Sunak Says Claims UK Headed for Austerity ‘Simply Unfounded’

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- Sign up for The Readout newsletter for essential insight from Allegra Stratton and Bloomberg's top reporters on the stories that matter for the UK.

Most Read from Bloomberg

Billions Wiped Out as Stock-Safety Trade on Wall Street Misfires

Singapore High Court Grants Injunction Against PM Lee’s Brother

Russia Downs Drones Over Moscow in Ukrainian Retaliatory Strike

Israel, Hamas Extend Gaza Truce as 11 More Hostages Are Freed

Rishi Sunak denied his economic plans are about to deliver a fresh bout of UK austerity, even as the official fiscal watchdog warned his tax-cutting strategy assumes a significant squeeze on stretched public services.

“Any commentary or accusation that’s what’s happening is just simply unfounded,” the British prime minister said in a Bloomberg TV interview late Sunday. “Government is already spending a lot of people’s money. I’d rather focus on efficiency in the public sector and prioritize cutting people’s taxes rather than the government spending ever more of their money.”

Sunak was speaking before the UK’s Global Investment Summit in London, with Blackstone’s Stephen Schwarzman and JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon among those expected to attend. The government said it is unveiling £29.5 billion ($37.2 billion) of new investment for the summit, though at least £10 billion of the investment had already been announced.

The bulk of the new investment being announced comes from two of Australia’s largest pension investors, IFM Investors and Aware Super. Both said they are looking at energy transition projects, as well as other infrastructure projects.

The “austerity” label is politically sensitive for Sunak as he tries to close a poll gap with the opposition Labour Party of about 20 points ahead of a general election expected next year. Britain’s last period of austerity came in the premiership of David Cameron — who is now Sunak’s foreign secretary — and its legacy is still being felt across swathes of the public sector including social care, the justice system and local governments.

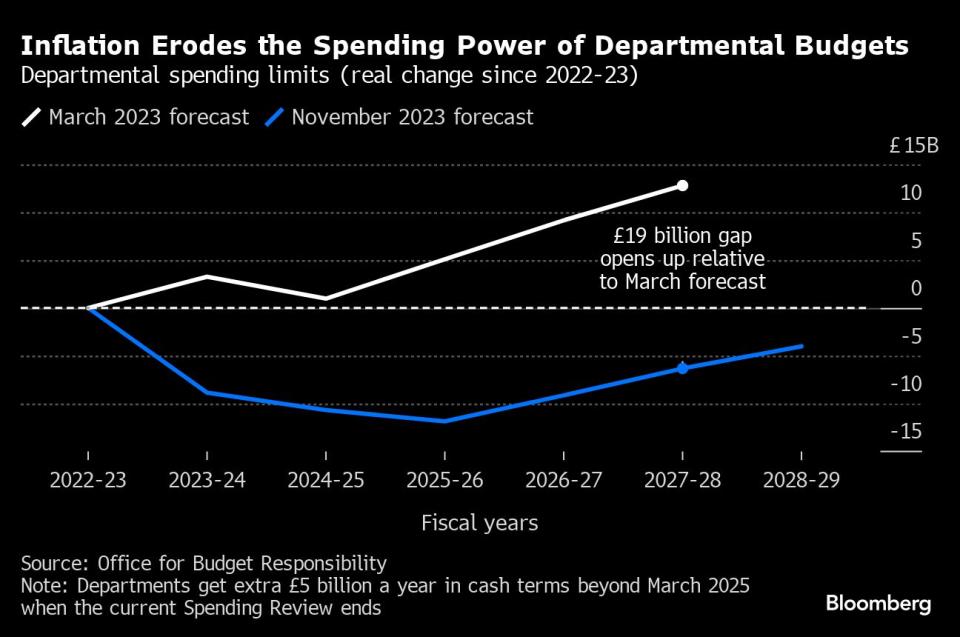

But Sunak’s government has spent days battling criticism that another round of cuts is now baked in, after Chancellor of the Exchequer Jeremy Hunt last week announced £21 billion of giveaways in business and personal tax cuts. According to the Office of Budget Responsibility, the tax cuts were funded in large part by a £19 billion reduction in the real value of government spending after the next general election, compared to the government’s previous plans.

The Institute for Fiscal Studies called those spending cuts “questionable, if not plain implausible,” in a way that could make the plan unsustainable. Unprotected departments like Justice, where the prisons are overflowing, face cuts of 3.4% a year through to 2028.

The tight post-election spending plans will be a difficult inheritance for the next government, presenting a choice between raising taxes or cutting public services, all else being equal.

In the interview, Sunak acknowledged that he is trying to reduce state spending to pay for tax cuts. He said he intends to go further than the 2 percentage-point reduction in the headline rate of national insurance announced by Hunt. His reference to “efficiency” is an attempt to avoid the austerity accusation.

“This is the start of a journey,” he said of the tax cuts. “When we can do more we will, because that’s the direction of travel now.”

The pivot toward tax cuts comes amid intense pressure from his own Conservative Party to reduce the overall burden, which is heading to a postwar high even after Hunt’s announcement. The government has said the rise is largely fueled by the cost of the pandemic and supporting households with soaring energy bills following Russia’s invasion of Ukraine.

The move also plays into pre-election politics. Tory MPs are worried about being punished over the cost of living, which is also making it difficult to land the Conservatives’ typical attack line about Labour as the party of higher taxes.

Yet the tax cuts have also renewed a focus on the Bank of England and its efforts to keep a lid on inflation. Sunak and Hunt have argued for months they couldn’t cut taxes until inflation was tamed. They declared victory in their target to halve inflation when it fell to 4.6% in October, but that’s still more than double the central bank’s 2% target.

Sunak said his government is boosting the labor supply and being disciplined with both borrowing and public sector wage settlements, which he said would continue to combat rising prices.

“We’re not fueling the inflationary fire,” he said. “We’re being sensible.”

Speaking ahead of the investment summit, Sunak said he is confident in the investment outlook for the UK, even after the OBR downgraded Britain’s growth forecasts last week.

“I think there’s real momentum in the economy,” Sunak said. “I feel very positive about the long-term growth outlook for the UK.”

--With assistance from Ellie Harmsworth.

(Updates with investment from Australian pension funds in fourth paragraph.)

Most Read from Bloomberg Businessweek

Scientists and Farmers Race to Save the World’s Banana Supply

Chinese Car Companies Cracked North America by Going to Mexico

How Elon Musk Spent Three Years Falling Down a Red-Pilled Rabbit Hole

MBA Alternative Augment Clinches $3.7 Million in New Funding

©2023 Bloomberg L.P.