Tapestry (TPR) Q4 Loss Narrower Than Expected, Sales Fall Y/Y

Tapestry, Inc. TPR reported better-than-expected fourth-quarter fiscal 2020 results. This house of modern luxury accessories and lifestyle brands posted narrower-than-expected loss. Further, the company’s net sales surpassed the Zacks Consensus Estimate for the third straight quarter. However, the coronavirus pandemic did impact the company’s performance with both top and bottom line declining sharply from the year-ago period.

The company posted adjusted loss of 25 cents a share narrower-than-the Zacks Consensus Estimate of loss of 48 cents. However, this compares unfavorably with the year-ago period. The company had reported adjusted earnings of 61 cents in the prior-year quarter. Lower net sales and higher interest expense hurt the company’s bottom-line results.

Net sales of this New York-based company came in at $714.8 million, down 53% year over year. However, the metric came ahead of the Zacks Consensus Estimate of $691.1 million. Sales declined across all brands.

Shares of Tapestry were up during the pre-market trading hours. Shares of this Zacks Rank #3 (Hold) company have increased 25.7% in the past three months compared with the industry’s rally of 43.6%.

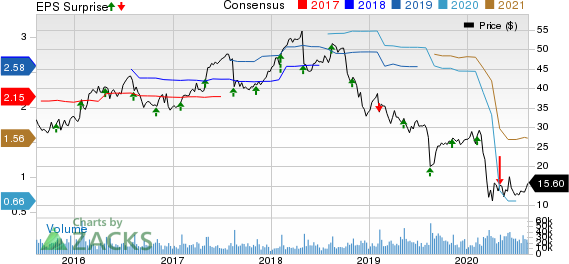

Tapestry, Inc. Price, Consensus and EPS Surprise

Tapestry, Inc. price-consensus-eps-surprise-chart | Tapestry, Inc. Quote

Management stated that quarterly results came ahead of internal expectations. Notably, Tapestry continued with its sturdy e-commerce performance with digital sales rising in triple digits compared with the year-ago period. Impressively, the company registered year-over-year increase in sales in Mainland China during the quarter under review. Additionally, the company notified that the vast majority of directly operated stores globally were reopened by the end of the quarter. The company also efficiently managed inventories, which were down 5% from the prior-year period.

Tapestry also announced an Acceleration Program with multi-year initiatives to drive revenue growth, gross margin expansion and operating leverage across its portfolio. The program aims at transforming into a leaner and more responsive organization, building significant data and analytics capabilities with focus on e-commerce channels, and operating with a clearly defined path and strategy for each brand. Management anticipates to realize about $300 million in gross run rate expense savings from these endeavors, including $200 million projected for fiscal 2021.

Although management did not provide any guidance for fiscal 2021, it stated that the company is undertaking actions to lower promotional activity and improve Average Unit Retail or AURs across brands. The company is also targeting reductions in SG&A expenses. The company expects to revert to sustained sales growth in the second half of fiscal 2021 as well as bottom-line growth in fiscal 2021, 2022 and 2023.

Margin Discussion

Consolidated adjusted gross profit came in at $507.3 million, significantly down $1,017.9 million in the year-ago period. However, gross margin expanded 370 basis points to 71% owing to lower and more disciplined promotional activity. Further, the company reported adjusted operating loss of $69.8 million as against operating income of $222 million in the prior-year quarter. We note that adjusted SG&A expenses fell 27.5% to $577.1 million. However, as a percentage of net sales, the same increased to 80.8% from 52.6% in the year-ago quarter.

Segment Details

Net sales for Coach came in at $517.4 million, down 53% year over year. Adjusted gross margin for the segment expanded 390 basis points to 73.6%. We note that adjusted operating margin shriveled to 9.1% from 27.5% a year ago.

Kate Spade sales came in at $164.1 million, down 51% from the year-ago period. Adjusted gross margin for the segment increased 270 basis points to 64.9%. The segment reported adjusted operating loss was $30 million as against adjusted operating income of $31 million in the year-ago period.

Net sales for Stuart Weitzman totaled $33.3 million, down 61% year over year. The segment’s adjusted gross margin jumped 460 basis points to 59.4%. Adjusted operating loss for the segment was $23 million compared with adjusted operating loss of $9 million in the year-ago period.

Store Update

At the end of the quarter, the company operated 375 Coach stores, 213 Kate Spade outlets and 58 Stuart Weitzman stores in North America. Internationally, the count was 583, 207 and 73 for Coach, Kate Spade and Stuart Weitzman, respectively.

Other Financial Details

Tapestry ended the quarter with cash, cash equivalents and short-term investments of $1,434.4 million (including $700 million revolver draw down), long-term debt of 1,587.9 million and stockholders' equity of $ 2,276.4 million.

Here are 3 Key Stocks for You

Grocery Outlet GO, a Zacks Rank #1 (Strong Buy) stock, has a trailing four-quarter earnings surprise of 33.6%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

MarineMax HZO flaunts a Zacks Rank #1. The company’s bottom line has outperformed the Zacks Consensus Estimate in each of the trailing four quarters.

Dollar General DG has a long-term earnings growth rate of 12.5%. Currently, it carries a Zacks Rank #2.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dollar General Corporation (DG) : Free Stock Analysis Report

MarineMax, Inc. (HZO) : Free Stock Analysis Report

Grocery Outlet Holding Corp. (GO) : Free Stock Analysis Report

Tapestry, Inc. (TPR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research