Sunak to scrap Covid business loans and unveil new scheme

- Oops!Something went wrong.Please try again later.

Rishi Sunak is expected to unveil a new UK state-guaranteed loan scheme as he shuts down emergency coronavirus loan programmes in the Budget next week.

The Chancellor will end the three current support schemes at the end of March, roughly a year after they were launched during the UK's first coronavirus lockdown to try and keep cash-starved businesses afloat.

A new scheme with more stringent criteria will be launched in April to replace current support, reported the Financial Times, in a bid to wean businesses off a reliance on state support.

The decision does, however, highlights a recognition by the Government that many pandemic-hit companies will continue to need support as they may struggle to access standard bank loans.

It is expected to offer loans of up to £10m with an 80pc government guarantee, while interest rates will be capped at about 15pc.

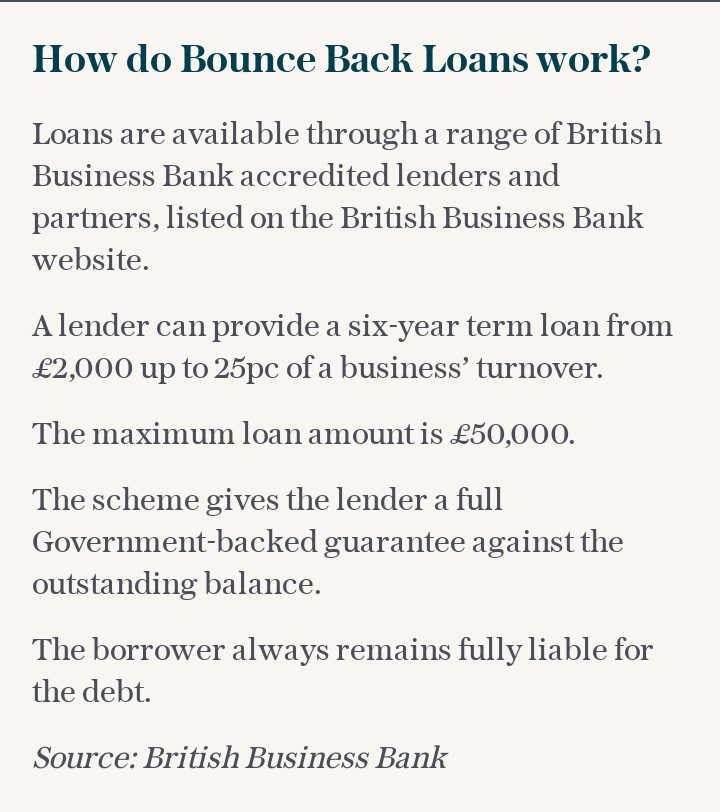

While this is a similar rate to the business interruption loan, it marks a significant uptick from the 2.5pc interest rate available on the current bounce back loans following a fee and interest-free first year.

According to the Daily Mail the business interruption loan - which has helped over 92,000 mid-sized businesses borrow £22bn - will be used to morph into the new package.

Some 1.6m smaller businesses have borrowed almost £73bn in bank loans under the Government's out-going programme, while almost £5.3bn was lent to 700 firms via the large business interruption loan scheme.