How Suspects Laundered Billions in Singapore for Years

(Bloomberg) -- Wang Dehai was already on the run when he made Singapore his home five years ago. Police in China were offering a bounty for information about him for his alleged role in an illegal gambling ring.

Most Read from Bloomberg

Harvard Alumni Rebuke Its Israel Response With Mere $1 Donations

Bitcoin Surges Past $42,000 Even as Stocks and Bonds Take a Hit

Stocks Mixed on China Concern, Dovish ECB Comments: Markets Wrap

Once in Singapore, Wang and his wife set up a family office and he got an employment pass, giving him the right to stay in the city-state. They banked with Credit Suisse, and the couple got passports from the tax haven of Cyprus. Wang, 34, splurged on a S$23 million ($17.2 million) condominium in the prime Orchard area and held about $2.8 million in cryptocurrency.

Wang’s idyllic world came crashing down in August when he was among 10 people of Chinese origin arrested and charged in the biggest money-laundering case the nation has ever seen. Authorities have seized more than S$2.8 billion in assets including gold bars, jewelry, 62 cars and 152 properties. The tally may rise, with many suspects still on the loose.

The seizures have sent shockwaves through the orderly nation, prompting a review of the policies that were exploited to allow so much money to allegedly be laundered for so long at some of the world’s biggest banks. The police raids across the toniest neighborhoods also highlight how Singapore is paying the price for its open borders just as some wealthy Chinese with suspected tainted funds are looking for places to park their money.

“There was enough risks or obvious questions to require much more rigorous and significant due diligence to be done on the provenance of these people and their money,” said Christopher Leahy, the Singapore-based managing director of Blackpeak (Holdings) Ltd., a research and risk advisory firm.

For decades, Singapore has taken steps to attract the uber rich, spawning a finance industry that’s made it one of the wealthiest countries on earth. Generous tax incentives and programs that offer pathways to long-term residency have paid off handsomely, prompting billionaires from James Dyson to Ray Dalio to set up family offices. Assets overseen by the money management sector have almost doubled in seven years to $3.65 trillion, with about three-quarters of that from abroad.

More recently, a wave of Chinese investors has arrived, fleeing strenuous pandemic restrictions and crackdowns that hit industries from technology to real estate. Singapore is a natural choice for them, as ethnic Chinese make up about three-quarters of the population and Mandarin is widely spoken. Since 2019, direct investment from mainland China and Hong Kong has risen 79% to S$19.3 billion. Private wine bars and country clubs have benefited from the surge in spending.

Read more: China’s Rich Tap Underground Networks to Sneak Their Money Out

The surprise sting operation is now prompting a rethink of all this, amid signs dirty money is joining legitimate businesses in the rush to Singapore, with cash winding up at global lenders from Credit Suisse to Citigroup Inc.

The policies drawing scrutiny include family office programs after the government said at least one of the accused may have set up an office that was awarded tax incentives. In all, the 10 accused have at least five family offices among them, according to documents reviewed by Bloomberg News, and people familiar with the matter. It’s not clear whether all five received tax breaks. More than 1,100 clans from around the world have created these vehicles in Singapore to manage their fortunes as of the end of 2022, an almost threefold increase from 2020.

Read more: Singapore Mulls Family Office Rules as Launderer Ties Probed

Many of the accused also invested in existing companies or set up their own businesses to establish ties. Wang Dehai, for example, whose employment pass is valid through June 2024 according to manpower ministry records, invested in Delibowl Pte, a Chinese restaurant chain, records show.

Su Haijin, 40, another of the accused, became a director at listed restaurant firm No Signboard Holdings Ltd. in 2021, after investing S$6.5 million through an entity controlled by Chief Executive Officer Lim Yong Sim. Su also holds or has had shares in seven other firms, according to documents.

Su — who fractured both feet and injured his wrist jumping from the balcony of his rented mansion after his son alerted him that police had arrived — now faces charges linked to laundering money in Singapore using profit from illegal gambling operations. Su was arrested with S$171 million in assets tied to him and his wife in Singapore. His lawyers didn’t respond to emailed requests for comment.

Wang Dehai is wanted under a class “B” order in China, which he claims is not for very serious crimes, according to his written submission to the court. While he acknowledges he was involved in remote gambling in the Philippines from 2012 to 2016, his understanding is that that remains legal there, according to the Oct. 12 document. Online gambling is illegal in China.

Jerry Liao, owner of Delibowl, and Lim, on leave from No Signboard after being charged with price rigging, didn’t respond to requests for comment.

Singapore has acknowledged the challenges in trying to stop money launderers who get these work passes. Some of them may pretend to be employed by companies that are dormant, or operate active companies that mask the movement of ill-gotten gains, Manpower Minister Tan See Leng told parliament in October.

“Some individuals may abuse the work pass framework to enter Singapore to commit illicit activities, such as the present case of money laundering,” Tan said. “Criminals will constantly find new ways to circumvent our laws and regulations and update their methods over time.”

Singapore is also looking into the effects of a little-known loophole that helped many of the accused start businesses. According to Singapore law, foreigners must hire a citizen or permanent resident as an authorized representative to set up a company. To meet this demand, some locals have become serial directors, representing hundreds of firms at the same time.

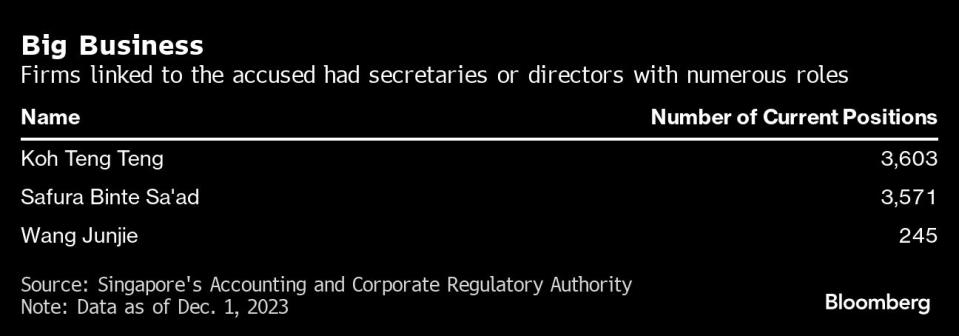

Wang Junjie is a prime example. The Singaporean is director, shareholder or secretary of more than 200 companies, and has held roles in at least nine firms related to three of the arrested — most of which he left recently, according to corporate filings.

One of the firms linked to Zhang Ruijin, another of the accused, has two corporate secretaries from a firm called VentureHaven, which claims it can deliver business registrations in under 24 hours, according to its website. Those two secretaries alone — Koh Teng Teng and Safura Binte Sa’ad — each hold more than 3,500 positions at various firms. None of these company officials, including Wang Junjie, has been accused of any wrongdoing.

Lawyers for Zhang said they are unable to comment. Wang Junjie declined to comment and VentureHaven didn’t respond to a request for comment from its two employees.

“You have hundreds and hundreds of companies using the same address,” set up within a short span of time in some instances, said Chua Choon Hong, the head of Moody’s Analytics Inc.’s Financial Crime Practice Group for Asia-Pacific and the Middle East. “What is it for, we don’t know.”

With close to 600,000 entities registered in Singapore — about one for every 10 residents — corporate registry is big business. Last year, Bloomberg News reported that another person has been a corporate secretary in Singapore for more than 200 companies, including those owned by a Myanmar tycoon sanctioned by the US and the UK for arms dealing with the military junta.

“This industry definitely has grown,” said Chua, adding that many startups test the waters by setting up a business that they control from outside Singapore via their local secretary. But the “good ones and bad ones come in together.”

Authorities say that the lack of limits on the number of directorships is in line with international standards, and that the bulk of directors — 99% — hold fewer than 10. Still, restrictions are now being mulled, with proposed rule changes set to be tabled in parliament next year, authorities said.

Singapore is also shining a light on the banks that did business with the accused. One of the arrested, Vang Shuiming, held S$92 million with Credit Suisse, while Switzerland’s Julius Baer Group Ltd. kept some S$33 million for him.

Citigroup and Singapore lenders DBS Group Holdings Ltd., Oversea-Chinese Banking Corp. and United Overseas Bank Ltd. also banked some of the accused. DBS, the largest bank in Singapore, said its exposure was almost S$100 million, mainly from financing properties. UOB’s exposure is immaterial, a spokesperson said. OCBC CEO Helen Wong said the bank’s exposure is insignificant. In a statement, Citigroup said it’s committed to the fight against money laundering and ensuring the highest standard of governance and controls. The New York-based bank said it’s been working with the authorities to strengthen and protect the integrity of the financial system. Julius Baer declined comment.

Bank Competition

“Large deposits attract a lot of competition from banks,” said Leahy at Blackpeak. “If these guys turned up with a million dollars, they’d have probably been shown the door, but they turned up with a billion dollars and they rolled out the red carpet.”

The Monetary Authority of Singapore, the country’s financial regulator, said it’s “engaging” with the banks, while praising some unidentified lenders for raising red flags that aided police. Some banks have been tightening controls in anticipation of on-site inspections by the central bank to review any exposure to the suspects and overall handling of client vetting, according to people familiar with the matter. Credit Suisse was among the first banks to be inspected, Bloomberg News reported in October. The Swiss bank, now part of UBS Group AG, declined to comment.

Read more: Singapore to Inspect Credit Suisse, Others in Major Scandal

Private bankers are suspected of playing a role too. Wang Qiming, a former wealth banker at Citigroup, worked with at least one member of the so-called Fujian gang, a nod to the southern province all 10 of the accused hail from, according to affidavits and people familiar with the matter. A Citigroup spokesperson in Singapore referred to a previous statement: “The individual in question has not been in our employ since April 2022. We do not comment on matters that are before the courts.”

Wang Qiming, who has been released on bail and not charged, couldn’t be reached for comment.

Though the recent arrests have led to the seizure of more than S$1 billion in bank accounts alone, it may just be the tip of the iceberg, with at least eight suspects at large, according to police.

“As we probe further, there may be more arrests and assets seized,” said Second Home Affairs Minister Josephine Teo.

She said Singapore police detected suspicious transactions related to the Fujian gang as early as 2021, and launched a comprehensive probe the following year. The authorities decided to wait for enough evidence to ensure they could arrest as many as possible, she said.

Read more: Singapore Money Laundering Case Embroils Its Banking Giants

The alleged cases of money-laundering are the latest in a string of scandals in the past decade for Singapore, unusual in a place where crime is so rare that people have no qualms about leaving their valuables unguarded at crowded food centers. There were breaches of money-laundering rules connected to Malaysia’s state fund 1Malaysia Development Bhd., and with German firm Wirecard AG. In those cases, bankers were barred from the industry or the lenders involved were fined.

Money-laundering isn’t unique to Singapore of course. Some $800 billion to $2 trillion, or about 2% to 5% of global gross domestic product, is laundered worldwide each year, according to the United Nations Office on Drugs and Crime. The accused in Singapore also had businesses and real estate spanning the globe, including in Dubai, Hong Kong and London. Wang Dehai, for example, kept HK$53 million ($6.8 million) and $500,000 stashed in Hong Kong accounts at UBS, Industrial & Commercial Bank of China Ltd. and Bank of China Ltd., police records show.

Singapore is rated above average for fighting illicit funds, based on reports by the Paris-based Financial Action Task Force and the Basel Institute on Governance. While the country’s strengths range from understanding risks to international cooperation, areas of improvement include regulation of intermediaries such as real estate agents.

The latest money laundering cases demonstrate that the deficiencies identified by the FATF "are still relevant," said Kateryna Boguslavska, a project manager for Basel Institute's AML Index.

“Singapore’s regulatory regime for money laundering/terrorism financing is aligned with FATF standards,” the MAS and the Home Affairs Ministry said in response to questions from Bloomberg. The government is “working towards full and effective implementation” of FATF’s recommendation on due diligence requirements for real estate agents, precious stones and metals dealers, and has strengthened its oversight of the sector.

The seizure of so many high-end properties has spawned questions about whether realtors have been too lax in spotting red flags. The Council for Estate Agencies, the local industry regulator, is investigating if any lapses occurred. Outgoing central bank chief Ravi Menon has indicated there might be a problem.

“Real estate agents have an obligation to look out for suspicious transactions. Do they all do that well? I don’t think so, and that’s one area we need to focus on,” he told Bloomberg Television’s Haslinda Amin in an interview.

Upholding its otherwise sterling reputation is crucial for Singapore ahead of a new round of assessments by the global financial crime watchdog in 2025. A general election must be called by the end of that year, with Finance Minister Lawrence Wong poised to succeed Prime Minister Lee Hsien Loong as leader of the ruling party. With affluent newcomers seen splurging on everything from cars to real estate, the growing wealth gap is certain to be a hot-button election issue.

“Singapore’s ability to attract funds from across the region and beyond means it has an added responsibility to ensure its anti-money laundering controls are effective,” said John Cusack, the London-based chairperson of the Global Coalition to Fight Financial Crime. The purpose of such controls are to "follow the money and deprive criminals of these funds. This appears to be a likely successful example of delivering on that purpose."

For his part, Lee the premier said the money laundering case isn’t a scandal, and that the “system” is clean.

“If my system had been corrupted, then I’m in trouble,” he said in an interview at the Bloomberg New Economy Forum last month. “It’s a criminal case. Criminals do bad things. We find out, we investigate it” and charge them in court.

Money Flows

With all the money flowing into Singapore, officials argue it’s nearly impossible to catch everyone using loopholes or to nab those faking their way in. The 10 arrested were granted various visas to stay or work in part because none of them was on the Interpol Red Notice list, despite being wanted in China, according to authorities. Chen Qingyuan, Su Wenqiang and Su Jianfeng were wanted in China and were charged after the raids in Singapore.

Su Jianfeng's lawyer didn’t respond to a request for comment. Chen’s legal team said he will claim trial — meaning he would like to put forward a defense to the charges. Su Wenqiang's lawyers said they were "considering the options" for their client.

“There is no ‘silver bullet’ to tightly seal any system from infiltration of tainted money and the responsibility has to be distributed equitably across the ecosystem,” said Radish Singh, the financial services risk management leader for Southeast Asia at Ernst & Young.

The seizures highlight just how much wealth is circulating through Singapore. The properties owned by the accused spanned everything from luxury villas in a gated community on the island of Sentosa, to multiple century-old shophouses in the heart of the business district, according to authorities and property records seen by Bloomberg. The seized goods included 164 luxury watches, 294 hand bags and thousands of liquor and wine bottles.

Vang Shuiming, 42, sporting passports from Turkey, Cambodia and Vanuatu, financed the purchase of 10 units at Canninghill Piers, a condominium under construction along the Singapore River, according to police.

Vang, along with the others charged, is now remanded at the Changi Prison, a far cry from his mansion spanning about 17,200 square feet in the high-end Bishopsgate area, which he rented for a then record S$150,000 a month in late 2020, rental data show. He wishes to claim trial, according to his lawyer Wendell Wong from Drew & Napier LLC. Wong declined to comment on other queries, citing the ongoing court case.

The houses of some of the suspects had at least four cars in their driveways during recent visits, ranging from Ferraris to Rolls-Royces. The rented mansion of Wang Bingang, whom Chinese authorities and media say is the head of the so-called Hongli online gambling group, is within walking distance of Prime Minister Lee’s home in the Tanglin neighborhood. Wang Bingang, a suspect at large, couldn’t be reached for comment.

The crackdown is even having an effect on the local economy. Luxury housing deals have slowed. At the private Sentosa Golf Club, where membership fees have soared to more than $600,000, five suspects in the case, including Su Haijin, have been placed on the default list.

Read more: Ultra-Rich Chinese Drive Premier Singapore Golf Fees to $618,000Singapore is setting up an inter-ministerial committee to focus on areas of improvement, and will consider whether it needs to tighten its immigration process further. The government is also reviewing the vetting process for family offices awarded tax incentives to ensure it’s stringent enough, Alvin Tan, minister of state for trade and industry, told parliament. Police are working with overseas counterparts on the case, including in Hong Kong and mainland China, according to a person familiar with the matter.

For the booming financial hub, it’s all a delicate balancing act: Singapore wants to keep borders open to attract the super rich, while having enough controls in place to detect tainted funds. Minister Teo cautioned against ``knee-jerk reactions’’ and making the rules too tight.

Leahy at Blackpeak doesn’t expect major changes, despite the massive amount of money and assets involved.

“There will be some accountability and they might tighten some regulation, but then it will be business back to normal because the vast majority of funds flowing through Singapore are legitimate,” he said. “If they do too much, the whole financial system will grind to a halt.”

--With assistance from Reinie Booysen, Catherine Bosley, Andrea Tan, Venus Feng, Faris Mokhtar, Alfred Cang, Josef Reyes and Jin Wu.

Most Read from Bloomberg Businessweek

B-School Admissions Deans Are Feeling The Pressure From Falling Applications

Anduril Builds a Tiny, Reusable Fighter Jet That Blows Up Drones

No Laws Protect People From Deepfake Porn. These Victims Fought Back

Microsoft Is Happy Being the Co-Pilot on the OpenAI Rocket Ship

©2023 Bloomberg L.P.