Sunak Seeks to Deflect Blame for Cost-of-Living Crisis Onto Corporate Britain

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- Rishi Sunak’s efforts to ensure companies give UK consumers the full benefit of cost cuts and interest rate rises appear unlikely to yield significant results, leaving the government with few palatable options to shield ordinary Britons from inflation.

Most Read from Bloomberg

Switzerland Blocks Sale of Leopard 1 Tanks Bound for Ukraine

Putin Claims He’s Back in Control. Russia’s Elite Isn’t Sure

Rolex and Patek Prices Fall as Subdial Index Nears Two-Year Low

Sweden Police Give Permit to Koran Burning Near Stockholm Mosque

Chancellor of the Exchequer Jeremy Hunt will meet regulators of key UK industries on Wednesday as the government seeks to deflect some of the blame for the cost-of-living squeeze onto corporate Britain. The meeting is down to “politics and optics,” said Vicky Pryce, chief economic adviser at the Centre for Economics and Business Research.

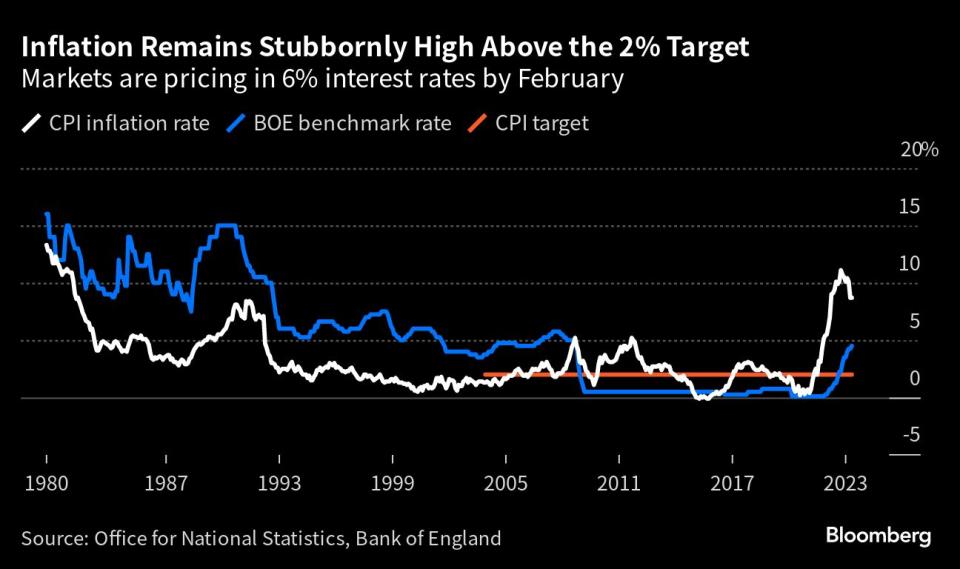

The pace of price rises has proved sticky at more than four times the official target for the past 14 months, putting in danger the British prime minister’s promise to cut inflation in half this year. Sunak has steered clear of direct help to struggling consumers because of the risk of stoking prices further, and instead has urged companies to see what they can do.

“The main reason he’s doing it is to be seen to be doing something,” Pryce said in a phone interview. Hunt “has very limited direct power to intervene, but he can encourage the regulators do their job properly.”

The cast list for the meeting includes the regulators for water, energy and telecommunications companies, Ofwat and Ofgem, and Ofcom. Also attending will be the Competition and Markets Authority and the Financial Conduct Authority.

Politicians of all stripes have turned their attention in recent weeks to the price pressures facing consumers. On Tuesday, the cross-party Business and Trade Committee held a hearing in which they grilled supermarket executives on whether they’re profiteering from rampant inflation on groceries.

Pryce said the government could change the remit of the regulators and encourage them to be tougher on the companies they oversee; and it could also require certain industries to have voluntary or even mandatory agreements to keep prices lower. If a particular industry is deemed to be making excess profits, another option would be to impose windfall taxes, she said.

While the government does have tools it can use to bear down on inflation, they’re largely politically unpalatable options such as cutting benefits, raising taxes and boosting immigration.

As such, it’s ramped up the rhetoric suggesting companies could do more. Hunt on Monday told the House of Commons that banks are taking “too long” to pass on higher interest rates to savers. And Sunak’s spokesman, Max Blain, on Tuesday told reporters the premier expects “supermarkets and others to do everything possible to help people.”

Here’s the picture for the industries in the government spotlight:

Banks

The bosses of NatWest Group Plc, Lloyds Banking Group Plc and the UK arms of Barclays Plc and HSBC Holdings Plc have faced questions in parliament over how the Bank of England’s string of recent rate rises are leading to little reward for savers and a squeeze for mortgage borrowers. The opposition Labour party’s Lisa Nandy at the weekend called for banks to be forced to pass more of the rate hikes to savers.

Most accounts pay below the 5% base rate, while the cost of new mortgages is mostly tracking above the level set by the BOE. This gap helps banks to boost their net interest margin, a closely-watched measure of profitability.

Bloomberg Intelligence calculated in May that about 40% of the rate rises have been passed on by UK lenders since rates started to rise in late 2021. The analysis was carried out before the latest 50-basis-point rise and using deposit data for March.

That’s led plenty of lawmakers to ask whether banks could do more to reward savers.

Water Companies

The sector is under increased scrutiny as a lack of investment is causing sewage to be pumped into the sea and rivers and millions of people to have their domestic water use curtailed even as leaks are rife.

The regulator, Ofwat, in March revealed new powers to stop dividend payments if water companies fail to protect the environment or do not have an acceptable level of financial resilience.

The utilities are also working on new business plans for the 2025-2030 period to outline investment but also what impact more spending will have on people’s bills. The plans will be revealed in October, but the regulator, Ofwat, isn’t due to make decisions on those until December 2024.

Profits and margins of listed water companies remain fairly stable or dropped for UK water companies in 2022, suggesting they’re not piggybacking on high inflation to boost profits.

Energy Providers

Bills for most households are due to fall in July, reflecting a decline in the wholesale costs at which suppliers buy their energy. The typical annual bill will be £2,074 ($2,642) for the third quarter of the year, a 17% drop — but one that’s still heavily above the normal bill before the crisis.

Scottish Power Ltd and EDF Energy Ltd are operating energy retail at a loss, while Centrica Plc’s supply arm, British Gas, saw adjusted operating profit drop last year.

Firms are given a prescriptive way to hedge supply and price by regulator Ofgem, which is currently engaged in a consultation over whether to allow utilities to raise their margins rather than squeeze them further. With slim margins already, there’s little room for energy suppliers to ease bills further for consumers.

Supermarkets

The UK’s traditional supermarkets are competing fiercely with German discounters Aldi and Lidl, famed for their low prices.

Tesco Plc, J Sainsbury Plc, Asda and Morrisons all reported a decline in profit in the past year. Tesco’s operating margin fell to 4% in the year through February, from 4.6% the year before. The margin at Sainsbury fell to around 3% last year from 3.4% a year earlier.

That means accusations of profiteering — dubbed “greedflation” by the UK media — don’t necessarily stack up in an industry where margins are tight and profits have fallen.

“It’s not very convincing to argue, at least as of yet, that grocery inflation is driven by greedflation,” Bank of England rate-setter Swati Dhingra said on Tuesday.

Mobile Phone Companies

The situation is more complicated in the telecommunications sector. The UK’s big mobile companies have increased bills by inflation plus 3.9% — suggesting there’s room for maneuver on pricing.

But they are also diverting cash to invest in newer networks including 5G, as people use more and more data. That situation means the two smallest network operators — Vodafone and Three — are not always making back their cost of capital in the UK, according to regulator Ofcom.

--With assistance from Todd Gillespie, Tom Metcalf, Thomas Seal, Eamon Akil Farhat, Katie Linsell, Rachel Morison and Alex Wickham.

(Updates with further comment from Pryce in seventh paragraph.)

Most Read from Bloomberg Businessweek

EBT Skimmers Are Draining Millions of Dollars From the Neediest Americans

The Air Jordan Drop So Hot It Blew Up an Alleged $85 Million Ponzi Scheme

The World’s Empty Office Buildings Have Become a Debt Time Bomb

How a $100 Cheetah Cub Becomes an Illegal $50,000 Status Symbol

©2023 Bloomberg L.P.