Surging Dropbox Stock Attracts Options Bulls

One of the top performers on the Nasdaq today is file sharing specialist Dropbox Inc (NASDAQ:DBX), which is bucking the broadmarket trend after posting fourth-quarter earnings and revenue that beat analysts' expectations, and lifting its 2024 operating margin target. The firm also announced a $600 million share buyback plan. At midday, DBX is trading at its highest level in six months, up 22% at $22.83.

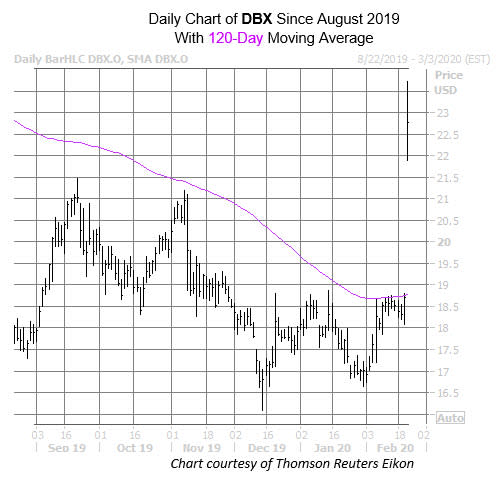

The pop has also put DBX well atop familiar pressure at its 120-day moving average, for the first time since early August. Dropbox is still off 10.5% in the last 12-months, but now boasts a year-to-date gain of 27.9%. Plus, the equity is eyeing its biggest one-day percentage jump on record.

Today's news has inspired a handful of analysts to lift their price targets, including Deutsche Bank, which raised its estimate all the way to $30. This puts the consensus 12-month target price at $28.75 -- a 25% premium to current levels. Most members of the brokerage bunch were already bullish, with five of the seven in coverage calling DBX a "buy" or better.

Options players have also been quite noisy. So far, 68,000 calls and 19,000 puts have exchanged hands, eight times what's typically seen at this point. The most popular contract is the weekly 3/6 25-strike call, and it appears that there may be some sell-to-open action happening here, per data from Trade Alert. The February 22.50 call is also seeing a lot of action, with positions being opened.

This rush towards calls hasn't been the norm, however. In fact, during the last 10 days, 1.11 puts were bought for every call at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). This ratio sits higher than all but 1% of readings from the past year, indicating a much healthier appetite for long puts of late.