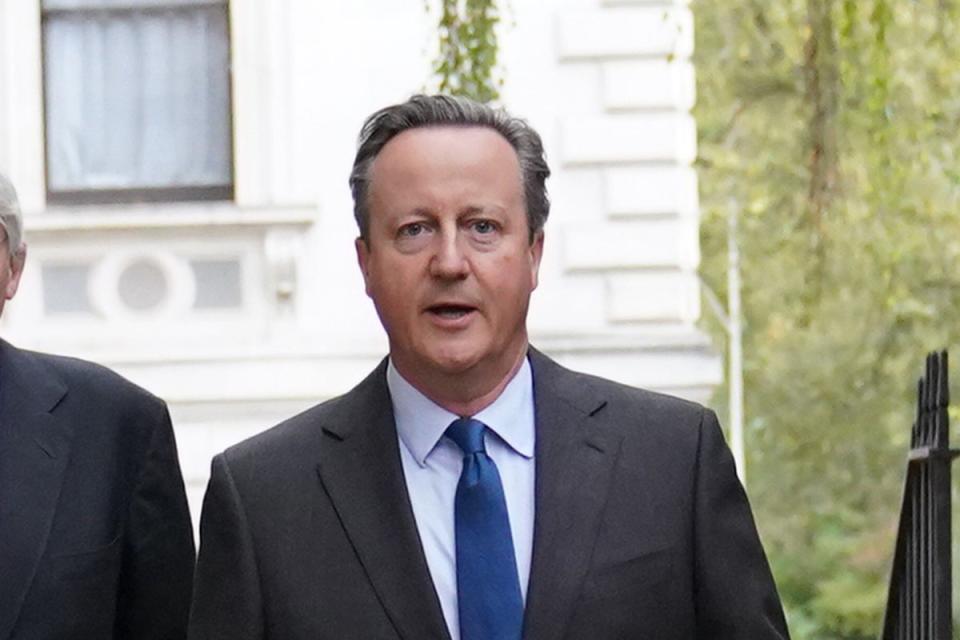

Sunak must investigate David Cameron’s Greensill tax affairs, says Labour

- Oops!Something went wrong.Please try again later.

Labour is urging Rishi Sunak to probe the tax affairs of his new foreign secretary David Cameron after fresh questions arose about his time at finance firm Greensill Capital.

Tax officials at HMRC are reportedly examining whether the former Tory PM failed to fully disclose perks such as private jet flights when he lobbied for the collapsed lender.

Officials are also looking at an offshore trust was created by Greensill to pay Lord Cameron extra benefits, it was claimed in The Guardian.

Labour’s Pat McFadden, shadow chancellor of the Duchy of Lancaster, has now written to Mr Sunak to demand he answers key questions about Lord Cameron’s shock return to government.

It comes as Labour also challenged Lord Cameron to explain his links to a Chinese-backed enterprise – amid ongoing questions about his lobbying work after leaving No 10 in 2016.

Mr McFadden said the PM should now explain the precise process followed in the foreign secretary’s speedy appointment during last week’s surprise reshuffle.

“Were there any concerns raised about the foreign secretary’s tax affairs during the HOLAC [House of Lords Appointment Commission] appointment process? If so, what were they?”

“Were you aware of any investigations into or concerns about the foreign secretary’s tax affairs prior to his appointment?” McFadden also asked the PM.

The Labour frontbencher challenged the PM to “conduct an investigation into this matter in the interests of maintaining the ‘integrity, professionalism and accountability’ that you have committed to”.

Mr McFadden also asked if Lord Cameron is being investigated by HMRC, whether he has been informed of that fact, and whether advised whether or not he was under scrutiny when handed the foreign secretary role.

According to The Guardian, HMRC officials are looking at whether Lord Cameron declared all the so-called benefits in kind he received during his work for Greensill between 2018 and 2021.

The alleged issue was revealed days after the ex-PM’s shock return to frontline politics which saw given a life peerage. There have been wider concerns about the move, including that the process was rushed through to avoid details of Mr Sunak’s reshuffle leaking.

Labour’s Mr McFadden also questioned reports of Lord Cameron’s links to a Sri Lankan port development and its ties with the Chinese government in the Commons on Thursday.

He asked who the “ultimate client” was for Lord Cameron’s “role in promoting the Port City Colombo project in Sri Lanka”, and if it was a company owned by the Chinese state.

The project is part of China’s global infrastructure strategy, the belt and road initiative, with Chinese companies involved in its construction.

Responding for the government, Cabinet Office minister John Glen replied: “This isn’t a matter for me. This is a matter for the processes that I have set out which have been complied with.”

Turning to Greensill, the Labour frontbencher added: “If not, will the government now investigate this to see if all such matters, including any use of offshore trusts, were properly declared and taken into account before this appointment was made?”

Mr Glen responded: “I’m not going to comment on media speculation ... Lord Cameron’s appointment followed all the established processes for both peerages and ministerial appointments.”

The ex-PM’s lobbying role at Greensill, which went bust in 2021, has been probed by parliamentary committees – along with his relationship with founder Lex Greensill while he was still in government.

Lord Cameron was cleared of any wrongdoing, but MPs on the Treasury committee criticised his “significant lack of judgement” and said there was “a good case for strengthening” existing lobbying rules.

A spokesperson for Lord Cameron said: “As already made clear in David Cameron’s evidence to the Treasury select committee in May 2021, he did use Greensill’s company plane a number of times on a personal basis, all for short-haul flights, and tax was paid appropriately for any benefit received.

They added: “Further, all income received from Greensill has been properly declared to HMRC and all tax paid in full.”