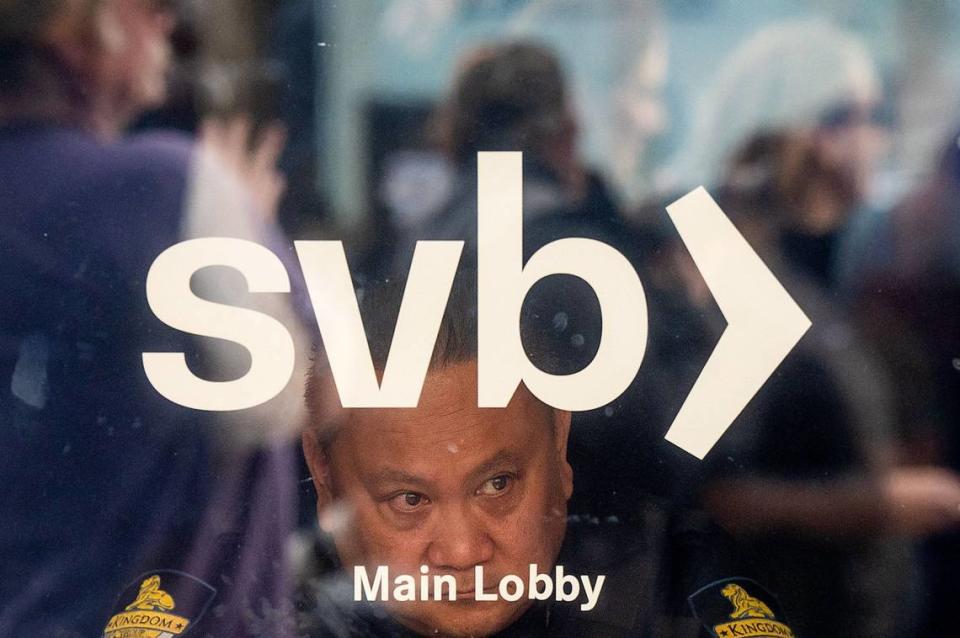

After collapse, what is SVB like under Raleigh’s First Citizens Bank? NC startups share.

On March 27, Raleigh’s First Citizens Bank transformed its present and future by purchasing the remains of the failed Silicon Valley Bank. Overnight, it went from the 30th largest U.S. bank to the 16th, adding $56 billion in deposits and nearly doubling its loans.

The move surprised many in the finance world. Silicon Valley Bank was the go-to bank for early-stage tech startups before a bank run sparked its collapse on March 10.

“When you started one of these companies, you didn’t give another bank a second thought,” said Igor Jablokov, founder of the Raleigh AI management firm Pryon. “You just started working with SVB.”

In reputation and portfolio, First Citizens was the opposite. It was a family-run bank founded more than 120 years ago in Johnston County. While First Citizens would eventually move north to the burgeoning technology hub of Raleigh, it never focused on the type of venture banking done by the Bay Area-based SVB.

However, it did have a track record of buying distressed financial institutions. In that way, the acquisition made sense.

“I was excited because they’re a local bank,” said Jud Bowman, a serial entrepreneur in Durham who had an SVB account and loan for his startup Sift Media.

So, seven months later, how is Silicon Valley doing under First Citizens?

Answers arrived last week when First Citizens released its latest earnings.

In the five days following the sale, deposits in the SVB segment of First Citizens Bank fell $7 billion as clients moved money to larger banks that were perceived to be safer. By the end of April, deposits had fallen a total of $15.5 billion since First Citizens took over.

Since May 1, however, the deposit exodus has largely ceased. The SVB division of First Citizens finished September with roughly the same deposit level it had six months prior — $40 billion.

“From the data, it seems at least they’re not hemorrhaging (deposits),” said Qi Chen, an accounting professor at the Duke Fuqua School of Business.

‘They understand they have to convince us’

First Citizens has put resources into reassuring startup founders that SVB is still a reliable banking option. It launched a nationwide “Yes, SVB” campaign and, despite laying off around 500 former SVB employees in May, First Citizens has retained several former SVB staffers in local markets.

The SVB managing director in the Carolinas remains Chris Stoecker, who is based in Raleigh. Stoecker has been with SVB since 2010 and previously worked at Square 1 Bank in Durham.

“I talk to Chris every few weeks,” Bowman said. “For SVB to survive and thrive under (First Citizens), they’ve got to hold on to that talent base.”

Like founders nationwide, Bowman felt the chaos of SVB’s demise this spring. Silicon Valley was itself the 16th largest bank in the country, with a reputation for helping technology startups stretch their venture funding. But as interest rates rose, some grew anxious about the company’s significant holdings of long-term bonds. This ignited a bank run, which prompted the federal government to assume control.

Bowman was unable to extricate Sift Media’s money before the Federal Deposit Insurance Corp. froze SVB accounts.

“Is this the end of the company?” he recalled thinking.

Under its business loan agreement, Sift Media was obligated to keep an account with SVB, he said. But Bowman is confident in SVB’s future regardless of this requirement.

“They understand they have to convince us,” he said. “I think they’re back.”

Bowman was further reassured a few weeks ago when he attended a dinner with First Citizens Bank President Peter Bristow, who married into the Holding family, which has led First Citizens since 1935. Bowman said he left the dinner feeling First Citizens would make a strong commitment to startups.

While Sift Media only banks with SVB, others in the Triangle who had exclusively banked with SVB now diversify their deposits.

“As a firm, we follow the same policies we suggested with our companies,” said Jason Caplain, general partner and cofounder of Bull City Venture Partners in Durham. “So we have a cash balance at SVB that’s now smaller in size and the rest we pushed off to another bank.”

Jablokov said SVB under First Citizens has been more “liberal” in permitting his startup, which has an SVB loan, to store some of its deposits at other banks as well.

“‘There’s no way any sort of (chief financial officer) in these startups is going to allow you to not have a backup (account),” he said. “So, we do have relationships with other banking providers now.”

Like Bowman, Caplain and Jablokov described the transition of SVB to First Citizens as seamless.

“For us, there’s been no change,” Caplain said. “Still the same account. Still the same software. Still the same people.”

Others stick with the bigger banks

Today, First Citizens is the 15th largest bank in the country with more than $200 billion in assets. Yet some Triangle entrepreneurs say they still prefer to keep funds with the handful of national banks more universally deemed to be “too big to fail.”

For example, the largest U.S. commercial bank, JPMorgan, has $3.4 trillion in assets. Charlotte-based Bank of America is second with $2.45 trillion.

“Since First Citizens purchased SVB, uncertainty has been largely diminished,” said Ben Scruggs, CEO of Altis Biosystems in Research Triangle Park. Still, he has decided to keep Altis’ primary accounts with bigger banks that he finds “understand small companies.”

Compared to deposits, SVB loan levels have more consistently declined since the acquisition.

The bank added $68 billion in loans with the sale but had around $57 billion as of Sept. 30, a 17% drop. This decrease slowed over the summer, and in its Oct. 26 earnings presentation, First Citizens said that about half of its recent loan slide was due to winding down SVB’s global banking unit.

Speaking to investors, First Citizens Bank CEO Frank Holding acknowledged that the current “private market investment landscape” continues to suppress fundraising activity, exits and deals.

Higher interest rates have caused the entire sector to be more cautious, said Chen of Duke University.

“The (loan) industry itself is in a quiet period,” he said. “Nobody wants loans, nobody’s getting loans. So, it’s not clear going forward whether those innovative small business startups, when they need money, will still come to SVB.”

First Citizens flourishes on Wall Street

First Citizens bought SVB’s deposits and loans in exchange for company stock worth up to $500 million. It’s a decision that appears to be paying off.

Since the acquisition, the share price of First Citizens has soared. On the year, the bank’s stock is up 79%. In contrast, the Dow Jones U.S. Banks Index is down 16%.

First Citizens beat analysts’ expectations last week, as the company ended September with around $146 billion in deposits. For comparison, the company had less than $88 billion in deposits the same time last year.

Holding told investors the SVB purchase has given his bank access to new U.S. markets it was “already targeting.” Legacy SVB has a strong presence in Northern California, while First Citizens’ California branches were clustered in the southern part of the state.

First Citizens seems to be hiring, too, at least locally. According to data provided to The News & Observer by the North Carolina Technology Association, First Citizens was the Triangle’s top hirer for tech jobs in September.

“First Citizens has experienced significant growth over the past couple of years,” company spokesperson Frank Smith said in an email. “As a result, we continue to assess our tech talent requirements and positions to ensure we are meeting the needs of our growing enterprise.”

Open Source

Do you enjoy Triangle tech news? Subscribe to Open Source, The News & Observer's weekly technology newsletter and look for it in your inbox every Friday morning. Sign up here.