T. Rowe Price Japan Fund Adds 3 Stocks to Portfolio in 4th Quarter

The T. Rowe Price Japan Fund (Trades, Portfolio) disclosed its fourth-quarter 2019 portfolio earlier this week, listing three new holdings.

The fund, which is part of Baltimore-based asset management firm T. Rowe Price Group, is managed by Archibald Ciganer. In order to achieve long-term growth of capital, the fund invests in Japanese companies that have a leading market position, experienced management teams and are capable of maintaining above-average, long-term earnings and cash flow growth.

Based on these criteria, the fund established positions in JMDC Inc. (TSE:4483), Industrial & Infrastructure Fund Investment Corp. (TSE:3249) and Freee KK (TSE:4478) during the quarter.

JMDC

The fund invested in 118,400 shares of JMDC, which recently became public, allocating 0.63% of the equity portfolio to the position. The stock traded for an average price of 4,148.64 yen ($37.66) per share during the quarter.

The Japanese company, which provides medical statistics data services, has a market cap of 69.17 billion yen; it shares closed at 4,945 yen on Thursday.

The price chart shows the stock has gained more than 30% since its initial public offering in December.

The Japan Fund holds 0.85% of JMDC's outstanding shares.

Industrial & Infrastructure Fund Investment

T. Rowe Price picked up 1,690 shares of Industrial and Infrastructure Fund, dedicating 0.33% of the equity portfolio to the holding. During the quarter, the stock traded for an average per-share price of 166,404.92 yen.

The real estate investment trust, which mainly invests in commercial facilities, has a market cap of 294.22 billion yen; its shares closed at 164,000 yen on Thursday with a price-earnings ratio of 28.68, a price-book ratio of 2.06 and a price-sales ratio of 13.79.

According to the Peter Lynch chart, the stock is overpriced since it is trading above its fair value.

While GuruFocus did not give the REIT financial strength or profitability ratings, it did identify several of its strengths and weaknesses. Despite the company issuing approximately 13.3 billion yen in new long-term debt over the past three years, it is at a manageable level due to adequate interest coverage. Regardless, the Altman Z-Score of 1.26 warns it is in financial distress and could be in danger of going bankrupt.

The REIT is also supported by margins and returns that outperform at least half of its competitors, as well as a moderate Piotroski F-Score of 6, which indicates operations are stable, and a business predictability rank of one out of five stars. GuruFocus says companies with this rank typically see their stocks gain an average of 1.1% per annum over a 10-year period.

The fund holds 0.09% of the company's outstanding shares.

Freee KK

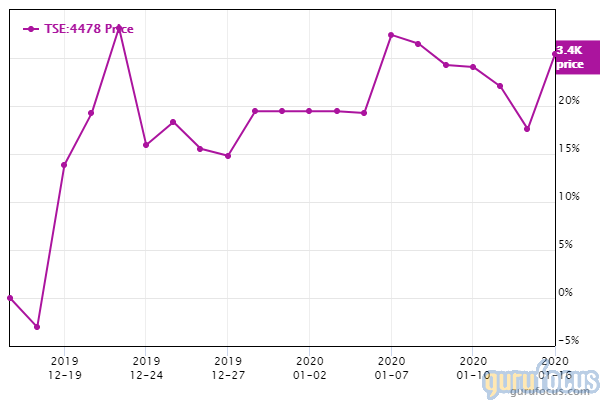

The Japan Fund purchased 79,000 shares of the newly public Freee, giving it 0.30% space in the equity portfolio. Shares traded for an average price of 3,084.3 yen during the quarter.

The company, which provides cloud-based accounting software, has a market cap of 157.88 billion yen; its shares closed at 3,385 yen on Thursday with a price-book ratio of 36.36.

Based on the price chart, the stock has climbed roughly 25% since its IPO in December.

While Freee does not have financial strength or profitability scores, GuruFocus did identify some strengths and weaknesses. For instance, as a result of having no long-term debt, it has a comfortable level of interest coverage.

The company is being weighed down, however, by negative margins and returns that underperform a majority of competitors.

T. Rowe Price holds 0.17% of Freee's outstanding shares.

Additional trades

During the quarter, the fund also added to a number of holdings, including Sansan Inc. (TSE:4443), Pigeon Corp. (TSE:7956), Hamamatsu Photonics KK (TSE:6965), Demae-Can Co. Ltd. (TSE:2484), Daio Paper Corp. (TSE:3880), Solasto Corp. (TSE:61.97) and Sumitomo Densetsu Co. Ltd. (TSE:1949).

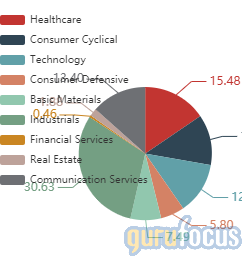

Composed of 75 stocks, the Japan Fund's $781 million equity portfolio is largely invested in the industrials sector with a weight of 30.63%, followed by smaller positions in the health care (15.48%) and communication services (13.40%) spaces.

According to its website, the fund returned 26.50% in 2019, beating the MSCI Japan Index's 19.61% return.

Disclosure: No positions.

Read more here:

T. Rowe Price Equity Income Fund Invests in Utility Company CenterPoint Energy

Parnassus Endeavor Fund Invests in Insurance and Logistics in 4th Quarter

Jana Partners Pares Stake in Conagra Brands

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.