SVB lobbied Congress for years to loosen bank regulations. Lawmakers knew the risks.

- Oops!Something went wrong.Please try again later.

Silicon Valley Bank lobbied Congress to repeal a law that experts say could have helped prevent its collapse last month that sent ripple effects throughout the economy.

Although it had long employed a top lobbying firm and lobbyists before a key law was signed into law,, as that bill got closer to former President Donald Trump's desk they hired a former Senate staffer and increased lobbying spending by 25%.

The new law removed regulations like mandatory stress tests on banks the size of Silicon Valley Bank that were designed in the aftermath of the Great Recession to protect the economy from bank collapses — and many say it helped led to the bank's downfall.

Experts say the way banks like Silicon Valley Bank lobbied for the law demonstrates how special interests with enough money can get their way with elected officials, and how loophole-ridden federal law facilitates a revolving door between Congress and the lobbying industry.

The bank's spokespeople did not respond to requests for comment.

SVB fallout: Yellen tells Congress that banking system 'remains sound,' savings 'remain safe'

SVB fails to raise capital: Silicon Valley Bank assets seized by FDIC in largest bank failure since 2008

In this case, the eventual failure of Silicon Valley Bank led to turmoil in the banking industry earlier this year and sent consumers all over the country into a panic as they wondered whether money they kept in their own community banks was secure.

“It’s not a certain thing that if that 2018 legislation had been passed these bank failures would not have happened,” said Alexandra Thornton, the senior director of financial regulation for inclusive economy at the Center for American Progress.

“It definitely would have been much less likely for them to happen because there were liquidity tests and so forth that those banks would have had to comply with in order to satisfy the regulations and those tests would have raised concerns to the bank managers,” Thornton said.

Silicon Valley Bank and other lenders fought Obama-era Dodd-Frank law

The law known as Dodd-Frank that sought to fix banking regulation after the 2008 financial crisis required banks with $50 billion or more in assets to be subject to increased regulation. Starting at least as far back as 2015, the banking industry sought to increase that threshold.

Bart Naylor, a corporate governance expert for the nonprofit advocacy group Public Citizen, said lawmakers in the House wrote what felt like thousands of bills over the years related to the same subject, and passed most of them through the House.

Banks criticized the $50 billion number as arbitrary and said institutions that wanted to grow had to spend significant sums to satisfy the regulations once they surpassed the threshold, even if the core aspects of their business remained unchanged. They said if banks chose not to expand, fewer small businesses would get loans.

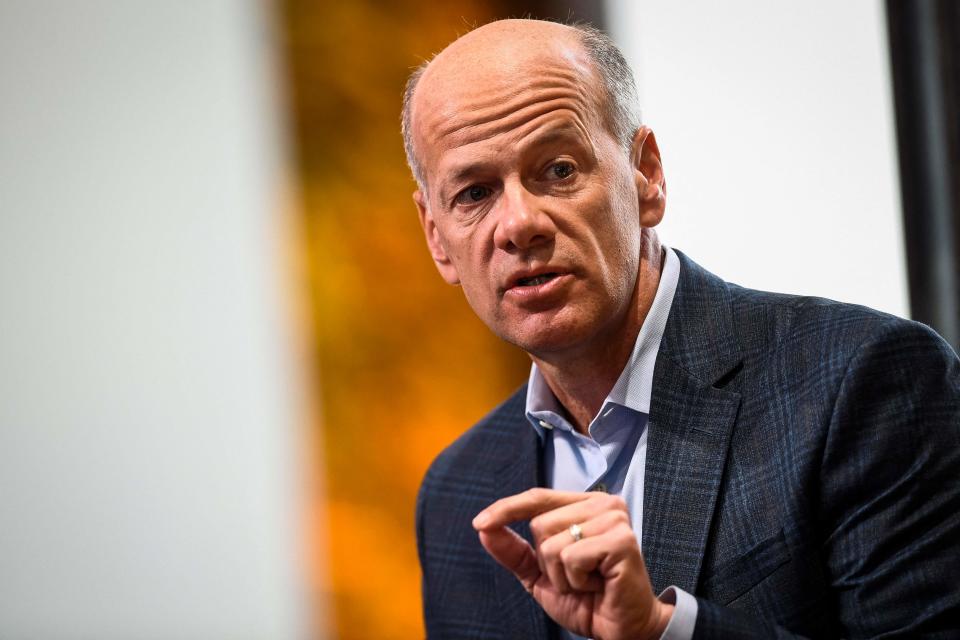

That effort included Greg Becker, Silicon Valley Bank’s most recent CEO, one of many executives who submitted a letter to the Senate Committee on Banking, Housing and Urban Affairs as they considered the Systemic Risk Designation Improvement Act of 2015 to raise that threshold.

Becker wrote that the bank was creeping up on the $50 billion threshold, and having to deal with the regulation would “require us to divert resources and attention for making loans to small and growing businesses that are the job creation engines of our country.”

He also said the bank “does not present systemic risks.”

What we know: Political donations tied to Silicon Valley Bank, Signature Bank

Bank failures: Questions remain about political donations from Silicon Valley Bank, Signature Bank

In a September 2017 hearing, the House Financial Services Committee unveiled another bill to increase the threshold for tougher regulation to $250 billion, and have regulators decide whether to regulate banks whose assets fell between the old and new thresholds.

In the hearing, Chairman Blaine Luetkemeyer, R-Mo., called the $50 billion threshold “inflexible, arbitrary” and an example of Washington’s “top-down approach and micromanagement” of small businesses. He said five Republicans and five Democrats alike supported the new bill.

Witnesses included Charles Tuggle, the executive vice president for the largest bank in Tennessee, who spoke on behalf of the American Bankers Association, who said the threshold “needlessly trapped many banks without any benefit to the system, handcuffing their abilities to provide needed credit and other services to their communities.”

Silicon Valley Bank boosted lobbying as it sought to loosen regulations

As that bill headed through the House, another one appeared in the Senate. SVB Financial Services increased its total spending on lobbyists from $40,000 per quarter to $50,000 per quarter and hired a new lobbyist who had worked for Sens. Tom Coburn, R-Okla., and Jeff Sessions, R-Ala.

In total, the bank had six lobbyists working on regulatory issues and what would become the Economic Growth, Regulatory Relief, and Consumer Protection Act. They worked through Franklin Square Group, which did not respond to USA TODAY's request for comment.

Craig Holman, a government affairs lobbyist Public Citizen, said the lobbyist’s disclosure of working as a staffer was a sign that the person could have been subject to a two-year cooling off period, during which staffers cannot contact their former office about bills.

Despite the cooling off period, because of loopholes in federal law, former staffers face no limitation on performing most duties of a lobbyist, including registering, creating a strategy, and contacting the offices of the senators who did not employ them.

“The revolving door is probably one of the most pernicious and effective influence-peddling tools when it comes to lobbying,” he said. “The revolvers have networks inside government. They know who is working on which issues. They know how to appeal to those people, and those people know those lobbyists, and so they get their phone calls answered.”

Banks like SVB won looser regulations in the Senate

Banks won their fight when the Senate passed its own bill in 2018 and sent it to the House. A handful of Democrats joined Republicans to get the bill to Trump's desk.

Introduced by Sen. Mike Crapo, R-Idaho, the bill raised the threshold for automatic application of the Dodd-Frank regulations to $250 billion in assets, and directed federal regulators to conduct stress tests of banks with between $100 billion and $250 billion in assets.

“They basically undid the application of more stringent on banks that were $50 billion to $250 billion in assets, just sort of a clean elimination of those requirements,” Thornton, from the Center for American Progress, said.

In 2018, Silicon Valley Bank had just under $57 billion in assets. That number kept increasing right up until its collapse; the bank reported just under $212 billion in assets at the end of 2022. Despite almost quadrupling its value, the bank was not subject to stricter regulation under the new law.

From 2017: Why consumer groups are ready to fight Trump rollback of financial safeguards

From 2017: Trump to dismantle Dodd-Frank Wall Street rules through executive orders

Deregulation risked bank failures, and lawmakers knew it

Even if the downfall at Silicon Valley Bank in particular was not certain, members of Congress had repeated warnings that raising the threshold increased the risk that banks would fail and that federal regulators would need to get involved to clean them up.

Dating back to at least 2016, reports from the Congressional Budget Office, the nonpartisan group of economists that reviews bills, said repeatedly that raising the threshold for more stringent regulation from $50 billion to $250 billion would increase the risk of bank failures and therefore costs to the Federal Deposit Insurance Corporation, which took over Silicon Valley Bank when it failed.

On the 2015 bill that Becker advocated for, the Congressional Budget Office wrote the threshold change “would slightly increase the probability of losses to the FDIC from resolving possible future defaults." Similar language was in reports on the 2017 and 2018 bills.

'It's a wake-up call': Advocacy groups, lawmakers highlight law they say led to SVB collapse

From 2017: House passes bill to dismantle Dodd-Frank

Silicon Valley Bank collapsed March 10 after investing much of its cash into long-term government bonds that plunged in value. The bank tried to raise money, prompting customers to try to withdraw their deposits all at once, but they couldn't. The FDIC took over the failed bank immediately and facilitated a sale March 27 to First Citizens Bank & Trust Company. The FDIC continues to sell off the bank's assets.

Norm Eisen, a scholar at the Brookings Institute who created a blueprint for Dodd-Frank while working for former President Barack Obama, challenged the idea from banking lobbyists and lawmakers that the $50 billion threshold arbitrary.

Eisen said any number can be challenged as arbitrary, but the size of a bank influences how far its failure can ripple through the economy, and the policy sought to address that.

“Is there a big difference between $49 billion and $51 billion?” he asked. “No. But you have to pick a number.”

Elected officials all the way up to President Joe Biden have called on Congress to at least partially reverse the 2018 law that they say helped lead to SVB’s collapse. Democrats have been the most outspoken.

“Because those stringent requirements were taken out of Dodd-Frank, when an old-fashioned bank run hit SVB, the bank could not withstand the pressure,” Sen. Elizabeth Warren, D-Mass., said on the Senate floor days after the bank collapsed.

Rep. Katie Porter, D-Calif., also introduced a bill to reverse the 2018 rollback. She said both she and Warren warned about the consequences when the bill was going through the legislative process, but it passed because “Wall Street’s lobby in Washington is simply too powerful.”

Biden unveiled a plan that would increase regulation of banks with assets between $100 billion and $250 billion, saying that “Trump Administration regulators weakened many important common-sense requirements and supervision for large regional banks like Silicon Valley Bank.”

This article originally appeared on USA TODAY: SVB helped push Congress to deregulate banks. Lawmakers knew the risks