assets could potentially trade hands to prospective clients, such as Summit Carbon. This would further expand Summit Carbon's footprint and make it easier for the company to route their pipeline along or near Navigator's now-canceled route, in the event POET or other ethanol plants decide to partner with them.

However, Elizabeth Burns-Thompson, Navigator's vice president of government and public affairs, told the Argus Leader in an e-mail, "We do not have plans at this point in time to sell those options."

Furthermore, Burns-Thompson said the agreements Navigator signed with landowners are not considered "full easements" and "will expire after a few years."

Navigator's cancelation was looming after ailing progress in South Dakota, Illinois

The Nebraskan company suffered a major blow to its plans in Sept. 6, when the South Dakota Public Utilities Commission unanimously denied its permit application nearly a year after it was originally filed.

Much of the rejection arguments centered around Navigator's inability to meet various legal, safety and municipal standards under South Dakota law.

Nine days later, Navigator announced it would be "pausing" easement acquisition work in South Dakota and parts of Iowa, which led the company to release some land agents in the affected areas. This sparked rumors from the fired land agents that the company planned to discontinue its entire project, which the company denied at the time.

Then, on Oct. 10, Navigator asked the Illinois Commerce Commission to pull its permit application in the key state, which would have served as the home of the project's sequestration facilities. This came after consistently critical testimony from ICC Senior Gas Engineer Mark Maple, who told regulators the project secured a mere 14.9% of land easements — the lowest percentage he had seen in his "25 years of professional experience" — and failed to obtain a number of essential permits.

In South Dakota, Navigator paved the path for Summit Carbon by jumping — and falling — over the state's regulatory and governmental hurdles. After Navigator underwent the PUC's evidentiary hearing process, which consisted of weeks of scrutinizing every aspect of their pipeline project, only to come out of it with a unanimous denial, Summit Carbon benefited from observing the process.

Summit Carbon was later denied their South Dakota permit, as well, but their rejection came on the first day of their evidentiary hearing, likely saving them time and money in the long run.

And, on the same day they saw a similarly unanimous thumbs down from the South Dakota commissioners, Summit Carbon shortly thereafter indicated their plans to refile their permit application in the state.

"There's a lot of weight on our shoulders for making … a transformative project that will ensure the viability of ethanol and agriculture for the Midwest well into the future," Zenor said. "I mean, that now lies on our plate, and that's a lot."

Summit Carbon is not without its own setbacks. Bruce Rastetter, chief executive officer of Summit Agricultural Group, Summit Carbon's parent company, told Bloomberg News on Wednesday the Midwest Carbon Express project would be delayed until early 2026, two years later than initially expected.

Additionally, the North Dakota Public Service Commission denied the company's siting permit in August, which is a key state for their sequestration goals. However, the regulators later granted Summit Carbon's request to reconsider the denial, allowing the company time to address deficiencies in the permit.

While Summit Carbon's statement indicates it is ready to bring more ethanol plants into its fold, Zenor said the company has not negotiated any new agreements at this point.

"We don't have agreements with them. Only time will tell exactly how that all shakes out," Zenor said. "It's going to be an interesting next couple weeks."

This article originally appeared on Sioux Falls Argus Leader: With Navigator out of the picture, Summit Carbon's footprint could grow