Supreme Court strikes down Biden's student loan forgiveness plan. What happens now?

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

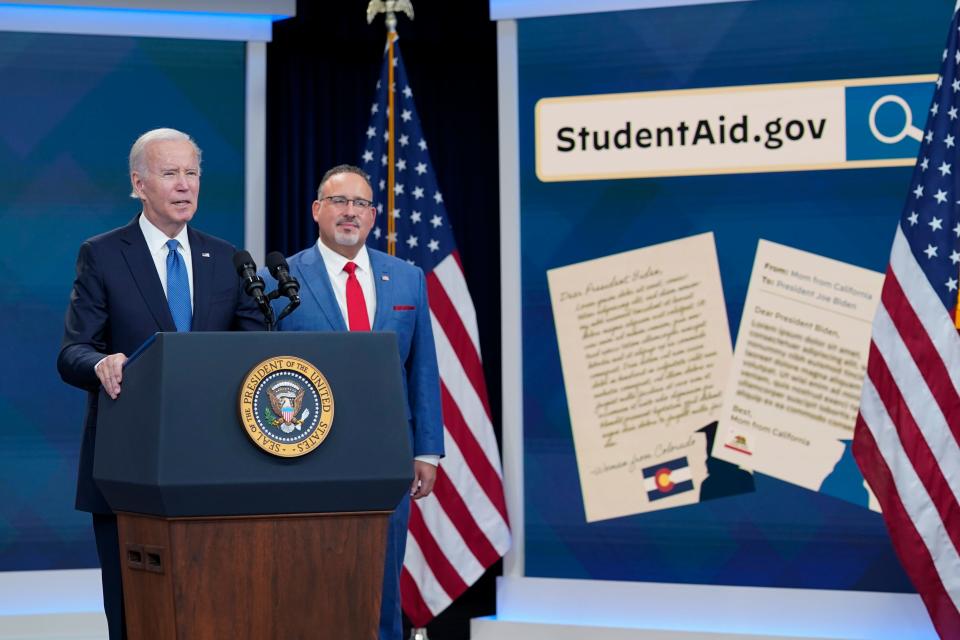

Nearly a year after President Joe Biden's administration first announced its plan to forgive $400 billion in student loan debt for tens of millions of borrowers, the U.S. Supreme Court officially put an end to it Friday morning. But Biden made clear at a news conference denouncing the decision later that afternoon that he has a new plan to still cancel debts for more than 40 million Americans.

In a 6-3 decision, with the court's liberal justices dissenting, the Supreme Court agreed with six Republican-led states that the HEROES Act does not authorize the debt forgiveness plan.

The case — Biden v. Nebraska — challenged Biden's authority to use the Higher Education Relief Opportunities for Students Act, better known as the HEROES Act, to forgive borrowers' student loans. The post-9/11 law was initially passed to keep service members from being financially hurt while deployed in Afghanistan and Iraq. It has since been used to allow the Secretary of Education to waive or modify the terms of federal student loans as necessary during a national emergency.

In Department of Education v. Brown, another case related to Biden's forgiveness plan, justices unanimously ruled that the respondents never had legal standing to sue and prove they were harmed by the plan in the first place.

But the court's conservative justices argued that Missouri, one of the states who sued as part of Biden v. Nebraska, had at least some standing.

That's because Missouri is home to the Higher Education Loan Authority of the State of Missouri, also known as the Missouri Higher Education Loan Authority or MOHELA, one of the largest holders and servicers of student loans in the U.S. MOHELA itself was not a respondent in the case.

Biden's forgiveness plan, the majority opinion said, would hurt MOHELA's revenues, impairing its ability to help Missouri's college students. This harm to MOHELA in the performance of its public function, the conservative justices said, is essentially a direct injury to Missouri itself.

"The authority to 'modify' statutes and regulations allows the Secretary to make modest adjustments and additions to existing regulations," Chief Justice John Roberts wrote in the majority opinion, "not transform them."

Associate Justice Elena Kagan, who authored the dissenting opinion, wrote that "in every respect, the court today exceeds its proper, limited role in our nation’s governance."

"The court once again substitutes itself for Congress and the executive branch — and the hundreds of millions of people they represent — in making this nation’s most important, as well as most contested, policy decisions," she wrote."

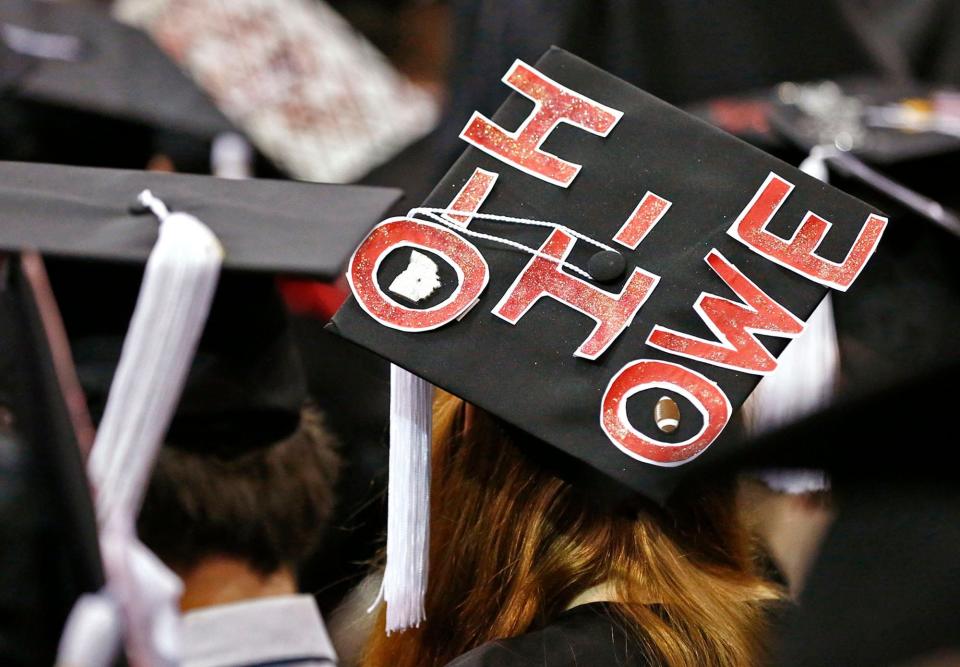

The White House announced last August that borrowers with federal student loans could receive up to $20,000 in forgiveness if they had received a Pell grant and up to $10,000 for many other borrowers. The relief was available only to those who earn less than $125,000 individually or $250,000 as a household.

Roughly 43 million borrowers were eligible for some type of relief under Biden’s programs, and about 20 million of those would've seen their debts wiped away completely.

How does Biden plan to forgive student loan debt now?

At a news conference Friday afternoon, Biden mourned the end of one of his administration's signature programs.

“Let me begin by saying I know there’s millions of Americans — millions of Americans — in this country who feel disappointed and discouraged and even a little bit angry about the court’s decision today about student debt,” Biden says. “And I must admit I do, too.”

He also called out Republican members of Congress, some of whom received thousands of dollars in Paycheck Protection Program (PPP) loans during the pandemic that were later forgiven but did not support his student debt plan.

“The hypocrisy is stunning,” he said.

In addition to laying out several other ways his administration has made college more affordable by increasing the Pell Grant, Biden said his administration will pursue a different legal argument under a Higher Education Act of 1965, rather than the HEROES Act.

The HEA gives the Secretary of Education broad authority to “compromise, waive, or release any right, title, claim, lien, or demand” associated with federal student loans, according to the law.

“In my view, it’s the best path that remains to providing as many borrowers as possible with debt relief,” Biden said.

Student loan debt relief: How we got here

Since Biden announced his plan to forgive up to $20,000 in student debt back in August 2022, opponents have sought to quash it. A handful of lawsuits filed in federal courts across the country attempted to overturn the debt cancellation program, and two of those cases have put the plan on pause.

In October, the 8th U.S. Circuit Court of Appeals issued a stay prohibiting the administration from discharging any loan forgiveness until it ruled on an emergency request by six Republican states: Arkansas, Iowa, Kansas, Missouri, Nebraska and South Carolina. A three-judge panel of that court issued an injunction Nov. 14 temporarily barring the program, ruling the U.S. Department of Education overstepped its authority.

The court heard the two cases related to Biden's student loan forgiveness plan in February. Though there had been considerable debate before justices heard both cases over whether or not they were the right parties to sue, the court's conservative majority suggested Biden overstepped his legal authority.

"We take very seriously the idea of separation of powers and that power should be divided to prevent its abuse,” Chief Justice John Roberts said at the time. “This is a case that presents extraordinarily serious, important issues about the role of Congress and about the role that we should exercise in scrutinizing that significance."

Two of the court's liberal justices — Associate Justices Kagan and Ketanji Brown Jackson — pushed back against some criticism from their conservative colleagues that the Biden program is unfair to those who didn't attend college or who already paid off their loans.

“I just don't know how far we can go with this notion of, to the extent that the government is providing much-needed assistance to people in an emergency, it's going to be unfair to those who don't get the same benefit," Brown Jackson said during arguments.

Have a student loan balance? Get ready to start making those payments again

After three years and nine extensions, student loan borrowers will actually start repaying on their loans by the end of this summer.

Biden and House Speaker Kevin McCarthy came to an agreement during the federal debt ceiling negotiations stating that student loan forbearance would officially end 60 days after June 30. Although the timeline is close to what the Biden administration had previously laid out, codifying it all but removes the ability to extend forbearance any longer.

Student loan forbearance: With or without forgiveness, you will have to start paying on your student loans soon

That means student loan interest will begin to accrue again on Sept. 1, and payments will be due starting in October, according to the U.S. Department of Education.

In addition to a new pathway to loan forgiveness, Biden said that the Department of Education will give borrowers a 12-month "ramp-up" period to get used to paying their loans again. Borrowers who don’t pay their student loan bills won't be referred to credit agencies during that time.

USA Today reporters John Fritze, Joey Garrison, Nirvi Shah, Chris Quintana and Alia Wong contributed to the reporting of this article.

Sheridan Hendrix is a higher education reporter for The Columbus Dispatch. Sign up for her Mobile Newsroom newsletter here and Extra Credit, her education newsletter, here.

shendrix@dispatch.com

@sheridan120

This article originally appeared on The Columbus Dispatch: Supreme Court cancels Biden's student loan forgiveness plan. What now?