Swiss leak provides look behind curtain at how dictators, kleptocrats, spies stash cash

A Yemeni spy chief implicated in torture. The sons of an Azerbaijani strongman who rules a mountainous territory as his own private fiefdom. Bureaucrats accused of looting Venezuela’s oil wealth and hastening its descent into humanitarian crisis.

They come from all over the world, each associated with a different corrupt, authoritarian regime and each enriching themselves in their own way. But there is one thing that unites them: where they kept their money.

After its luxury watches, snow-capped mountains, and superior chocolates, the Alpine nation of Switzerland is perhaps known best for its secretive banking sector. And at the heart of that sector is Credit Suisse, which over its 166-year history has become one of the world’s most important financial institutions.

SUISSE SECRETS

A cache of leaked data from a cornerstone of the global banking industry reveals how the rich, powerful and corrupt use secret Swiss accounts to move millions — and funnel some of it into Florida real estate.

With nearly 50,000 employees and $1.5 trillion in assets under management for 1.5 million clients, this banking behemoth is a testament to how central the banking sector is in this wealthy and comfortable nation.

But, as a new collaborative investigation spearheaded by the German newspaper Süddeutsche Zeitung and the Organized Crime and Corruption Reporting Project reveals, this glittering success has its murky side.

Journalists have obtained leaked records identifying thousands of foreign customers who stashed their money at Credit Suisse. The records, shared with the Miami Herald and news organizations around the world, including the New York Times and the U.K.’s Guardian, are nowhere near a complete list of the bank’s clients, but they provide a revealing glimpse behind the curtain of Swiss banking secrecy.

Over 160 reporters from 48 outlets spent months sifting through the data to identify dozens of accounts that belonged to corrupt politicians, criminals, spies, dictators, and other dubious characters. These are not obscure names, their misdeeds often identifiable through a simple Google search. And yet, their accounts — which held over $8 billion — remained open for years.

The clients included the family of an Egyptian intelligence chief who oversaw torture of terrorism suspects for the Central Intelligence Agency; an Italian with a broad portfolio of South Florida properties accused of laundering criminal funds for Italy’s ‘Ndrangheta crime group; a German executive who bribed Nigerian officials for telecoms contracts; and Jordan’s King Abdullah II, who held over 230 million Swiss francs ($223 million) in a single Swiss bank account, even as his country raked in billions in foreign aid.

From Caracas to Zurich

In Venezuela, elites accused of plundering the state oil firm funneled hundreds of millions of dollars into Credit Suisse accounts. That looting of public coffers helped precipitate Venezuela’s economic collapse, one that has prompted six million people to flee extreme poverty, malnutrition, and a lack of medical care.

An influx of Venezuelans, driven out of their homeland by the cratering economy and political strife, has transformed parts of South Florida, notably Doral and Weston.

Credit Suisse kept its Venezuelan clients’ accounts open even as global media exposed corruption cases against many of them.

Compliance experts who reviewed OCCRP’s findings said many of these people should not have been allowed to bank at Credit Suisse at all.

“People should not have access to the system if what they are carrying is corrupt money,” said Graham Barrow, an independent expert on financial crime.

“The bank has a clear duty to ensure that the funds it handles have clear and legitimate provenance.”

Credit Suisse is not the only culprit. Many major banks and financial service firms have faced similar scandals over the years. Many then pledge to reform. And yet — as projects like this one reveal — they continue to allow dodgy clients to take wealth they’ve made in countries with poor legal systems and lax oversight, and safeguard it in some of the safest and most secure places in the world. From there, it’s available anywhere the global Swiss banks operate and has the imprimatur of clean, wholesome money.

“The tax evaders, the kleptocrats, the people who are stealing their countries blind are using these first-world institutions as places to hide their money,” says James Henry, a senior adviser to the U.K. charity Tax Justice Network who has studied tax evasion at Credit Suisse. “Because there are legal systems, independent judiciaries that can’t be bought.”

The leaks and related revelations are likely to bring additional U.S. scrutiny on Credit Suisse, which in 2014 pleaded guilty to helping Americans skirt taxes and paid a whopping $2.6 billion in penalties and restitution. The bank recently lost two top leaders and it remains under investigation by the Justice Department and the Senate Finance Committee, both believed to be looking into undeclared accounts there.

While the Credit Suisse leak involved more than 18,000 bank accounts, just about 100 were U.S. citizens and none were considered public figures.

Insider opinions

Asked to comment on the findings of the Suisse Secrets project, Credit Suisse said that risk management was “at the very core of our business.” While refusing to discuss individual customers, the bank said that they were “predominantly historical” and that an “overwhelming majority” of problem accounts identified by journalists “are today closed or were in the process of closure prior to the receipt of press inquiries.”

“As a leading global financial institution, Credit Suisse is deeply aware of its responsibility to clients, and the financial system as a whole to ensure that the highest standards of conduct are upheld,” the bank added.

Credit Suisse’s full response to Suisse Secrets

OCCRP talked to more than a dozen former and current Credit Suisse employees to see if they could explain why the bank took on so many problematic clients. None would talk on the record, saying the bank was highly litigious toward former employees, and none offered documentary proof of their comments. However, many of those interviewed mentioned the same issues, and there was consensus about some problems.

While some said compliance was diligent and had improved considerably in recent years, most talked of a highly toxic corporate culture. Part of this culture involved incentivizing taking on risk to maximize profits — and bonuses.

Employees said bonuses were tied to “new net money,” how much additional money bankers brought into the company over accounts that leave.

“The bank incentivizes a banker to look the other way with an account they know to be toxic,” said a longtime executive. “If you close a toxic account, especially a large account in excess of $20 million, the banker finds himself in a deep hole. A deep hole that is almost impossible to get out of.”

This has led to a culture, employees said, where there are two sets of rules for two levels of customers — the common customer and the very rich customer.

“Due diligence of customers and accounts — say at a level of $1 million — are very thorough,” said a former senior executive. “But when it comes to high net-worth accounts, bosses encourage everyone to look the other way and managers get intimidated about their bonuses and job security.”

In addition, very big accounts are kept so secret that only a few senior executives might know who owns them.

“When someone wants to engage in money laundering after he loots assets of the country, for example, he needs to transfer the money. So holders of big accounts go directly to the very senior managers, and they do not go through the normal private banking system,” the former senior executive said.

The system was based on plausible deniability, said former employees. Employees are given strict rules, but the incentives are to ignore them.

“It’s never the bank’s fault, it’s always this bad apple employee who is responsible for something bad happening. That’s the approach,” one manager said.

The end result, said one manager, is a lack of loyalty between the bank and its employees.

The employees are unlikely to care how bad their clients are and that the deals they made were likely to come back to haunt the bank.

“You don’t need to worry about what happens eight to 10 years from now because you’re unlikely to be there. Usually that’s how long it takes for deals to blow up,” the manager said.

These insider accounts echo allegations Credit Suisse is now fighting in court, in the first criminal case ever launched against a Swiss bank in Switzerland. Prosecutors say the bank allowed a group of Bulgarian cocaine smugglers to launder over 146 million euros in drug money through Credit Suisse accounts.

Senior managers are accused of ignoring many warnings that their Bulgarian clients were up to no good, including the fact that they were depositing suitcases of cash driven from Sofia, the Bulgarian capital, to Switzerland. Even after one of the criminals was assassinated and named in the media as a cocaine trafficker, bank staff looked the other way.

A banker who dealt with the Bulgarians testified that Credit Suisse trained her carefully on how to present herself to potential clients and on the importance of Swiss banking secrecy, but not on compliance.

As evidence, one of her compliance tests was presented in court. She had answered just a quarter of the questions right.

The indictment cited a “failure” by Credit Suisse to take “reasonable and necessary organizational measures to prevent the occurrence of money laundering activities.”

While many of the accounts in the leak involve the past, secrecy remains for sale at Credit Suisse and in Switzerland. There lawmakers are busily building a better mousetrap, proposing to introduce a new system of legal trusts to bolster banking anonymity.

Working with a wealthy investor from an African nation, OCCRP reporters inquired about opening a Credit Suisse numbered account — one that provides more privacy.

Privacy was the chief sales pitch.

“There are limited people even within the bank who would be able to access your account information,” a Credit Suisse vice president assured the OCCRP reporter.

In an email, another Credit Suisse banker offered that personal information “is treated strictly with secrecy and on a need-to-know basis.”

Aside from anonymous numbered accounts — at a cost of around $3,000 per year — the bank offered the African investor an array of options designed to enhance secrecy.

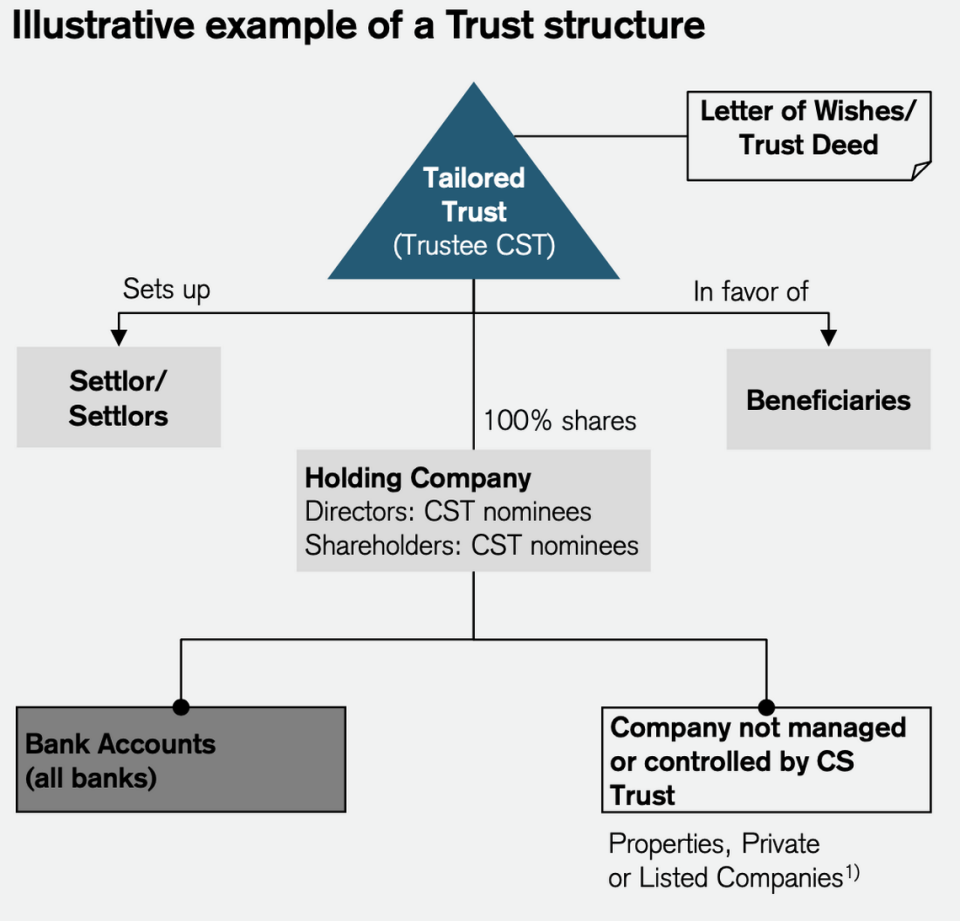

Top Credit Suisse executives proposed putting the investor money in a trust. These financial tools have come under fire, especially from the recent Pandora Papers, because they camouflage true owners behind a wall of “nominees” who can act as shareholders and directors.

Credit Suisse executives told the potential investor that bank staff can act as nominee shareholders and directors in holding companies, trusts and bank accounts. All can be registered to anonymous holding companies, they said, pointing to mechanisms that on paper distance wealthy individuals from their wealth.

Switzerland’s reputation for financial secrecy goes back hundreds of years. But in recent years, the country has made changes to the way its banking sector is regulated.

After the 2008 financial crash, the country agreed to lift the veil on thousands of accounts after an employee with the Swiss-based multinational financial firm UBS told U.S. prosecutors how that bank was helping Americans hide their assets.

But not without first securing the dismissal of U.S. charges for enabling tax evasion, and raising the max sentence for breaching financial secrecy laws from just six months to five years.

Experts say the law essentially criminalizes whistleblowing, silencing insiders and journalists who may want to expose wrongdoing within a Swiss bank.

“That law demonizes those who come forward with good information to expose corruption,” said Jeffrey Neiman, a U.S. lawyer representing whistleblowers, including some from Credit Suisse.

Selling secrecy

If Credit Suisse was selling secrecy, there were plenty of buyers.

The leaked records analyzed by Suisse Secrets reporters show accounts held by several high-profile human rights abusers, such as Algeria’s former defense minister Khaled Nezzar. As head of the armed forces, Nezzar was Algeria’s de facto leader from 1991 to 1993, when the country was embroiled in a civil war marked by atrocities committed against civilians.

Despite well-publicized allegations against him, Nezzar appears in the Suisse Secrets data as a Credit Suisse client, with two accounts worth at least two million Swiss francs ($1.6 million). A 1995 law criminalized the removal of the financial proceeds of Algerian economic activity from the country without central bank approval. The source of the funds deposited in Nezzar’s Credit Suisse account is unknown. It remained open until 2013, two years after he was charged in Switzerland with war crimes.

He denies any wrongdoing.

Credit Suisse also offered banking services to key figures implicated in corruption scandals in some of the poorest countries in the world. In Angola a disgraced banker, under investigation in Portugal after the bank he led collapsed with $5.7 billion in untraceable debt, was able to open at least a dozen Credit Suisse accounts, some of which are being looked at by Portuguese prosecutors.

In Kenya Credit Suisse banked accounts for a key player in a huge corruption scandal even after authorities declared him wanted in a criminal probe. Millions of dollars appeared to be withdrawn from the account even as investigators in Switzerland and Kenya were trying to trace the stolen funds.

Another client was former Venezuelan spy chief Carlos Luis Aguilera Borjas. Aguilera was close to Hugo Chávez, Venezuela’s former president who died in 2013 after establishing a socialist regime that has become mired in corruption. Aguilera was with Chávez during his first attempt to seize power in a failed coup in 1992, and served in government after he swept to electoral victory in 1998.

In 2001, Chávez installed Aguilera as head of the secret service, where he kept a low profile, avoiding interviews and photographs.

But Aguilera fell out of favor later that year after failing to prevent a coup attempt that almost toppled Chávez. He left his secret service post and entered the private sector full time, amassing wealth most Venezuelans could only imagine.

In 2007, Aguilera became the major shareholder of Inversiones Dirca S.A., a Venezuelan firm that secured a $1.85 billion contract the following year to renovate a Caracas metro line. There was no public bidding process, and Aguilera took a 4.8% commission worth almost $90 million.

In 2011, two accounts were opened in Aguilera’s name and credited with at least 7.8 million Swiss francs ($8.6 million). The Aguilera accounts were still open well into the last decade when the Suisse Secrets data was collected.

“By any definition, he’s high-risk,” said Barrow, the financial crime expert, adding that banks are responsible for making sure the sources of funds from politically connected customers are legitimate.

But a whistleblower who previously worked at Credit Suisse in Zurich recalled how executives encouraged bankers to pursue high-risk relationships.

“Management incentivizes the servicing of questionably sourced money by putting pressure on its bankers, especially junior bankers, to keep toxic accounts or face the consequences,” the former banker said, on condition of anonymity. “Those consequences are often termination, no bonus, and no pay increase.”

Aguilera did not respond to OCCRP’s emailed questions.

Credit Suisse has repeatedly pledged to crack down on illicit funds, following a string of scandals beginning over two decades ago with the death of an infamous Nigerian dictator. After Sani Abacha died in 1998, it emerged that Credit Suisse had helped stash some of the $4.3 billion his family had looted from his country.

In an effort to defuse the fallout from that revelation, the bank’s then-chairman said in 2000 that it had “continuously improved … control procedures and compliance with them.”

Later that year, Credit Suisse became a founding member of the Wolfsberg Group, an international banking association assembled to curb illicit financial flows.

“The bank will endeavor to accept only those clients whose source of wealth and funds can be reasonably established to be legitimate,” read a Wolfsberg Group mission statement in 2000.

‘Rogue bankers’

Yet Credit Suisse’s promises to clean up did little to prevent its entanglement in criminal cases for many years to come.

“The bank likes to say it’s just rogue bankers,” said Neiman, the American lawyer. “But how many rogue bankers do you need to have before you start having a rogue bank?”

Neiman does not represent the source of the Suisse Secrets leak, but his clients include a whistleblower who in February 2021 told a U.S. court that Credit Suisse continued to help American citizens illegally hide hundreds of millions of dollars offshore. If true, this would be a violation of a 2014 pledge the bank made in order to settle criminal charges in the United States.

The Department of Justice and the Senate Finance Committee are currently investigating whether Credit Suisse continued to facilitate tax evasion after it settled and paid a record $1.3 billion fine in 2014.

In 2014, the bank’s chairman at the time, Urs Rohner, conceded mistakes in its handling of the U.S. tax evasion scandal but told a Swiss television station that he himself had “clean hands.”

Recalling this incident in a recent interview with OCCRP, Swiss member of parliament Gerhard Andrey said he was still incredulous that Credit Suisse executives never accepted responsibility for the scandal.

“He’s the head of the company,” Andrey said on the phone from his office in parliament, where he represents the Green Party. “If you’re CEO or president, you can’t say, ‘It has nothing to do with me,’ because you’re responsible for defining the culture. Culture is defined top-down by senior staff, the board and executives.”

Frank Vogl, a former World Bank official who is now an anti-kleptocracy campaigner, said U.S. and European justice authorities had filed an “astounding” number of cases over the years against Swiss banks, including Credit Suisse. But he pointed out that to date not a single chairman of such banks has ever been personally prosecuted, or even lost his job because of these crimes.

“The criminal prosecutions force the banks to pay fines, but the bankers appear to treat these as merely the costs of doing business,” he said.

An October 2021 email from Credit Suisse’s chairman and CEO to its 50,000 staff following a global employee survey identified a “need for an environment that empowers colleagues to speak up.”

But experts say Credit Suisse’s culture won’t change until top executives face repercussions for the scandals that plague the bank. “CEOs have to go to jail for this to hit home,” said James Henry, with the Tax Justice Network.

While critics accuse Credit Suisse of negligence, they reserve much of the blame for Switzerland’s government, which is responsible for a lax regulatory environment and laws that punish those who speak out against corruption.

Stefan Lenz, a Swiss former federal prosecutor who led major corruption cases, said there are very few investigations targeting Swiss banks or their management for accepting illicit money. “There seems to be a lack of both political will and law enforcement resources,” Lenz told OCCRP.

Andrey, the Green Party parliamentarian, urged the government to take action for the sake of its citizens.

“I’m a proud Swiss,” he said. “It hurts me when banks spoil my country’s reputation with this behavior.”

“People are angry at the scandals that have already been exposed — and we don’t even know the unknown scandals.”